During the Financial Street Talkshow on November 3rd, experts provided detailed insights into the current net selling trend by foreign investors. They also offered forecasts addressing the question: When will foreign capital flow abundantly into Vietnam’s stock market?

Short-Term Net Selling Persists Due to Multiple Obstacles

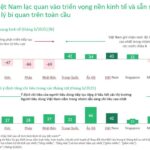

Recently, the Fed continued to cut interest rates, with further reductions expected. Meanwhile, Vietnam’s stock market was upgraded to Secondary Emerging status, raising expectations. However, there’s little indication that foreign investors will halt their net selling trend.

According to Mr. Le Quang Chung – Deputy General Director of Smart Invest Securities (AAS), this trend has valid reasons. First, the U.S. bond yield of around 4% remains attractive compared to Emerging Markets, keeping capital in the U.S.

Second, the VN-Index has seen a strong rally, making profit-taking by foreign investors understandable.

Additionally, the market is only in the preparatory phase for the September 2026 upgrade review. While the news is out, it hasn’t yet supported capital inflows.

Mr. Le Quang Chung speaking at the event

|

According to Dr. Ho Quoc Tuan – Senior Lecturer at the University of Bristol (UK), expectations for capital inflows post-upgrade fall into two groups. Passive funds will invest after the official upgrade, allocating around 0.3-0.5% of their portfolio, equivalent to $300-$500 million. This capital is almost certain.

Active funds, however, aren’t obligated to include Vietnamese stocks despite the upgrade. They’ll carefully evaluate stocks based on liquidity, potential, and risk.

Foreign Capital to Reverse in a Favorable Market Outlook

Mr. Chung forecasts two distinct phases for market liquidity. From now until late 2026, liquidity is expected to remain positive, with trading values reaching $1-2 billion per session. In the medium to long term (2026-2030), capital inflows will strengthen, pushing trading values up 150-200% and potentially driving the VN-Index to 2,000 points.

For foreign capital, from October 2025 to March 2026, most funds will remain in observation mode, though net selling is expected to gradually decrease.

From March 2026, post-upgrade review, some funds will start preparing portfolios and disbursement plans. Meanwhile, Frontier Market-focused funds may rebalance or withdraw.

From September 2026, when Vietnam’s market is officially classified as Emerging, foreign capital will flow strongly, combined with positive macro factors like GDP growth and public investment, boosting the 2026-2027 market.

Dr. Tuan notes that from June to September 2026, passive fund capital will begin entering Vietnam. Active funds are already scouting and selecting stocks.

Dr. Tuan emphasizes that foreign net buying is just a matter of time. Post-upgrade, coupled with strong economic growth, international funds and partners will view Vietnam more positively. However, exchange rate concerns persist. If Vietnam manages this well, foreign capital will return robustly. Additionally, foreign inflows depend heavily on economic growth and export resilience against U.S. tariffs.

Mr. Ho Quoc Tuan speaking at the event

|

Strengthening Domestic Fundamentals is Key

Dr. Tuan highlights Vietnam’s advantage in setting high growth targets and striving to achieve them. Businesses clearly benefit from operating in such an environment. However, to bolster foreign investor confidence, policies ensuring macro stability are essential.

Moreover, to boost domestic capital—which has a greater market impact—policies encouraging citizens to invest in stocks are needed. While external factors are often emphasized, market decisions ultimately hinge on domestic economic strength.

Echoing this, Mr. Chung believes that with GDP growth, public investment policies, and the market upgrade, the second half of 2025 and 2026 will be opportune for investors to deploy capital.

To attract foreign capital effectively, the market must prepare thoroughly: ensure quality assets and vibrant liquidity; upgrade trading systems to handle increased volumes; improve legal frameworks for seamless foreign investor account opening and trading; and increase domestic securities firms’ capital to meet investment demands.

– 14:48 04/11/2025

Vietnam’s Digital Financial Inclusion: A Leap Forward in Economic Empowerment

Over 70% of Vietnamese adults now possess financial accounts, fueling a dramatic surge in digital payments across the country.

Banks Focus on Supporting Businesses and Boosting Economic Growth in the Final Two Months of the Year

Implementing the 2025 monetary policy objectives outlined in Directive No. 01 from the State Bank of Vietnam (SBV), alongside local mandates, banking operations in Ho Chi Minh City and Dong Nai Province will focus on targeted solutions to support businesses and drive economic growth during the final two months of the year.