| Quarterly Profits of SDU from 2023 to Present |

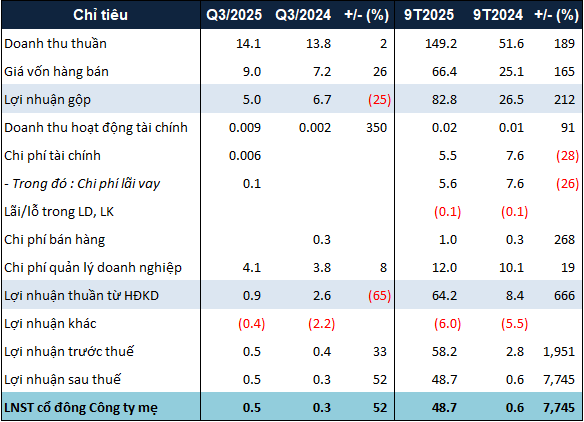

Specifically, the consolidated net revenue for Q3 exceeded 14 billion VND, a slight 2% increase compared to the same period last year. This revenue was entirely generated from office leasing and building management services.

However, a 26% rise in the cost of goods sold led to a 25% decline in gross profit, which stood at 5 billion VND. Additionally, with an 8% increase in corporate management expenses, the company’s net profit plummeted by 65%, reaching just over 900 million VND.

Nevertheless, due to a loss of over 2 billion VND in the same period last year, compared to a loss of only 400 million VND in Q3/2025, the company’s net profit for Q3 still surged by 52%, totaling nearly 500 million VND.

For the first nine months of the year, SDU recorded a net profit of nearly 49 billion VND, a 78-fold increase year-on-year, primarily driven by the exceptional performance in Q2. It’s understood that, alongside robust revenue growth, Q2 results were bolstered by the reversal of provisions for investments in a subsidiary.

|

Business Results for the First 9 Months of 2025 of SDU. Unit: Billion VND

Source: VietstocFinance

|

Despite the significant year-on-year growth, with a post-tax profit of nearly 49 billion VND for the first nine months, SDU has yet to meet its full-year profit target. The achievement rate after the consolidated Q3 financial statements stands at over 81%.

As of September 30, 2025, SDU’s total assets were recorded at over 1.1 trillion VND, a 5% decrease from the beginning of the year. This reduction is attributed to the two largest components: short-term receivables and inventory, which decreased by 4% and 9% respectively, to 407 billion VND and 486 billion VND.

Total liabilities decreased by 12%, to over 732 billion VND. Notably, outstanding loans decreased by 63%, to nearly 90 billion VND. Conversely, customer prepayments increased by 15%, to over 315 billion VND.

– 08:40 05/11/2025

Veteran Leader Kang Moon Kyung Steps Down from Mirae Asset’s Board of Directors

Following the extraordinary 2/2025 shareholders’ meeting on November 4th, Mirae Asset Securities (Vietnam) Joint Stock Company announced significant changes to its Board of Directors.

Zoo Revenue Surges After Tax Debt Scrutiny

After a challenging period, Saigon Zoo and Botanical Gardens is making a remarkable recovery. On average, the zoo welcomes over 5,500 visitors daily. Its cumulative revenue for the first nine months of this year reached nearly 122 billion VND, marking a 13% increase compared to the same period last year.

Novaland-Affiliated Leaders Fail to Fully Offload Registered NVL Shares

Diamond Properties has successfully offloaded over 1.1 million NVL shares, representing 52.2% of the total registered shares initially planned for sale, following an adjustment to their trading strategy.