After nearly 8 months of stability, Saigon-Hanoi Commercial Joint Stock Bank (SHB) has significantly increased its online deposit interest rates, focusing on short-term tenures.

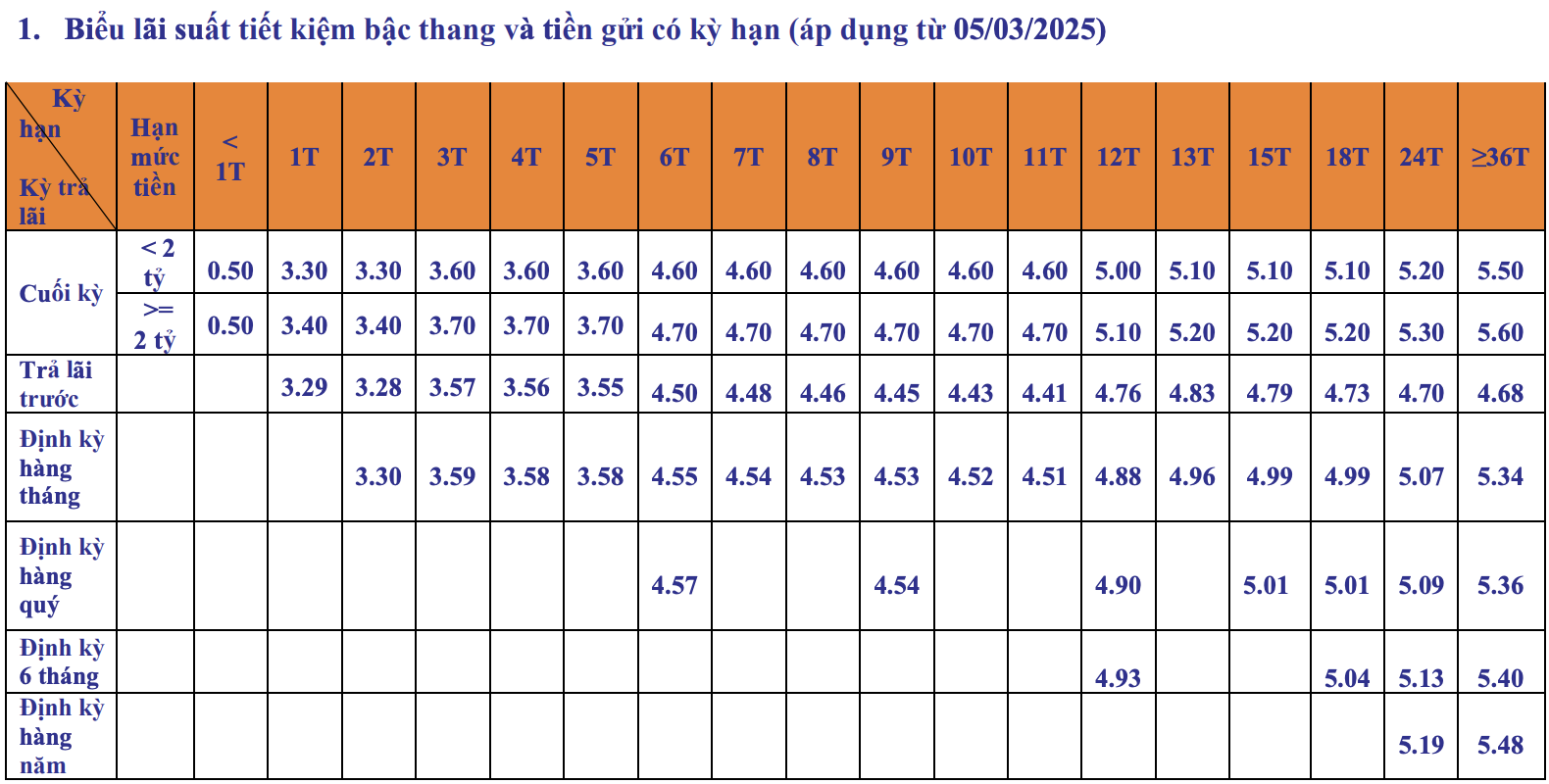

SHB Counter Deposit Interest Rates – November 2025

For customers depositing at the counter under the tiered savings product and receiving interest at maturity, SHB maintains its interest rate structure, continuing to apply rates based on two deposit tiers: Under 2 billion VND and 2 billion VND or more.

For deposits under 2 billion VND, interest rates range from 0.5% to 5.5% per annum. Specifically, tenures under 1 month earn 0.5% per annum; 1-2 months at 3.3% per annum; 3-5 months at 3.6% per annum; 6-11 months at 4.6% per annum; 12 months at 5.0% per annum; 13-18 months at 5.1% per annum; 24 months at 5.2% per annum; and tenures of 36 months or more at the highest rate of 5.5% per annum.

SHB Counter Savings Interest Rate Chart – November 2025

For deposits under 2 billion VND, interest rates range from 0.5% to 5.6% per annum. Specifically, tenures under 1 month earn 0.5% per annum; 1-2 months at 3.4% per annum; 3-5 months at 3.7% per annum; 6-11 months at 4.7% per annum; 12 months at 5.1% per annum; 13-18 months at 5.2% per annum; 24 months at 5.3% per annum; and tenures of 36 months or more at the highest rate of 5.6% per annum.

In addition to interest paid at maturity, customers can choose various interest payment options, including: Interest paid in advance; Monthly interest payments; Quarterly interest payments; Semi-annual interest payments; Annual interest payments.

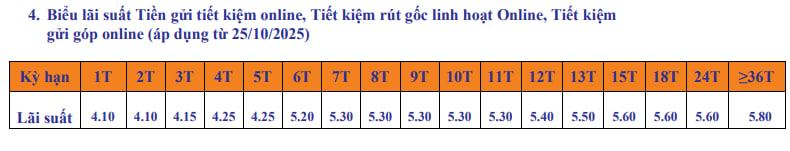

SHB Online Deposit Interest Rates – November 2025

For online deposits, SHB has increased rates across multiple tenures, with the highest increase reaching 0.6% per annum, ranging from 3.5% to 5.8% per annum.

Specifically, the online deposit rate for 1-2 months has increased by 0.6% per annum to 4.1% per annum; 3 months by 0.35% per annum to 4.15% per annum; 4-5 months by 0.45% per annum to 4.25% per annum; 6 months by 0.3% per annum to 5.2% per annum; 7-8 months by 0.4% per annum to 5.3% per annum; 9-11 months also at 5.3% per annum, up 0.3% per annum; 12 months at 5.4% per annum, up 0.1% per annum; 13 months remains at 5.5% per annum; 15-24 months up 0.1% per annum to 5.6% per annum; and tenures of 36 months or more remain unchanged, with SHB applying the highest rate of 5.8% per annum.

SHB Online Savings Interest Rate Chart – November 2025

SHB Unveils Plan to Boost Capital to VND 53,442 Billion

SHB (Saigon-Hanoi Commercial Joint Stock Bank) is set to seek shareholder approval via written consent for a proposed charter capital increase of VND 7,500 billion.