I. MARKET TRENDS IN WARRANTS

By the close of trading on November 5, 2025, the market saw 64 gainers, 178 decliners, and 31 unchanged stocks.

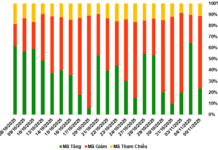

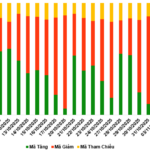

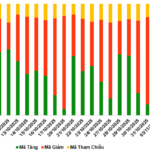

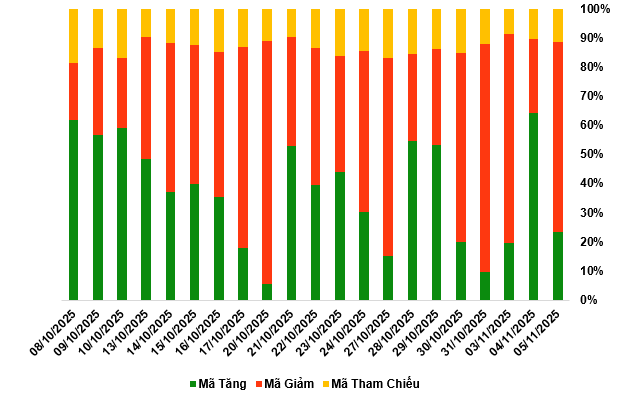

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

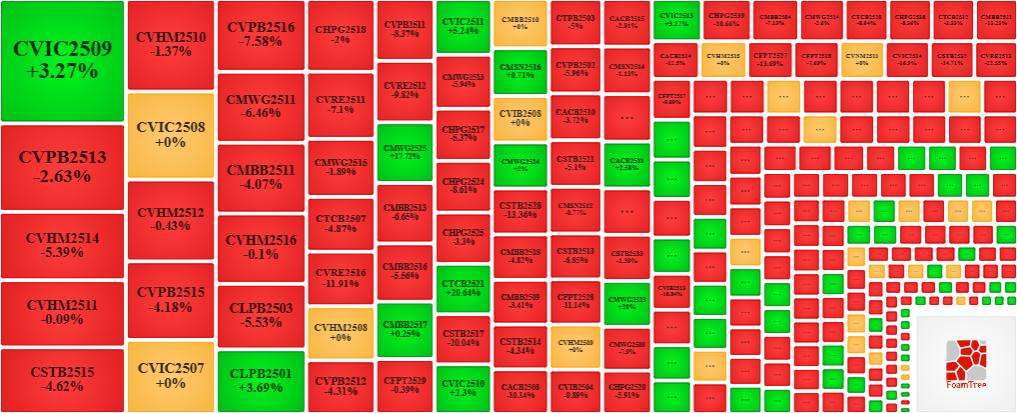

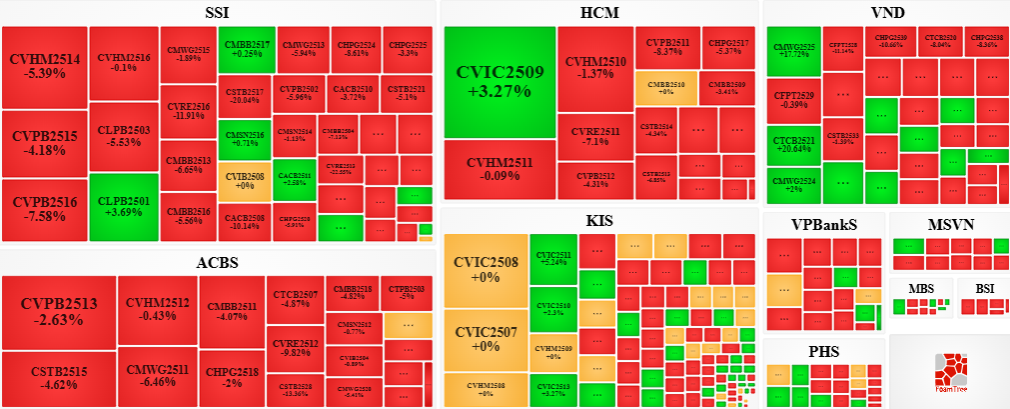

During the November 5, 2025 session, sellers dominated the market, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CVPB2513, CVHM2514, CSTB2515, and CMWG2511.

Source: VietstockFinance

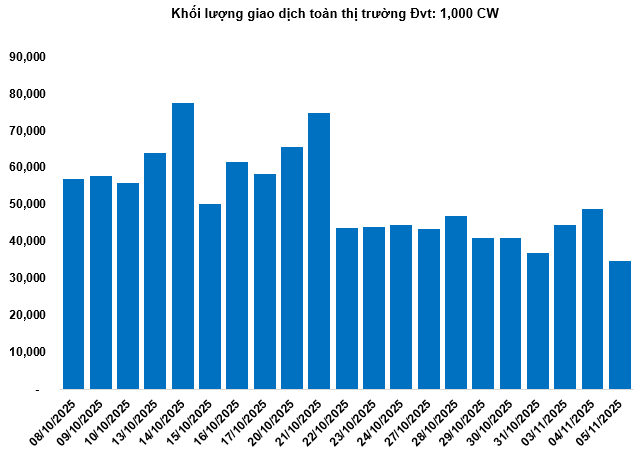

Total market volume on November 5 reached 34.61 million CW, down 29.16%; trading value hit 68.42 billion VND, a 34.14% decrease compared to November 4. Among these, CFPT2512 led in volume with 2.94 million CW, while CMWG2510 topped in trading value at 3.67 billion VND.

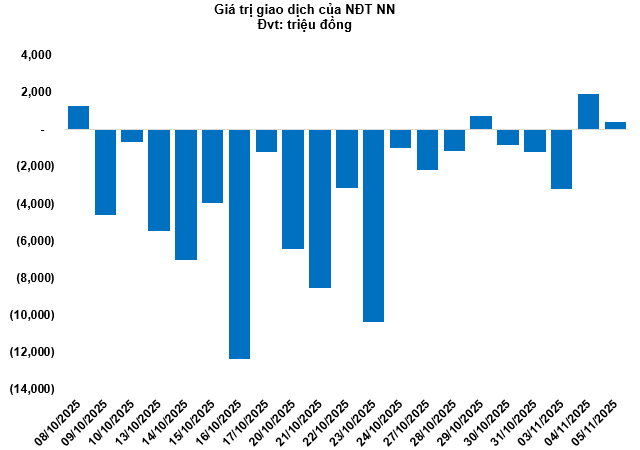

Foreign investors continued net buying on November 5, totaling 388.11 million VND. CVNM2521 and CSHB2507 were the most net-bought warrant codes.

Securities firms SSI, ACBS, KIS, and HCM are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

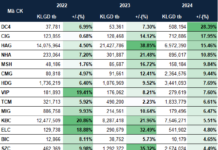

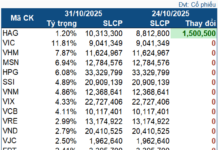

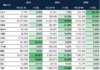

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

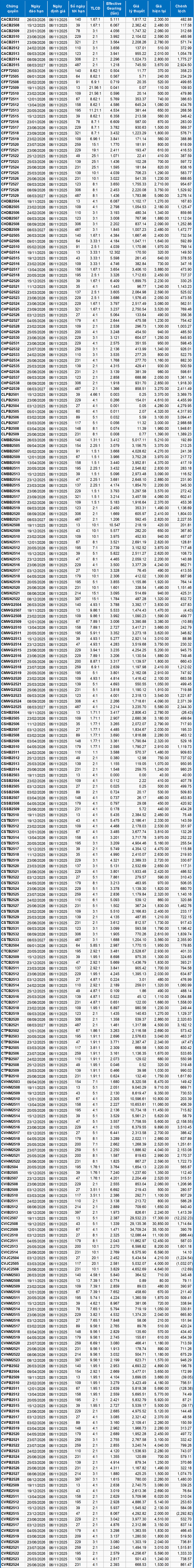

Based on the valuation method suitable for the starting date of November 6, 2025, the reasonable prices of warrants currently trading in the market are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (Government Treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each warrant type.

According to the above valuation, CVIC2507 and CVRE2515 are currently the most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to underlying securities. Currently, CHPG2514 and CMSN2508 are the warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 05/11/2025

November 5, 2025: Investor Sentiment Shows Signs of Improvement in the Warrant Market

At the close of trading on November 4, 2025, the market saw 155 stocks rise, 61 fall, and 25 remain unchanged. Foreign investors returned to net buying, with a total net purchase value of 1.9 billion VND.

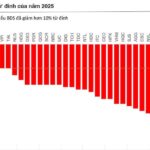

Vingroup Stock Adjustment: A Real Estate Group’s Market Test

The current market dynamics surrounding Vin Group stocks are setting the stage for a critical test within the real estate sector. By late October 2025, nearly all monitored stocks had relinquished their short-term upward trajectories, marking a pivotal shift in investor sentiment.