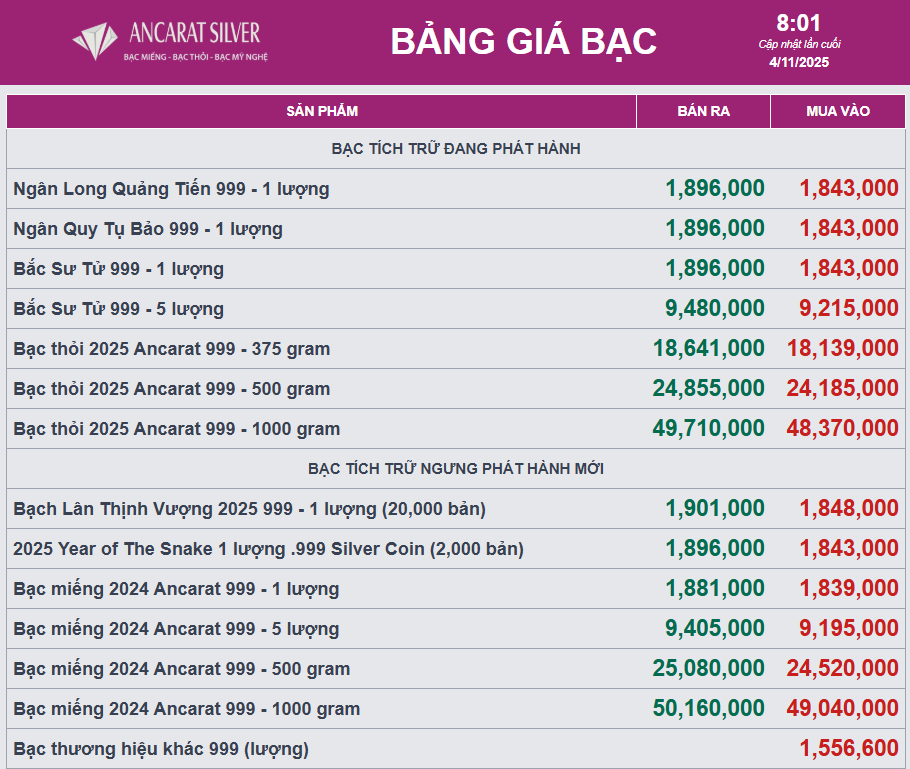

At Ancarat Vietnam Joint Stock Company, silver prices have decreased today, listed at VND 1,843,000 per tael (buy) and VND 1,896,000 per tael (sell) in Hanoi. This reflects a drop of over VND 27,000 in both buying and selling prices compared to the beginning of yesterday morning.

Meanwhile, the price of 1kg 999 silver bars stands at VND 48,370,000 (buy) and VND 49,710,000 (sell), updated at 8:01 AM on November 4th.

Globally, silver is trading at $48 per ounce.

Silver prices held steady around $48/ounce on the second day (November 3rd) as investors weighed the Federal Reserve’s policy outlook while assessing the impact of easing U.S.-China trade tensions.

Last week, the Fed implemented a widely anticipated 25-basis-point rate cut, although Chairman Powell emphasized that another move in December remains uncertain. The market is now turning to key U.S. data releases, including ADP employment and ISM PMI reports, for further insights.

According to precious metals analyst James Hyerczyk at FX Empire, silver prices remain under pressure, indicating that sellers continue to dominate the market, and the short-term trend remains bearish. Hyerczyk added that the metal still lacks intrinsic momentum from actual demand. Notably, capital is flowing back into equities, limiting silver’s upward potential.

Meanwhile, improved trade relations have reduced safe-haven demand for precious metals. Over the weekend, the White House announced that China would suspend additional export controls on rare earths and halt investigations into U.S. semiconductor firms, in exchange for the U.S. pausing certain tariffs and canceling plans to impose 100% tariffs on Chinese exports.

From Finances to Emotions: Unlocking the Secrets to Genuine Happiness for Vietnamese People

Economic growth is quantifiable, but the happiness of a nation is felt in the heart. When peace of mind and financial security become the foundation, the Vietnamese pursuit of happiness stands stronger and more proud.

Why Gold Sales Should Remain Tax-Free: A Timely Perspective

The Vietnam Association of Financial Investors (VAFI) has recently proposed a measure to stabilize the gold market by imposing a 10% value-added tax (VAT) on invoices for gold bullion and jewelry sales. However, experts caution that the taxation of gold should be carefully considered to avoid the issue of “tax on top of tax.”

How Far Has Real Estate Titan Hoàng Quân Come in Delivering on Its Promise of 50,000 Affordable Homes?

In a bold commitment to addressing the nation’s housing needs, Hoang Quan Real Estate has pledged to develop 50,000 social housing units across Vietnam between 2022 and 2030. This ambitious initiative underscores the company’s dedication to creating affordable, quality homes for communities nationwide.