According to a report by the Vietnam Association of Realtors, the market absorption rate in the first nine months of 2025 reached a highly positive 70%, equivalent to approximately 60,000 transactions, doubling the figure from the same period last year.

However, despite the significant demand for actual housing, market trends are being driven more by investment capital due to the extremely high property prices.

Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, explains that amidst rising inflation and infrastructure development, many investors view real estate as a safe haven and an effective profit-generating tool.

Investment capital is primarily focused on properties that cater to real housing needs—those with good rental potential and clear price appreciation prospects. These factors are key drivers behind investors’ decisions to commit funds.

“Most transactions in the market today come from secondary property buyers—those purchasing for investment rather than residence. This indicates that trading activity is primarily fueled by investment capital, while real housing demand remains constrained by prices far exceeding the affordability of most citizens,” Mr. Dinh noted.

Most transactions in the real estate market are currently from investors. (Illustrative image: Minh Duc)

Mr. Vo Huynh Tuan Kiet, Director of Residential Services at CBRE Vietnam, also stated that new supply in Ho Chi Minh City’s inner districts is now geared toward investment demand rather than actual housing needs. Most developers assume buyers will not reside in the properties but hold or lease them, positioning the products as premium to maximize profits.

“With current price levels, market capital is almost exclusively circulating among investors, making it extremely difficult for actual homebuyers to enter the market,” Mr. Kiet observed.

Data from DKRA Group reveals a similar trend. Of the over 2,000 transactions recorded in the first nine months, only about 30% were from actual homebuyers, while 70% were investors. The investor group has stronger financial capabilities and is willing to pay higher prices if they see profit opportunities, whereas actual homebuyers—with budgets of 1-2 billion VND—cannot afford units priced at 4-5 billion VND or higher.

Ms. Pham Thi Mien, Vice Director of the Vietnam Real Estate Market Research Institute (VARS IRE), noted that most transactions in the primary market come from multiple property owners. Additionally, many projects achieve good absorption rates by “riding the wave” of larger projects and benefiting from local mergers.

According to Ms. Mien, property prices will continue to rise in the short term due to investors’ high profit expectations. A significant portion of investors remains financially healthy and unaffected by financial leverage, leaving no reason to adjust selling prices.

“In a context of low interest rates, cheap capital continues to flow into the market, and strong public investment policies are being implemented. The supply of mid-range and affordable housing remains scarce, and investors maintain confidence that property prices will continue to rise,” Ms. Mien assessed.

Mr. Le Dinh Chung, a real estate expert, noted that recent condominium supply has primarily been in the high-end segment. The average condominium price is currently around 80 million VND/m², with some new projects launching at over 100 million VND/m².

At current prices, ordinary workers earning 30 million VND/month have virtually no chance of owning a home. Those who can afford prices of 70-100 million VND/m² are mainly investors, speculators, and individuals with extremely high incomes, such as business owners.

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, attributed Vietnam’s high speculative real estate investment trend to the ease of buying and selling, good liquidity, and higher profits compared to other channels like gold, stocks, or banks. Real estate investment returns in Vietnam over the past decade have been among the best, reaching 197% for condominiums and 137% for land plots.

Another factor is Vietnam’s low and lenient property tax policies compared to other regional countries, with insufficient penalties for speculation and property hoarding.

Mr. Nguyen Quoc Anh pointed out that globally, there are five basic property taxes: ownership tax, income tax, transfer tax, vacancy tax (for unused properties), and development tax (for infrastructure and services). Average ownership taxes range from 0.3% to 20%, transfer taxes from 2% to 6%, and income taxes from 14% to 45%. Some countries impose vacancy taxes of 12-20% and development taxes of 1-3%.

In Vietnam, buyers currently pay only the first three taxes: income tax (2-5%), ownership tax (0.03-0.2%), and transfer tax (0.5%). “Low taxes make it easy for buyers to ‘flip’ properties, buying one asset today and selling another tomorrow,” he said.

Warning of “Bubble” Risks

According to Mr. Nguyen Van Dinh, as actual homebuyers diminish, the market’s supply-demand imbalance, coupled with prices driven by speculative rather than real demand, increases the risk of a bubble.

A market dominated by investors is prone to price inflation. (Illustrative image: Minh Duc)

“Without timely intervention policies, urban housing will become increasingly out of reach for workers,” Mr. Dinh warned.

Economist Dinh The Hien emphasized the need to return the market to its fundamental purpose of serving the housing needs of the majority. When short-term investment dominates, properties become profit tools rather than homes, driving continuous price increases and causing social issues. He urged the government to quickly increase the supply of mid-range and affordable housing to balance the market structure.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, noted that when capital flows heavily into real estate, asset values rise faster than labor productivity and income growth, widening the gap between house prices and citizens’ affordability. This shifts the market’s operation from real demand to price appreciation expectations, making liquidity less sustainable and increasing bubble risks.

When transactions are dominated by investors, the market becomes more sensitive to policy changes. Small adjustments in credit, interest rates, or sentiment can trigger chain reactions, leading to stagnation or localized corrections. These risks not only affect speculators but can also spill over into the financial system, businesses, and the broader economy if not carefully managed.

“Therefore, the government’s decisive measures to cool price increases are strategically correct, aiming for long-term stability,” Mr. Huy stressed.

Critical Alert from VARS to All Condominium Buyers

According to the Vietnam Association of Realtors (VARS), lending interest rates are trending upward, while promotional periods remain temporary. Once loans transition to floating rates, if the general interest rate rises, debt repayment pressures will intensify significantly. Many borrowers find themselves in a situation where “they haven’t paid any principal yet, but the interest has already doubled.”

Soaring Land Prices Crush Real Estate Transactions

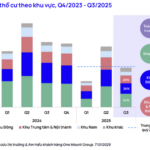

According to the Market Research & Consumer Insight Center of One Mount Group, in Q3/2025, residential land transactions experienced a significant decline compared to the previous quarter.

Emerging Real Estate Satellite Hubs: A Vibrant Ring Around Ho Chi Minh City

The real estate market is buzzing with activity in the satellite regions surrounding Ho Chi Minh City, as anticipation builds ahead of the city’s expansion. Leading the charge is the former Binh Duong province, topping the charts with an impressive index of 100. Close behind are Dong Nai (38), Ba Ria – Vung Tau (34), and Long An (28), collectively forming a vibrant “satellite belt” around the bustling metropolis.

Ministry of Construction Addresses Solutions to Cool Down Housing Prices

The Ministry of Construction highlights that property prices in many areas do not accurately reflect true supply and demand dynamics. Instead, they are heavily influenced by speculation, opaque planning information, administrative boundary adjustments, and herd mentality. Consequently, there is a pressing need to regulate the real estate market, particularly through measures that balance housing product structures and control land and property transaction prices.

Prime Minister Firmly Committed to Gold Market Inspections

Prime Minister Pham Minh Chinh is resolute in his commitment to scrutinizing the gold market. Deputy Prime Minister Le Thanh Long emphasized, “If the banking inspection falls short, the Government Inspectorate will step in to take charge.”