Following a significant adjustment in early April, Vietnam’s stock market has shown a remarkable recovery from Q2/2025 to the present. The VN-Index is currently fluctuating around the 1,600–1,700 point range, marking a nearly 50% increase from its April low. Notably, FTSE Russell, a leading market classification provider, officially upgraded Vietnam’s stock market from Frontier to Secondary Emerging status in early September 2026.

Liquidity has surged, with billion-dollar trading sessions becoming commonplace as individual investor capital flows return robustly. Large-cap stocks have collectively risen, driving the market upward in both index points and valuations.

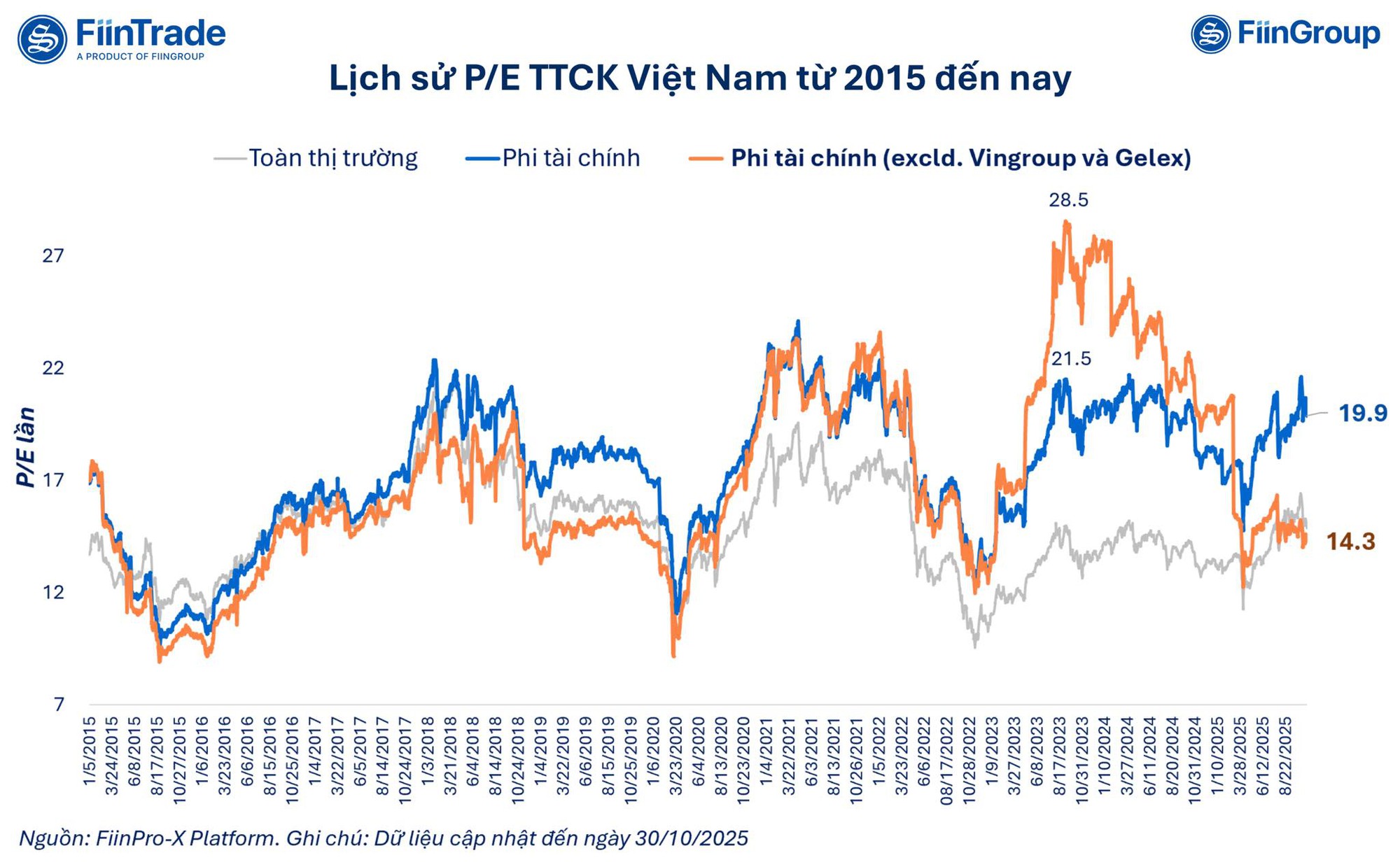

According to the latest data from FiinTrade, the market’s average P/E ratio stands at 14.9 times, an 11% increase over the past six months. However, a deeper dive into sector-specific metrics reveals a more nuanced story behind this seemingly straightforward figure.

The banking sector, contributing nearly 40% of the market’s total post-tax profits, trades at an average P/E of just 10.4 times—30% below the market average. Over the past six months, its valuation multiple has risen a modest 6%, reflecting tempered optimism.

In contrast, non-financial sectors exhibit higher valuations, with an average P/E of 19.9 times, up 13.5% in six months. Excluding Vingroup and Gelex, however, this figure drops to 14.3 times, a 4.1% decrease year-to-date despite profit growth in the sector.

FiinTrade emphasizes that while non-financial sectors appear “expensive” on average, a closer look reveals numerous attractively priced stocks. The “expensive” valuation is concentrated in high-profile names, while the market’s hidden gems—undervalued stocks with strong fundamentals—remain overlooked.

Thus, FiinTrade predicts that 2026 will favor underperforming stocks—the “unnoticed remainder” of the market. These are companies with solid earnings foundations that have yet to attract significant investor attention.

Echoing this sentiment, Mr. Bùi Văn Huy, Deputy CEO of FIDT, asserts that current market valuations remain attractive. Excluding the influence of large-cap stocks, particularly Vingroup, the market’s P/E ratio hovers around 10–11 times, significantly below its five-year average. This suggests substantial upside potential as corporate earnings expectations improve in 2026.

Mr. Huy advises investors to review their portfolios, assess sector and company prospects, and adjust allocations for Q4/2025 and 2026. Priority should be given to companies with strong financials, stable cash flows, attractive valuations, and exposure to long-term economic trends such as public investment, industrial zones, energy, construction materials, and banking.

Why Does the VN-Index Consistently Face Late-Session Sell-Offs?

Many investors attempting to “buy the dip” often find themselves facing losses, sometimes even before the stocks are credited to their accounts.

Record Sell-Off by Foreign Investors Surpasses 100 Trillion VND: When Will the Pressure Ease?

In the first ten months of 2025, foreign investors recorded a net sell-off exceeding 100 trillion VND on the Ho Chi Minh City Stock Exchange (HOSE), surpassing the entire year’s record of 2024 and placing significant pressure on the VN-Index. However, experts anticipate that this pressure will ease in the coming period.