Specifically, VC3‘s consolidated net revenue for Q3 reached nearly VND 122 billion, a 1.5-fold increase year-on-year. Of this, revenue from real estate operations accounted for over VND 117 billion, with the remaining VND 4 billion coming from service provision.

VC3 reported that the real estate revenue stems from products within the Bao Ninh 2 urban area project in Dong Hoi Ward, Quang Tri Province. Notably, VC3 is the developer of a social housing project within Bao Ninh 2, spanning 17,827 m² and comprising three 9-story apartment buildings with a total of 568 units.

|

Rendering of the three apartment buildings in the Bao Ninh 2 project

Source: VC3

|

In late October, VC3 announced that the Quang Tri Province Department of Construction confirmed the eligibility for future housing formation for 120 units in Building T1 of the Bao Ninh 2 project, including 16 one-bedroom and 104 two-bedroom apartments. Construction on Building T1 began on July 9, 2025, with the foundation now complete and full construction expected to finish by June 2027.

Regarding project-related financial changes in the quarterly report, as of September 30, 2025, customer deposits for the project plummeted from VND 324 billion at the start of the year to just over VND 113 billion. Inventory and accounts receivable for the project decreased by 20% and 86%, respectively, to nearly VND 1.2 trillion and over VND 6 billion. Conversely, the project secured nearly VND 12 billion in customer down payments during the first nine months of the year.

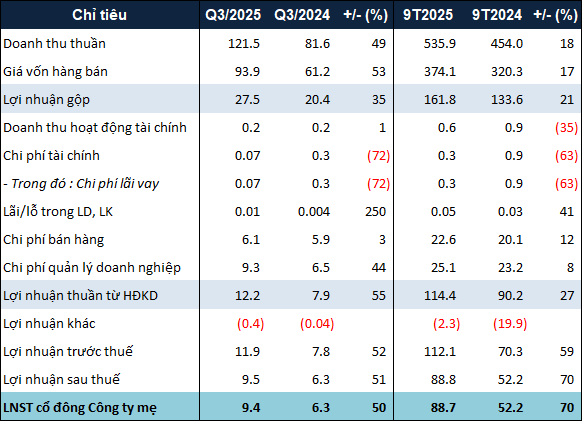

Returning to Q3 business results, after deducting expenses, VC3 achieved a net profit of over VND 9 billion, a 50% increase year-on-year.

For the first nine months of the year, the company’s cumulative net profit reached nearly VND 89 billion, a 70% increase year-on-year and nearly 53% of the target set for 2025.

|

Business results for the first nine months of 2025 for VC3. Unit: Billion VND

Specifically, VC3‘s consolidated net revenue for Q3 reached nearly VND 122 billion, a 1.5-fold increase year Specifically, VC3‘s consolidated net revenue for Q3 reached nearly VND 122 billion, Specifically, VC3‘s consolidated net revenue for Q3 reached nearly VND 122 billion, a 1.5-fold increase year-on-year. Of this, real estate sales contributed over VND 117 billion, while service provision accounted for the remaining VND 4 billion. VC3 reported that the real estate revenue stemmed from products within the Bao Ninh 2 Urban Area project in Dong Hoi Ward, Quang Tri Province. Notably, VC3 is the developer of a social housing project within Bao Ninh 2, spanning 17,827 m² and comprising three 9-story apartment buildings with a total of 568 units.

In late October, VC3 announced that the Department of Construction of Quang Tri Province confirmed the eligibility for future housing formation for 120 units in Building T1 of the Bao Ninh 2 project, including 16 one-bedroom and 104 two-bedroom apartments. Construction of Building T1 began on July 9, 2025, with the foundation now complete. The building is expected to be finished by June 2027. Regarding project-related financial changes in the quarterly report, as of September 30, 2025, customer deposits for the project decreased significantly from VND 324 billion at the beginning of the year to over VND 113 billion. Inventory and accounts receivable for the project dropped by 20% and 86%, respectively, to nearly VND 1.2 trillion and over VND 6 billion. Meanwhile, the project secured nearly VND 12 billion in customer hold deposits during the first nine months of the year. Returning to Q3 business results, after deducting expenses, VC3 achieved a net profit of over VND 9 billion, a 50% increase year-on-year. For the first nine months of the year, the company’s net profit reached nearly VND 89 billion, a 70% increase year-on-year and equivalent to nearly 53% of the annual target for 2025.

On the balance sheet, VC3‘s total assets as of September 30, 2025, stood at VND 3 trillion, a 3% decrease from the beginning of the year. Inventory also decreased by 15% to nearly VND 1.7 trillion, primarily due to the aforementioned Bao Ninh 2 project. Conversely, short-term receivables increased by 27% to VND 665 billion, driven by over VND 112 billion in interest income from deposits, loans, and a sharp rise in project cost advances from VND 35 billion to VND 146 billion. Total liabilities decreased by 10% to VND 1.5 trillion, mainly due to a significant reduction in customer deposits for the Bao Ninh 2 project. Meanwhile, outstanding debt increased 2.3-fold from the previous year-end to nearly VND 275 billion, largely due to a surge in long-term bank loans. – 08:25 05/11/2025 You may also like

Son Hai Group Responds to Allegations of “Violations in the VND 500 Billion Project” in Quang Tri

|