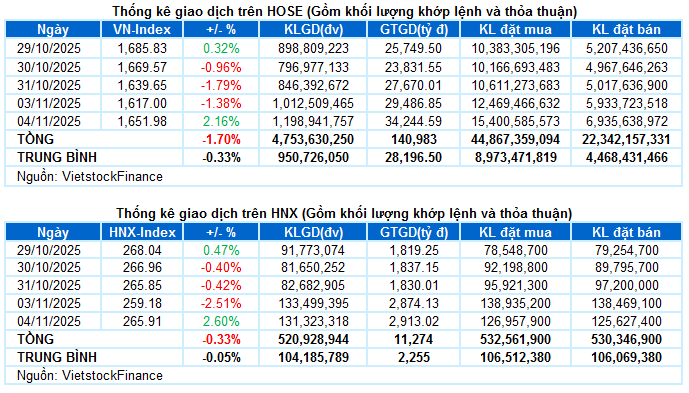

I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON NOVEMBER 4, 2025

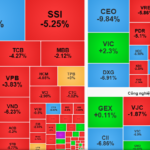

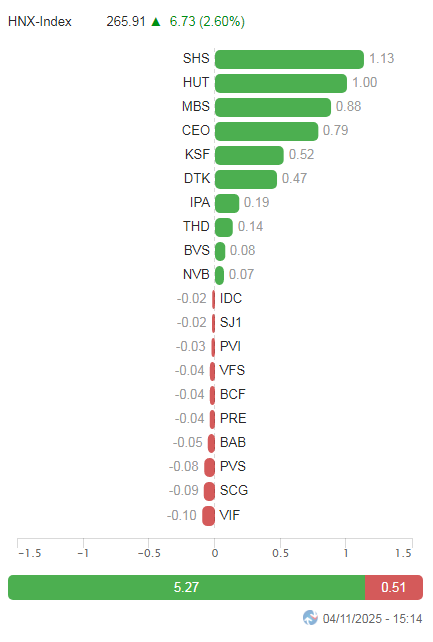

– Key indices surged strongly in the November 4 trading session. Specifically, the VN-Index rose sharply by 2.16%, reaching 1,651.98 points; the HNX-Index also increased by 2.6%, hitting 265.91 points.

– Matching volume on the HOSE floor rose by 17.2%, exceeding 1.1 billion units. Meanwhile, the HNX floor recorded only about 113 million matched units, down 10.8% from the previous session.

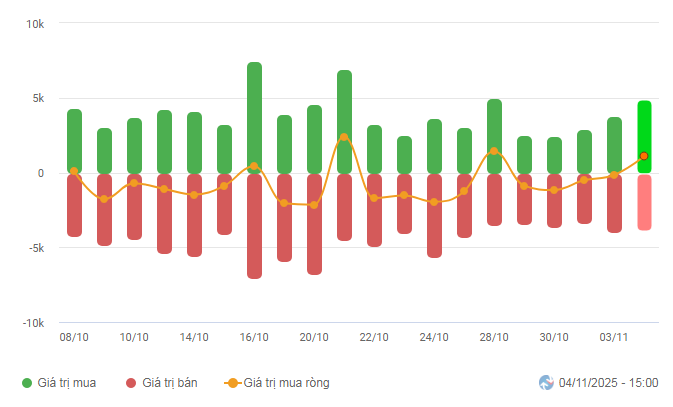

– Foreign investors turned net buyers on the HOSE floor with a value of over 1.1 trillion VND and over 52 billion VND on the HNX floor.

Trading Value of Foreign Investors on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

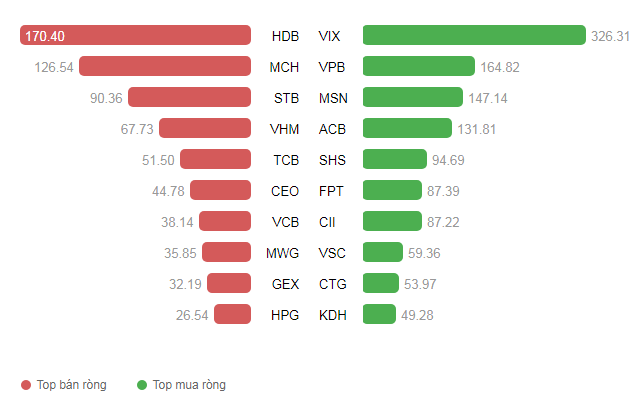

Net Trading Value by Stock Code. Unit: Billion VND

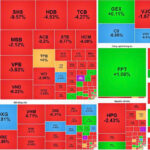

– The VN-Index had a strong breakout session on November 4 as buying momentum returned robustly in large-cap stocks. Despite a cautious start and briefly dipping near the 1,600-point mark, the market unexpectedly reversed from the afternoon session, driving numerous stocks to accelerate. The widespread euphoria across sectors helped the index surpass the 1,650-point threshold by the close. At the end of the session, the VN-Index closed at 1,651.98 points, up nearly 35 points (+2.16%).

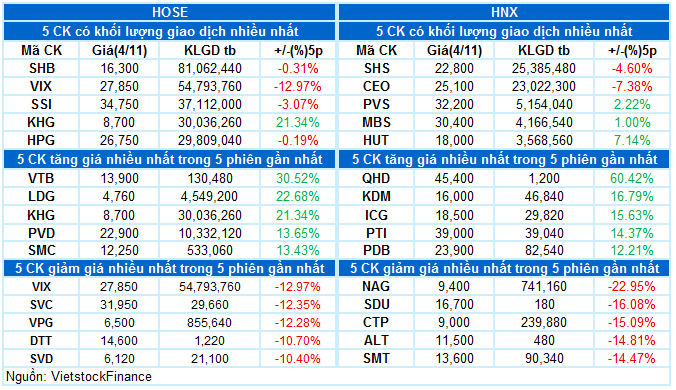

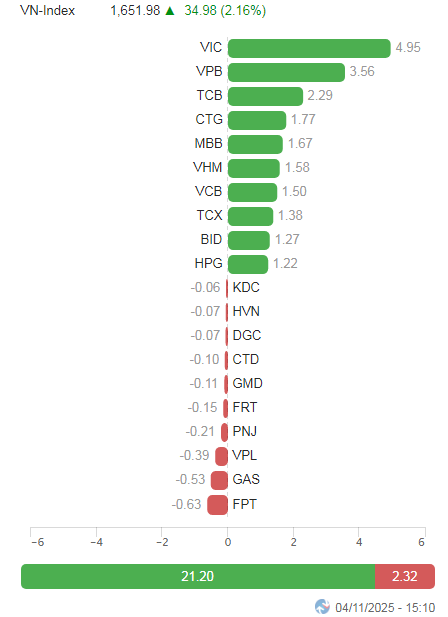

– In terms of impact, the top 10 stocks contributed positively to the VN-Index, adding a total of nearly 21.2 points, with VIC leading the charge with nearly 5 points. Conversely, FPT and GAS were the two stocks exerting the most pressure, taking away a combined total of over 1 point from the index.

Top Stocks Influencing the Index. Unit: Points

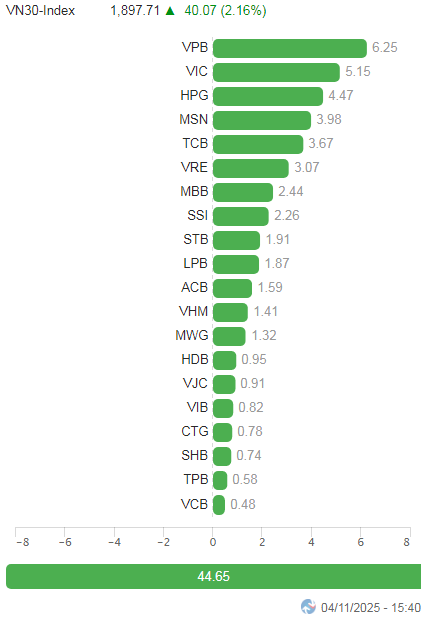

– The VN30-Index closed with a 40-point gain, reaching 1,897.71 points. Buyers dominated with 24 stocks rising, 5 falling, and 1 unchanged. Notably, SSI, VPB, and VRE stood out with impressive gains. Following closely were TCB, MBB, MSN, TPB, VIB, and STB, all surging over 3%. In contrast, GAS and FPT faced the heaviest pressure, both declining by 1.6%.

By sector, finance and real estate were the market’s focal points today, rising 3.12% and 2.72%, respectively. Strong buying momentum in these sectors drove numerous stocks to their ceiling prices, notably SSI, VIX, VPB, SHS, VCI, VND, CTS, ORS, VDS, DSE; DXG, CEO, PDR, VRE, DIG, HDC, TCH, DXS, and TAL. Additionally, many stocks rose over 3%, including TCB, STB, MBB, HCM, TPB, MBS, EIB; KDH, KHG, NVL, KBC, and NLG.

Following closely was the essential consumer sector, rising over 2%, led by MCH (+6.47%), MSN (+3.9%), HAG (+2.74%), VHC (+1.75%), and DBC (+2.13%).

Meanwhile, the industrial sector faced significant pressure from stocks like ACV (-2.15%), GMD (-1.75%), BMP (-1.61%), SJG (-3.21%), CTD (-4.75%), and VGR (-4.24%). However, several bright spots emerged, helping the sector maintain its green hue, such as VJC (+1.25%), VCG (+1.01%), VTP (+1.57%), THD (+2.01%), VGC (+2.57%), and GEX along with CII hitting their ceilings.

On the downside, the communication services sector lagged with a notable 3.67% decline, as major stocks in the sector plunged into the red, such as VGI (-4.49%) and FOX (-2.16%).

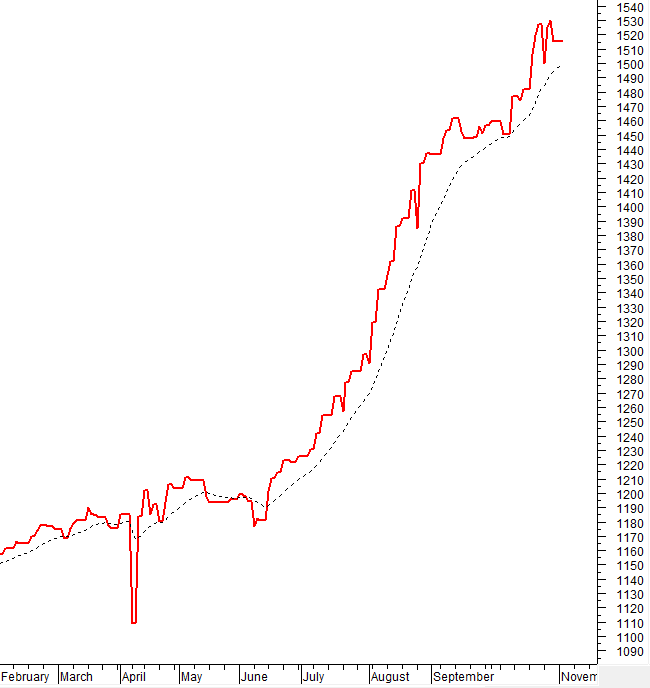

The VN-Index rebounded strongly with trading volume improving above the 20-day average, indicating that the August 2025 low continues to serve as solid support. The index needs to sustain its upward momentum with stable liquidity in the coming sessions to confirm the recovery trend. However, strong volatility may arise as the MACD indicator remains below the 0 threshold and is still far from the Signal line.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – The August 2025 low continues to serve as solid support

The VN-Index rebounded strongly with trading volume improving above the 20-day average, indicating that the August 2025 low continues to serve as solid support. The index needs to sustain its upward momentum with stable liquidity in the coming sessions to confirm the recovery trend.

However, strong volatility may arise as the MACD indicator remains below the 0 threshold and is still far from the Signal line.

HNX-Index – Stochastic Oscillator may signal a buying opportunity again

The HNX-Index recovered and crossed above the 100-day SMA. The Middle line of the Bollinger Bands remains a strong resistance for the index in the short term.

The Stochastic Oscillator may signal a buying opportunity again. If this signal appears in the coming sessions, the short-term outlook for the index will brighten.

Cash Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Cash Flow: Foreign investors turned net buyers in the November 4, 2025, trading session. If foreign investors maintain this action in the coming sessions, the situation will become more positive.

III. MARKET STATISTICS ON NOVEMBER 4, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:15 November 4, 2025

Bank Stocks Weigh on VN-Index in October

October closed in the red, marked by a sharp correction in the banking stock group, which negatively impacted the VN-Index.

Revised Financial Safety Ratio Regulations for Securities Firms

The Ministry of Finance has recently issued Circular 102/2025/TT-BTC, amending and supplementing Circular 91/2020/TT-BTC. This pivotal move marks a significant step in refining the legal framework for financial risk management, fostering a healthier, more transparent, and sustainable development of Vietnam’s stock market in the upcoming period.