On November 4th, based on the Board Resolution dated September 18th, VPBank’s CEO, Mr. Vu Huu Dien, signed the approval for the issuance and offering of the first batch of private bonds, code VPX32501. The total value is capped at 1,000 billion VND, with a 12-month term and a fixed interest rate of 7.5% per annum.

These bonds are non-convertible, unsecured, and uncollateralized, targeting professional securities investors, including both individuals and organizations.

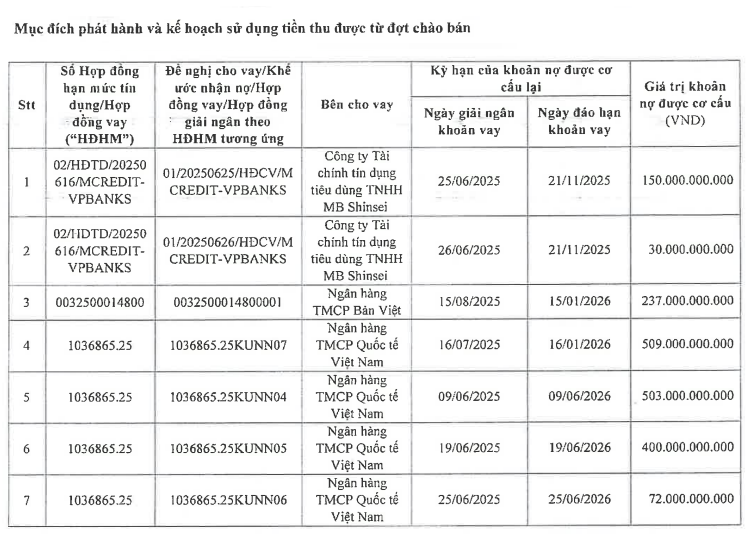

Regarding the implementation timeline, VPBank plans to issue the bonds in November 2025, with the entire offering period not exceeding six months. The proceeds will be used to repay the principal and interest of seven loans maturing between November 2025 and June 2026, held at BVBank, VIB, and the consumer finance company Mcredit.

VPBank also noted that, until the funds are fully or partially disbursed to restructure debts, the company may temporarily use the idle proceeds from the bond issuance to invest in term deposit contracts.

Source: VPBank

|

The decision also approves the registration of the bonds with the Vietnam Securities Depository and Clearing Corporation (VSDC) and their listing on the Hanoi Stock Exchange’s (HNX) private corporate bond trading system upon completion of the offering.

This issuance involves multiple service providers. Petroleum Securities Inc. (PSI) will handle the offering documentation, act as the issuing agent, and represent bondholders; BIDV’s Thai Ha branch will manage investor payment accounts; VIS Rating will conduct the credit rating; and Ernst & Young Vietnam will audit the 2024 financial statements.

In related financing activities, VPBank recently made headlines by successfully appointing Sumitomo Mitsui Banking Corporation (SMBC) as the lead arranger for a syndicated international loan of up to 200 million USD.

This marks VPBank’s largest-ever international capital raise, surpassing the 125 million USD loan arranged by SMBC in May 2025. In total, the company has raised 400 million USD this year through bilateral and syndicated loans led by SMBC.

According to plans, the funds will strengthen key business pillars, particularly investment banking (IB) and margin lending.

“VPBank’s ability to raise 400 million USD in international capital in 2025, despite being operational for just over three years, underscores its unique position within the VPBank and SMBC ecosystems. These funds will support our upcoming growth initiatives,” shared CEO Vu Huu Dien.

The 200 million USD syndication was announced as VPBank executed its IPO of nearly 12,713 billion VND. The latest update reveals that the subscription volume reached nearly 390.5 million shares, exceeding the offering size, with an allocation ratio of 96.036%.

VPBank and its distribution agents will notify investors of the share allocation results and required payments. Investors will settle the remaining amounts between November 3rd and 7th, 2025, with final purchase results announced by November 18th. The shares are expected to list on the Ho Chi Minh City Stock Exchange (HOSE) in December 2025.

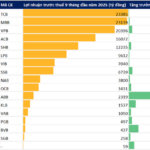

Alongside capital raising, the company is achieving new milestones in business performance. Pre-tax profit for the first nine months of 2025 hit a record 3,260 billion VND, nearly four times the previous year’s figure. This represents over 73% of the adjusted annual profit target (4,450 billion VND, the second-highest in the industry).

By the end of Q3 2025, VPBank’s total assets reached 62,127 billion VND, more than doubling since the start of the year and ranking among the market leaders. Margin debt set a new record at 26,664 billion VND, up 9,011 billion VND from Q2 and nearly tripling since the beginning of the year.

– 4:43 PM, November 5, 2025

2025 Q3 Bank Performance Update: More Lenders Surpass VND 10 Trillion Pre-Tax Profit by October 29

In Q3/2025, a bank reported a staggering pre-tax profit, soaring 12 times higher than the same period last year.