Proposed Tax to Stabilize the Market?

Recently, the Vietnam Association of Financial Investors (VAFI) submitted an official dispatch to the Prime Minister, the Ministry of Finance, and the State Bank of Vietnam, proposing the application of value-added tax (VAT) using the deduction method for physical gold trading activities.

According to VAFI, gold bars are currently exempt from VAT, while VAT on jewelry trading is calculated based on the selling price minus the purchase price, multiplied by a 10% tax rate (as per the listed price table).

“For instance, if a business buys and sells one tael of jewelry priced between 97 to 100 million VND per tael, with a price difference of 3 million VND, the tax payable is approximately 300,000 VND. If VAT is calculated using the deduction method, issuing an invoice for 110 million VND would result in a tax payment of 10 million VND. Thus, the VAT collected differs by 30 times between the deduction method and the direct method,” the association analyzed.

Proposal to impose a 10% tax on both gold bars and jewelry transactions.

VAFI suggests that both jewelry and gold bar trading should be subject to VAT using the deduction method, similar to other goods, ensuring tax equality. Accordingly, VAFI proposes a 10% VAT on invoices for gold bars and jewelry sales.

VAFI believes that this policy revision will curb speculative trading and price manipulation. Instead, funds will flow into the banking system, strengthening the national currency and increasing foreign exchange reserves within banks.

Previously, the Ministry of Finance proposed an additional tax of 0.1% on the transfer value when selling gold bars, such as a 100,000 VND tax on the sale of one tael of SJC gold priced at 100 million VND.

VAFI argues that such a low tax rate would have no effect on limiting the massive capital influx into the gold market.

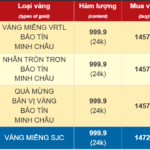

Recently, the proposal to tax gold has been repeatedly raised amid a significant surge in domestic gold prices, widening the gap with global prices to over 20 million VND per tael. Currently, SJC gold bars are priced at 149 million VND per tael.

Gold Taxation Not Yet Suitable

In an interview with Tiền Phong, economist Đinh Trọng Thịnh stated that taxing gold transactions requires careful consideration, as it is not the right time to implement such measures.

According to Thịnh, taxing gold is not inherently wrong, as gold is a commodity like any other. However, imposing a high tax, such as the 10% VAT proposed by VAFI or the 0.1% tax suggested by the Ministry of Finance, would increase costs for citizens and lead to a “tax-on-tax” effect.

Thịnh explained that most people buy gold to save income already taxed multiple times, so additional transaction taxes would disadvantage them.

Regarding the aim to stabilize the gold market and prevent speculation, the expert believes taxation is not a fundamental solution.

“Gold is just another commodity. If the market is transparent with legal investment channels, speculative behavior will naturally decrease. Taxation should not be the sole regulatory tool,” Thịnh said.

Thịnh suggests that instead of taxing, the government should improve management mechanisms and encourage trading through gold exchanges to ensure market transparency. This would allow citizens to invest confidently, maintaining physical gold as a safe savings option.

“Gold transaction taxation can be considered but not now. Thorough research and impact assessments are needed before implementation,” Thịnh advised.

On the evening of November 3rd, SJC gold bar prices rose to 149 million VND per tael, exceeding global prices by over 20 million VND per tael. Domestic gold prices have surged due to record-breaking global prices.

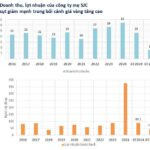

According to Vietnam’s 2024 GDP reports (approximately 12 million billion VND), the total reported gold trading volume in the first nine months of this year was around 23.3 trillion VND.

How Far Has Real Estate Titan Hoàng Quân Come in Delivering on Its Promise of 50,000 Affordable Homes?

In a bold commitment to addressing the nation’s housing needs, Hoang Quan Real Estate has pledged to develop 50,000 social housing units across Vietnam between 2022 and 2030. This ambitious initiative underscores the company’s dedication to creating affordable, quality homes for communities nationwide.