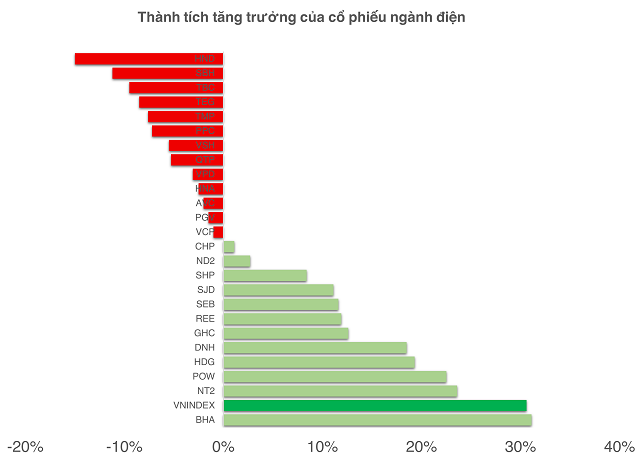

The Power Sector Lags Behind the VN-Index

After more than 10 months of 2025, the VN-Index has surged by over 30%, becoming one of the strongest-performing stock markets in the region. Many blue-chip stocks have doubled in value and continuously reached new highs. However, in contrast to the overall market enthusiasm, power sector stocks have had a much quieter year.

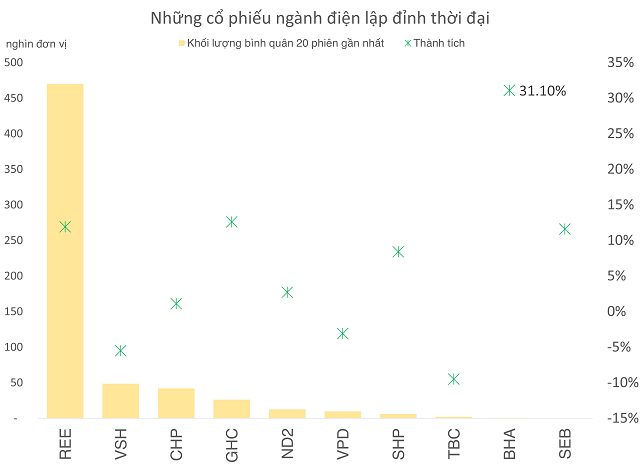

The stock BHA of Bac Ha Hydropower JSC on the UPCoM market is a rare exception, outperforming the VN-Index with a 31% increase – but its average trading volume over 20 sessions is below 1,000 units.

As of the close of trading on 05/11.

|

Stocks like REE, VSH, and CHP, which have also reached all-time highs, are “selective” in attracting investors, with average matching orders over the last 20 sessions not exceeding 1 million units: REE trades around 470,000 units, VSH less than 50,000, and CHP around 42,000 units per session.

In reality, the power sector still has highly liquid stocks, but they show inertia compared to the VN-Index.

Specifically, POW achieves a liquidity of over 7.4 million shares per session but has only increased by about 22.5%. Meanwhile, HDG reaches nearly 4.4 million shares per session and has risen by almost 20%.

The stock NT2 also trades over 1.6 million shares per session but fails to outpace the growth of the overall index.

As of the close of trading on 05/11.

|

Overall, despite decent business prospects, the power sector remains overshadowed in the market flow, where banking, Vingroup, and securities sectors continue to attract capital.

This reflects the typical characteristic of power sector stocks, which are not usually strong speculative targets. When the market heats up, capital tends to seek out fast-rising stocks rather than defensive groups.

Revitalizing the Power Sector

However, the sector’s prospects are not tied to short-term price fluctuations but to rapidly evolving policy foundations. Vietcap Securities views Resolution 70 as a “pivot” in Vietnam’s energy security strategy, aiming to ensure no power shortages, reliable electricity supply, and an electricity access index among the top 3 in ASEAN.

This includes developing a gas market of 30-35 billion m³/year, 3-4 times the current level, with oil refineries meeting at least 70% of gasoline demand and gasoline reserves reaching about 90 days of net imports.

The target for renewable energy is also raised to 25-30% of total supply by 2030.

The total installed capacity target is set at 183–236 GW, with electricity output potentially doubling compared to 2024. This necessitates the addition of new sources at a much faster pace than in previous years.

Source: Vietcap

|

LNG-based power is a critical pillar in this landscape. The government is finalizing a policy to increase the contracted power output guarantee (Qc) from 65% to 75% for LNG projects.

According to VIS Rating, investors can still negotiate higher guarantee levels in PPAs with EVN, thereby enhancing project efficiency. If approved, this mechanism would offer the highest guarantee level in ASEAN, directly addressing investors’ biggest concern: output and capital recovery. This could unlock new capital flows.

There are already signs of shifts. PV Power has raised 7,300 billion VND in equity and 2,000 billion VND in credit to develop Nhon Trach 3 and 4, two key LNG plants expected to operate before 2030.

Vingroup has also invested an additional 10,000 billion VND in VinEnergo to develop the Hai Phong LNG project, indicating that the private sector is ready to engage in LNG power production.

However, LNG power is more complex than coal-fired or solar power, requiring receiving ports, storage tanks, and liquefied gas pipelines. Some projects, like Hai Lang 1, Ca Na, and Quang Ninh, are delayed due to land clearance and planning procedures. According to VIS Rating, many of these bottlenecks may only be resolved once local authorities stabilize by late 2025.

Under Power Plan VIII, Vietnam aims to achieve 25,600–36,000 MW of LNG-based power by 2035, equivalent to over 10% of total national capacity. With an average construction time of four to five years, projects need to accelerate from 2026 to start operations before 2031 and benefit from policy incentives.

This opens significant opportunities for private enterprises with strong financial capabilities, implementation experience, and willingness to adopt a 30% equity – 70% credit model. With a 75% guarantee mechanism, easier PPA signings, and amended power laws fostering competition, the power sector will not only be defensive but also offer real growth potential.

While 2025 may not be the year of power stocks, the market is seeing a clear narrative: as electricity demand surges, policies favor private participation, and LNG becomes a strategic component of energy security, companies with major projects are poised to attract investor attention.

– 08:00 06/11/2025

Technical Analysis for the Afternoon Session of November 6th: Shifting Towards the August 2025 Lows

The VN-Index halted its upward momentum, unexpectedly correcting sharply toward its August 2025 lows (around 1,605–1,630 points). Meanwhile, the HNX-Index exhibited negative volatility, forming a Bearish Engulfing candlestick pattern.

Proposed $400 Million Renewable Energy Projects in Can Tho

The Can Tho Biomass Power Plant project boasts a total investment of over 8,000 billion VND. Meanwhile, the Sao Mai 1 Solar Power Plant project is expected to require an investment of approximately 1,000 billion VND.