Upon investigation, numerous securities companies directly owned by banks and bearing the bank’s brand name have emerged, such as VPBank Securities (VPBankS), ACB Securities (ACBS), MB Securities (MBS), Vietcombank Securities (VCBS), Techcombank Securities (TCBS), Tien Phong Securities (TPS), Agribank Securities (Agriseco), Shinhan Securities (SSV), VietinBank Securities (VBSE), Vikki Digital Bank Securities (VikkiBankS), and Public Bank Vietnam Securities (PBSV).

Another group comprises companies with bank shareholders or bank-related individuals, including LPBank Securities (LPBS) and LPBank, HD Securities (HDBS) and HDBank, Saigon-Hanoi Securities (SHS) and SHB, and KAFI Securities with VIB.

In recent years, this group of securities companies has increasingly captured attention, demonstrating impressive growth rates fueled by their unique advantages.

Many bank-backed securities firms are rising prominently, reshaping the market landscape.

|

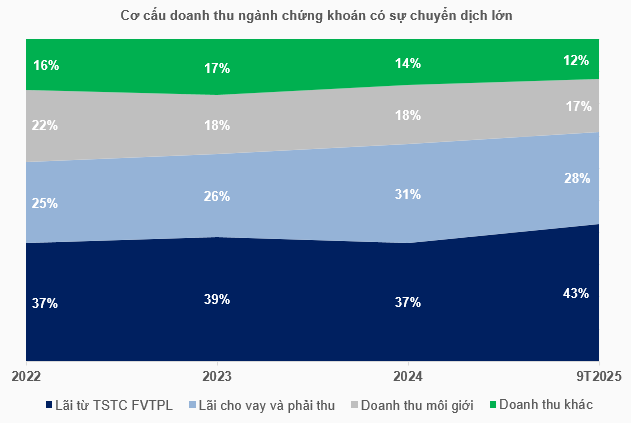

Examining the securities industry’s business landscape reveals a significant shift. According to VietstockFinance data, rather than focusing on brokerage activities, proprietary trading and margin lending now dominate revenue contributions, accounting for 43% and 28% respectively in the first nine months of 2025, with further expansion expected.

While independent securities firms excel in proprietary trading, margin lending has seen substantial changes, favoring bank-backed entities.

Source: VietstockFinance

|

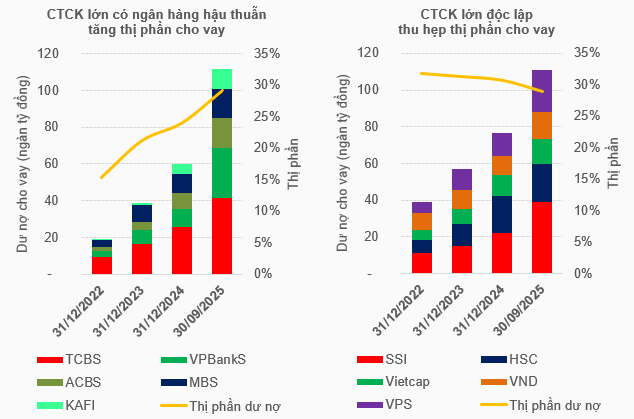

As of September 30, 2025, leading margin debt companies include bank-affiliated firms like TCBS, ACBS, VPBankS, MBS, and KAFI. Their combined debt reached nearly 112 trillion VND, a 493% increase from December 31, 2022, compared to 111 trillion VND for independent firms (up 185%).

This boosted the bank-backed group’s market share from 15.4% in late 2022 to 29.1% by Q3 2025, while top independent firms (SSI, HSC, Vietcap, VNDIRECT, VPS) dropped from 31.8% to 28.9%.

Source: VietstockFinance

|

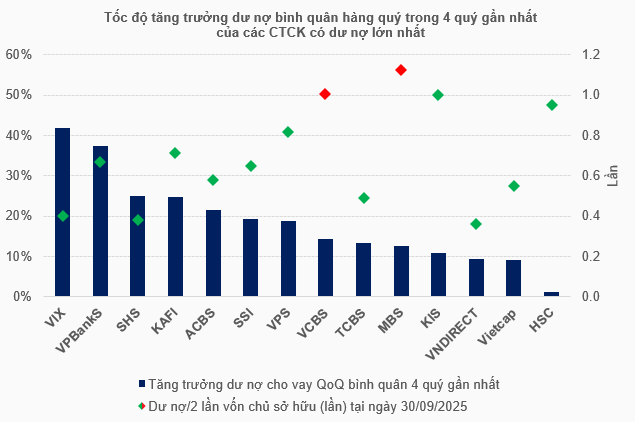

At VPBankS’s IPO Roadshow, Mr. Hoàng Nam, Director of Research and Analysis at Vietcap Securities, attributed this shift to structural advantages—a robust, low-cost capital foundation. This isn’t a short-term trend but a market reshaping.

Additionally, while overall margin debt rises, some firms slow due to capital limits. Bank-backed companies leverage their low-cost margin capacity to expand market share, especially in bullish markets.

Source: VietstockFinance

|

Market share competition extends beyond margin lending. Long-term success requires comprehensive investment services.

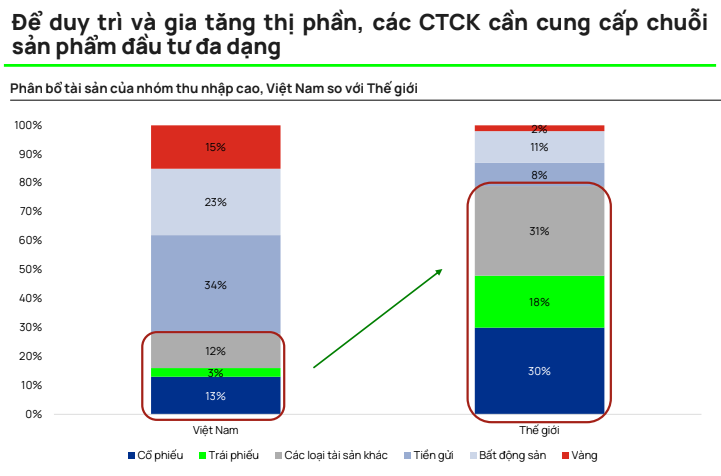

Vietcap data shows Vietnamese high-net-worth individuals allocate 72% to deposits, real estate, and gold—a stark contrast to global trends. This presents opportunities for asset diversification. Firms offering diverse products (stocks, bonds, funds, asset management) will capture more market share.

The corporate bond market exemplifies this potential. Success requires enterprise relationships, underwriting expertise, and capital—areas where bank-affiliated firms excel.

Source: Vietcap

|

Vietcap experts highlight standout performers like VPBankS and TCBS among bank-affiliated firms.

Independent firms leverage expertise in institutional brokerage, retail brand reputation, and seasoned proprietary trading. Bank-backed firms harness parent bank resources (technology, clients, capital), robust capital foundations, and end-to-end corporate bond capabilities. This group is reshaping the market.

– 12:00 06/11/2025

SSI Securities Reduces Number of Shares Offered to Shareholders

SSI Securities Corporation has revised its planned offering of shares to existing shareholders, reducing the number from 415.58 million units to 415.18 million units.

MSH Shares: FPTS Registers Sale of Nearly 1.2 Million Units

Shortly after the failed sale of nearly 1.2 million shares in Garment Manufacturing Corporation (HOSE: MSH), FPT Securities Corporation (FPTS, HOSE: FTS) is revisiting the deal.