Vietcombank has recently expanded its VCB Alert feature, which warns customers of potential fraud or scam risks when receiving money. This enhancement now covers internal bank transfers via VCB Digibank and over-the-counter transactions.

When customers initiate online money transfers, the system automatically flags accounts exhibiting suspicious indicators, such as: recipient details not matching the National Population Database; accounts listed on government watchlists; or accounts flagged for potential risks.

For in-branch transactions, Vietcombank staff will proactively notify customers if the recipient’s account shows similar suspicious signs.

Based on these alerts, customers can decide whether to proceed with the transaction.

Since its launch on June 30, VCB Alert has issued hundreds of thousands of warnings, helping customers avoid potentially fraudulent transactions.

Banks continue to urge customers to remain vigilant and protect their personal information to prevent fraud. |

Agribank offers its AgriNotify service, a free feature integrated into the Agribank Plus platform, designed to detect and alert customers about accounts suspected of fraud, thereby safeguarding their interests.

|

Several banks, including Vietcombank, BIDV, MB, and Agribank, have piloted fraud alert systems to enhance customer protection. |

When customers input a recipient’s account number, the system automatically cross-references it with databases from authorities (e.g., Ministry of Public Security, State Bank of Vietnam) and internal records before processing transfers within Agribank or via NAPAS 24/7.

If an account is flagged for potential fraud, the system immediately notifies the customer, advising caution before completing the transaction.

Alerts include: high-risk accounts linked to official warnings; medium-risk accounts with unusual activity; and unverified accounts with recipient details not matching the National Population Database.

According to the Payment Department of the State Bank of Vietnam, over five months, the SIMO fraud alert system has helped banks prevent approximately VND 1.79 trillion in suspicious transactions, protecting 468,000 customers.

|

Banks advise customers to stay alert, safeguard personal and service-related information, and regularly monitor risk alerts and safety guidelines from banks and authorities. |

Thái Phương

– 11:40 06/11/2025

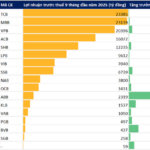

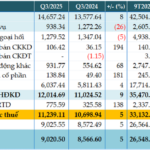

Full Overview of 9-Month Business Results of Major Banks as of October 30: Surprising Updates from Vietcombank, VietinBank, and BIDV

On the afternoon of October 30th, several major banks, including MSB, Eximbank, HDBank, Vietcombank, VietinBank, and BIDV, released their financial reports for the third quarter of 2025.