Binh Son Refining and Petrochemical JSC (Stock Code: BSR, HoSE) has recently submitted a report detailing the outcomes of its share issuance for dividend payment and capital increase from equity.

By the end of the issuance period on October 30, 2025, Binh Son successfully distributed over 1.9 billion shares to 26,870 shareholders, with 7,193 remaining fractional shares to be canceled. The shares are expected to be transferred in Q4/2025.

Specifically, the company issued more than 930.1 million shares as dividends to shareholders at a ratio of 100:3, meaning for every 100 shares held, shareholders receive 30 new shares.

Illustrative image

The total issuance value, based on par value, is approximately VND 9,301.5 trillion, sourced from undistributed after-tax profits in the audited 2024 Consolidated Financial Statements (after provisions as per the 2024 Profit Distribution Plan approved by the 2025 Annual General Meeting).

Additionally, the company issued nearly 976.7 million bonus shares to shareholders at a ratio of 100:31.5, meaning for every 100 shares held, shareholders receive 31.5 new shares.

The total issuance value, based on par value, is approximately VND 9,766.6 trillion, sourced from the development fund in the audited 2024 Financial Statements of Binh Son’s parent company.

Following these issuances, the total number of outstanding shares increased from over 3.1 billion to more than 5 billion, raising the charter capital from nearly VND 31,005 trillion to approximately VND 50,073 trillion.

Regarding business performance, according to the Q3/2025 Consolidated Financial Statements, Binh Son recorded net revenue of over VND 35,290.2 trillion, a 10.5% increase compared to the same period last year.

After deducting taxes and fees, the company reported a net profit of nearly VND 908.6 billion, compared to a net loss of VND 1,209.5 billion in the same period last year.

Binh Son explained that the shift from loss to profit was primarily due to lower crude oil prices, a more favorable spread between crude oil and product prices, and higher sales volumes.

For the first nine months of 2025, Binh Son achieved net revenue of nearly VND 103,956.8 trillion, a 19.4% increase compared to the same period in 2024; corporate income tax after-profit reached over VND 2,154.7 billion, up 219.5%.

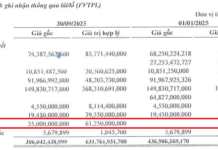

As of September 30, 2025, the company’s total assets decreased by 5.1% from the beginning of the year to VND 83,843.7 trillion. Term deposits amounted to nearly VND 31,112 trillion, a 121.9% increase from the beginning of the year, accounting for 37.1% of total assets.

On the liabilities side, total payables stood at over VND 26,389.9 trillion, down 19.7% from the beginning of the year. Short-term loans and finance leases totaled nearly VND 14,137 trillion, representing 53.6% of total liabilities.

Is the Largest Stock Offering in History on the Horizon?

Vingroup, one of Vietnam’s leading conglomerates, is seeking shareholder approval for a groundbreaking issuance of 3.85 billion shares—the largest in the country’s stock market history. If successful, this move will double the company’s chartered capital to over 77 trillion VND, marking a significant milestone in its growth trajectory.

Stock Market Flash Briefing & Event Calendar: November 6, 2025

“Stay ahead of the curve with our comprehensive roundup of the most impactful, concise news highlights tailored for listed companies on the stock exchange.”