Vingroup (stock code: VIC) has recently released a written shareholder consultation document, highlighting a significant proposal to issue bonus shares to increase capital. The conglomerate, owned by billionaire Pham Nhat Vuong, plans to present a scheme to shareholders involving the issuance of 3.85 billion shares (a 1:1 ratio). This marks the largest bonus share issuance in the history of Vietnam’s stock market.

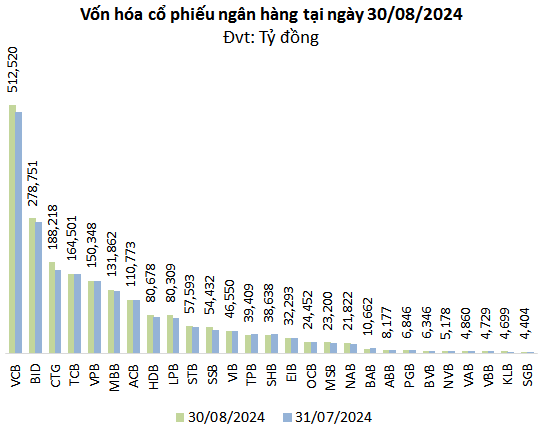

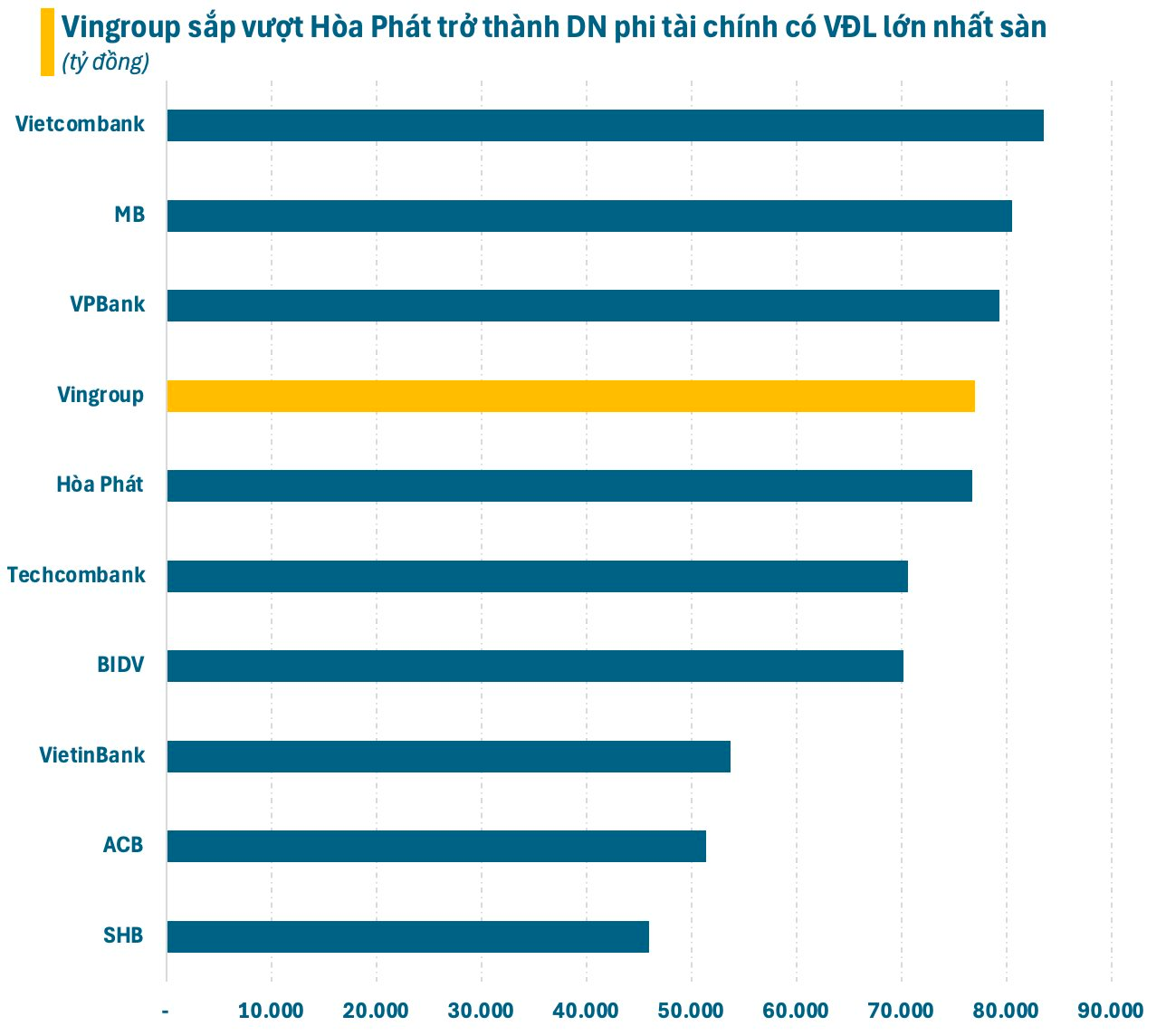

The issuance is scheduled for Q4, which will double Vingroup’s chartered capital to over 77,000 billion VND. This move will position Vingroup as the non-financial enterprise with the highest chartered capital on the stock exchange, surpassing Hoa Phat. Vingroup’s chartered capital will then trail only three banks: Vietcombank, MB, and VPBank.

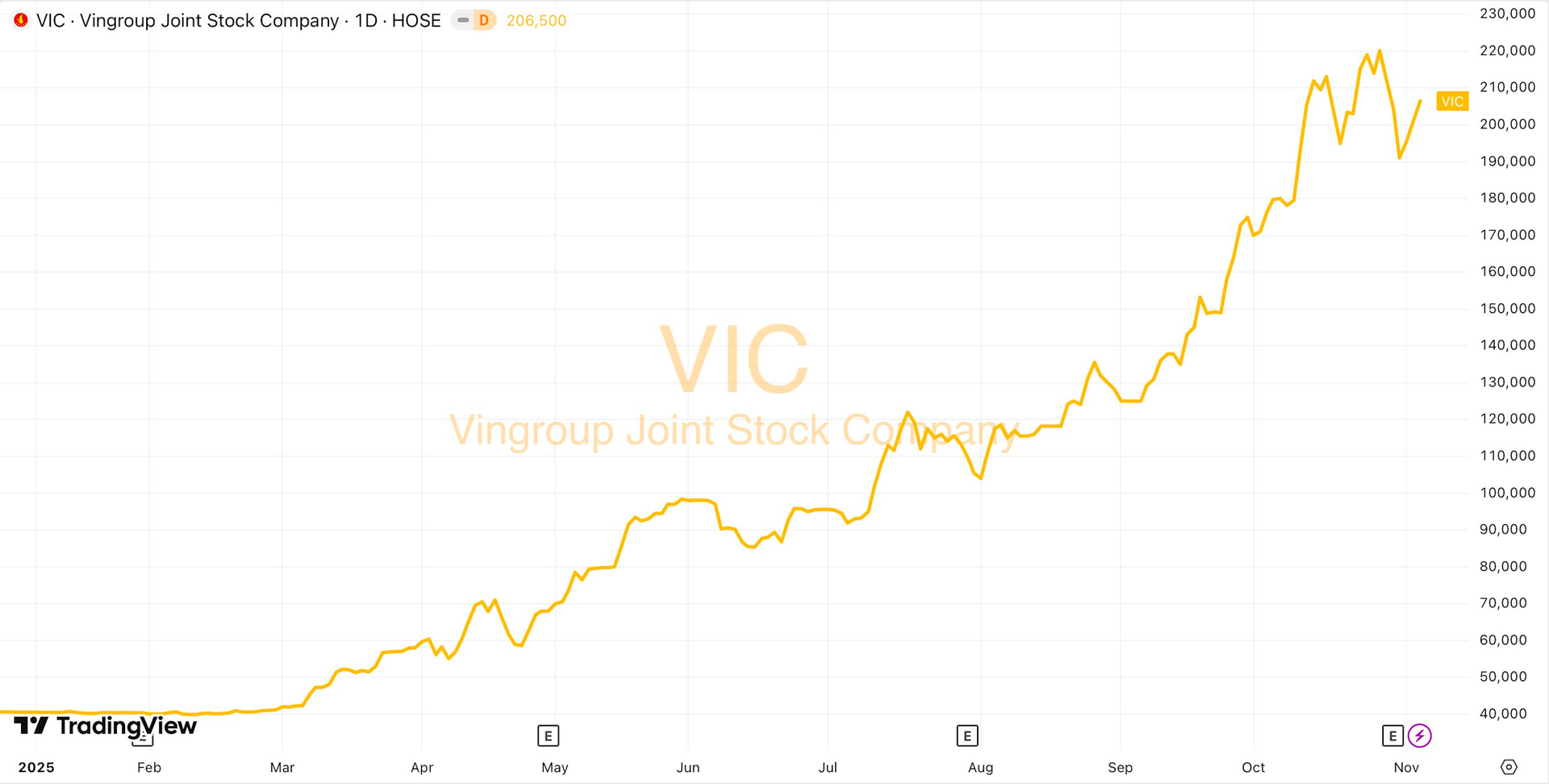

Currently, Vingroup is the largest enterprise on the stock market, boasting a market capitalization of nearly 800,000 billion VND, significantly outpacing its competitors. Since the beginning of 2025, VIC shares have surged fivefold, reaching an all-time high of 206,500 VND per share (closing price on November 5th).

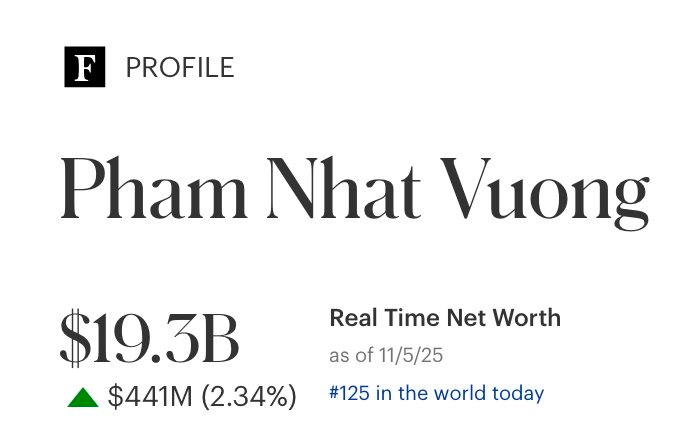

Consequently, Pham Nhat Vuong’s wealth has skyrocketed to over 19 billion USD (according to Forbes), ranking him 125th among the world’s wealthiest individuals.

In terms of business performance, Vingroup recorded a consolidated net revenue of 169,611 billion VND in the first nine months, a 34% increase compared to the same period last year, reflecting positive changes across its main business pillars. Consolidated after-tax profit for the nine months reached 7,565 billion VND, 1.9 times higher than the same period in 2024, achieving 76% of the profit target set for 2025.

As of September 30, 2025, Vingroup’s total assets amounted to 1,087,870 billion VND, a 30% increase from the end of last year. This milestone makes Vingroup the first private enterprise and the second non-banking enterprise to reach this asset level, following the Vietnam National Energy Group (PVN).

In the Technology and Industry sector, VinFast demonstrated impressive growth in the first nine months of 2025, delivering 110,362 electric vehicles globally, a 149% increase compared to the same period in 2024. Domestically, VinFast achieved a record-breaking 103,884 electric vehicle sales in nine months, the highest ever for an automotive brand in Vietnam. In the electric motorcycle segment, VinFast continues to lead Vietnam’s green transition, delivering 234,536 units in nine months, nearly six times more than in 2024.

In the Commerce and Services sector, Vinhomes reported robust sales in the first nine months of 2025, with a total revenue of 162,582 billion VND, a 96% increase year-on-year. Unrecognized sales by the end of September reached 223,937 billion VND, a 93% increase from the previous year, setting a new record and providing a solid foundation for Vinhomes’ future performance.

Vietnamese Billionaire Pham Nhat Vuong Ventures into Iron and Steel Production

Vingroup is expanding its business portfolio with the addition of several key industries, including: (1) Iron, Steel, and Cast Iron Production – specializing in the manufacturing of iron and steel; (2) Iron and Steel Casting; (3) Metal Forging, Stamping, Pressing, and Rolling – along with metal powder metallurgy; and (4) Mechanical Engineering – encompassing metal processing and coating services.

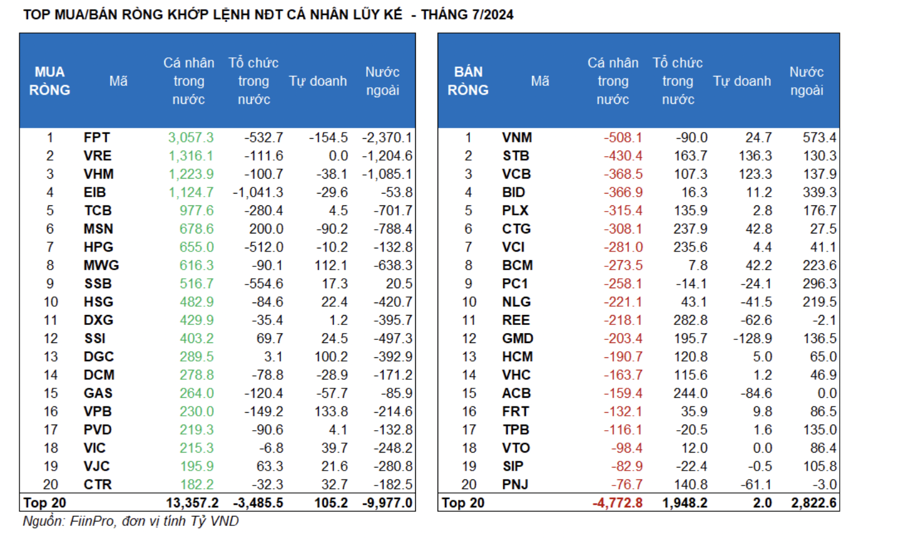

VN-Index Cools Down as Mutual Funds Gear Up for a New Cycle

October brought significant volatility as the VN-Index unexpectedly reversed course following a sharp rally. Despite short-term fund performance facing pressure, funds remain committed to their long-term strategies, actively strengthening positions to capitalize on the upcoming recovery cycle.

Maturing Investors: The Opportunity to Professionalize Vietnam’s Stock Market

Over the past 2–3 years, Vietnamese investors have shifted their approach to the stock market, moving beyond short-term speculation to embrace more structured and strategic participation. The market now exhibits clear signs of transitioning from a speculative mindset to one focused on value investing. This evolution presents an opportunity to foster a more professionalized market, encouraging investors to engage with investment organizations, thereby reducing risk and enhancing profitability.