Illustrative Image

As of now, Vietnam leads the world in cashew nut exports and is witnessing a significant surge in raw material imports this year, primarily from Cambodia and African nations.

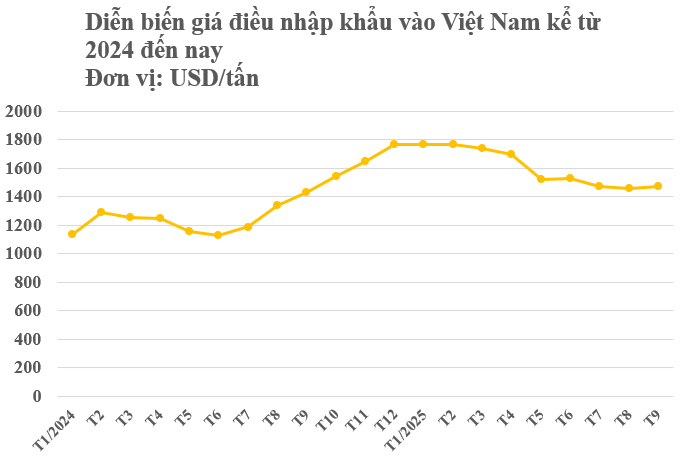

According to preliminary statistics from the General Department of Customs, Vietnam’s cashew nut imports in September reached over 272 thousand tons, valued at more than $401 million, a slight increase of 0.6% in volume and 1.8% in value compared to the previous month.

In the first three quarters, Vietnam spent over $3.7 billion on cashew nut imports, totaling more than 2.4 million tons, up 12.4% in volume and a robust 38.9% in value compared to the same period in 2024.

In terms of market share, Cambodia is Vietnam’s largest cashew nut supplier, with over 951 thousand tons valued at more than $1.4 billion, a strong increase of 18% in volume and 38% in value compared to the same period last year. The average import price reached $1,515 per ton, a 26% increase compared to Q3/2024.

Côte d’Ivoire ranks second, supplying over 542 thousand tons valued at more than $822 million, up 13% in volume and 42% in value year-on-year. Prices also rose by 26%, to $1,515 per ton.

Ghana is the third-largest supplier by volume, with over 204 thousand tons valued at more than $302 million. While volume decreased by 19%, value increased by 5% year-on-year. Prices rose by 30%, to $1,479 per ton.

Cambodia is now a strategic raw material source for Vietnam’s cashew industry, thanks to its proximity and compatible nut quality with domestic processing requirements. Many Vietnamese companies have expanded raw material investments in Cambodia’s eastern provinces to ensure a stable supply.

Vietnam currently holds approximately 80% of the global cashew kernel export market share, with over 500 processing facilities concentrated in Binh Phuoc, Dong Nai, Binh Duong, and the Central Highlands. Large-scale imports of raw cashews from Cambodia and Africa ensure year-round production, as domestic cashew cultivation meets only a fraction of demand.

The sharp rise in raw cashew prices in 2025 stems from multiple factors. Prolonged droughts and higher agricultural input costs in key West African producing nations have significantly reduced supply. Meanwhile, increased demand from major processing hubs like Vietnam, India, and Côte d’Ivoire has intensified competition for raw materials.

Beyond supply and demand, high logistics and shipping costs from Africa to Asia, due to container shortages and rising insurance expenses, have further inflated import prices. Additionally, recovering demand for nutritious nuts in the U.S., Europe, and China has boosted processed cashew prices, driving up raw material costs.

Despite higher raw material prices, stable demand from key markets like the U.S., EU, and China has helped Vietnam maintain its position as the world’s largest cashew processing and export hub.

The Ultimate Guide to Importing from Cambodia: How a 0% Tariff is Boosting Vietnam’s Economy

The Cambodian savior has arrived on Vietnamese shores, commanding a price tag nearly 20% higher than the first half of last year.

A Top Vietnamese Product: Leading Global Supplier and Manufacturer

Vietnam has been a powerhouse in exporting this particular product over the past years. With its exceptional quality and competitive pricing, it has gained a strong foothold in the global market. This success is a testament to the country’s expertise and dedication to delivering superior goods, solidifying its position as a leading exporter.