According to the Hanoi Stock Exchange, CMC Technology Group JSC (Stock Code: CMG, HoSE) has announced the successful issuance of corporate bonds. On October 30, 2025, the company issued 12,500 bonds under the code CMG12501 to the domestic market. With a face value of VND 100 million per bond, the total issuance value reached VND 1,250 billion, featuring a 10-year term and a maturity date of October 30, 2035.

As reported by HNX, the bonds carry an annual interest rate of 5.5%, marking the first bond issuance by CMC Technology Group in 2025 to date. Details regarding bondholders and collateral assets remain undisclosed.

However, sources reveal that just days before the issuance (on October 27, 2025), CMC Technology Group pledged assets to CGIF, an ADB credit fund. These assets include a capital contribution of over VND 148.5 billion in CMC Global LLC, all withdrawable profits from this investment, proceeds from the sale of the equity, and all balances held in the company’s account at An Binh Commercial Joint Stock Bank’s Hanoi branch, along with associated monetary benefits.

Illustrative image

Previously, CMC Technology Group’s Board of Directors approved the bond issuance plan to fund the CMC Starlake project.

CMC Starlake, officially known as the CMC Creative Space (CCS Hanoi), is a 23-story building with 3 basement levels, covering over 11,000 m² and offering a total floor area of 90,000 m². The project’s total investment is USD 300 million (approximately VND 7,800 billion).

Founded in 2007, CMC Technology Group is headquartered at CMC Tower, 11 Duy Tan Street, Cau Giay District, Hanoi. The company specializes in IT services, computer-related services, software production, and software solutions.

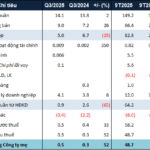

In Q2/2025 (June 1–September 30, 2025), the company reported net revenue of over VND 2,420 billion, a 10.6% year-on-year increase. Net profit reached nearly VND 113 billion, up 49.3%.

For the six months ending September 30, 2025, cumulative net revenue exceeded VND 4,630 billion, a 16.3% increase compared to the first half of 2024. Post-tax profit totaled over VND 229.5 billion, up 32.8%.

As of September 30, 2025, total assets rose 12.7% to VND 8,654 billion since March 30, 2025, while total liabilities increased 19.7% to VND 4,788 billion.

An Cuong Wood Announces 13% Cash Dividend Advance Payment

An Cuong Wood Processing Joint Stock Company (HOSE: ACG) announces the finalization of its shareholder list for the first interim dividend payment in 2025, to be distributed in cash at a rate of 13% (equivalent to VND 1,300 per share). The ex-dividend date is set for November 11th.

TCBS to Launch Public Offering of VND 5 Trillion in Bonds

TCBS is set to launch a public bond issuance of up to 5,000 billion VND, divided into four tranches, commencing in Q4 2025.