Stock investors experienced a rollercoaster ride during the November 6th trading session. The VN-Index fluctuated wildly, swinging between gains and losses, even plunging nearly 20 points in the afternoon before recovering slightly. At the close, the VN-Index dropped over 12 points to 1,642.64. Trading volume on the HoSE remained low, with order-matching value reaching 16.9 trillion VND.

Foreign trading activity continued to be a drag, with net selling of 1.236 trillion VND across the market. Here’s a breakdown:

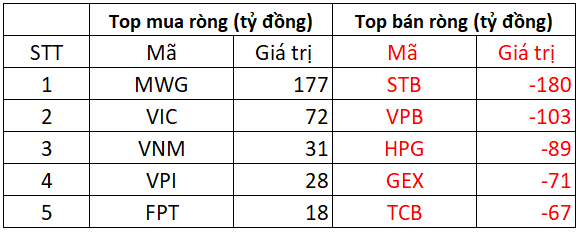

On HoSE, foreign investors net sold approximately 1.067 trillion VND

On the buying side, MWG stocks were the most heavily accumulated by foreign investors, with a value of 177 billion VND. VIC, VNM, and VPI followed closely, with net purchases ranging from 28 to 72 billion VND per stock. FPT also saw foreign inflows of around 18 billion VND.

Conversely, foreign investors heavily offloaded bank stocks such as STB, VPB, and TCB, totaling 350 billion VND. HPG and GEX were also significantly net sold, with values of 89 billion VND and 71 billion VND, respectively.

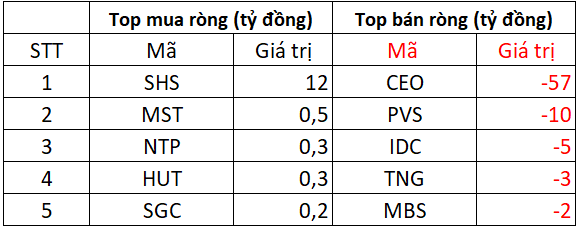

On HNX, foreign investors net sold around 69 billion VND

On the buying side, SHS stocks saw the strongest foreign accumulation, with a value of 12 billion VND. Foreign investors also made modest purchases in MST, NTP, HUT, and SGC, among others.

On the selling side, CEO and PVS were heavily net sold, with values of 57 billion VND and 10 billion VND, respectively. IDC, TNG, and MBS were also among the top net-sold stocks, with values ranging from 2 to 5 billion VND.

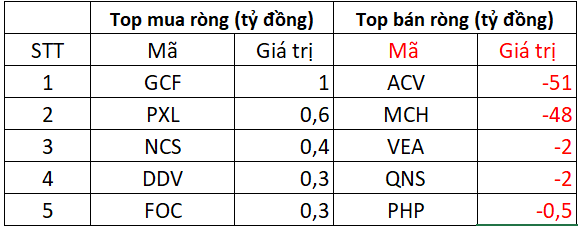

On UPCOM, foreign investors net sold approximately 101 billion VND

On the buying side, foreign investors made modest purchases in GCF, PXL, NCS, DDV, and FOC, with values ranging from a few hundred million to 1 billion VND.

On the selling side, ACV and MCH were heavily net sold, with values of 51 billion VND and 48 billion VND, respectively. VEA and QNS also saw net selling of around 2 billion VND, while PHP experienced minimal net selling.

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.

VN-Index Cools Down as Mutual Funds Gear Up for a New Cycle

October brought significant volatility as the VN-Index unexpectedly reversed course following a sharp rally. Despite short-term fund performance facing pressure, funds remain committed to their long-term strategies, actively strengthening positions to capitalize on the upcoming recovery cycle.