The Vietnamese stock market witnessed a vibrant trading session, with the VN-Index dipping to 1,600 points before a surge of bottom-fishing capital propelled a robust recovery. By the close of the November 4th session, the VN-Index climbed nearly 35 points to reach 1,651.98. Trading liquidity soared compared to the previous session, with the order-matching value on HoSE hitting VND 31.2 trillion.

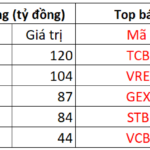

Foreign trading activity also turned positive, with net buying reaching VND 1.160 trillion during the session. Specifically:

On HoSE, foreign investors net bought approximately VND 1,223 billion

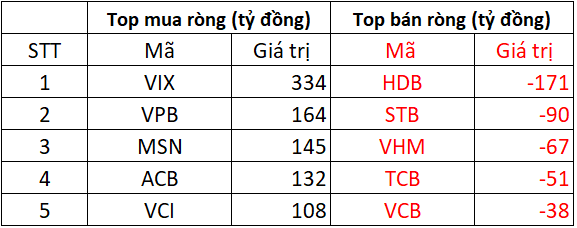

On the buying side, VIX shares were the most heavily accumulated by foreign investors, with a value of up to VND 334 billion. Following closely, blue-chip stocks such as VPB, MSN, ACB, and VCI also saw net buying ranging from VND 108 billion to VND 164 billion per ticker.

Conversely, HDB saw the most significant selling pressure from foreign investors, with a value of VND 171 billion. Three other banking stocks—STB, TCB, and VCB—also faced substantial net selling in the tens of billions of dong. Additionally, VHM experienced net selling of around VND 67 billion.

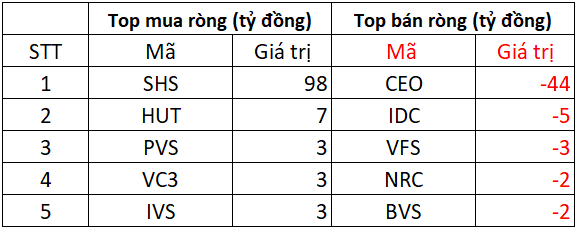

On HNX, foreign investors net bought approximately VND 57 billion

On the buying side, SHS shares saw the strongest net buying on HNX, with a value of VND 98 billion. Foreign investors also injected net capital ranging from VND 3 billion to VND 7 billion into HUT, PVS, VC3, and IVS.

On the selling side, CEO shares faced the most significant net selling on HNX, with a value of VND 44 billion. Other tickers such as IDC, VFS, NRC, and BVS saw net selling ranging from VND 2 billion to VND 5 billion.

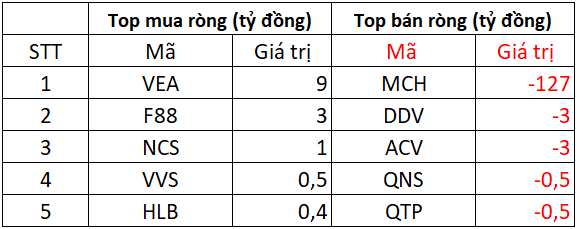

On UPCOM, foreign investors net sold approximately VND 119 billion

On the buying side, VEA and F88 shares were the most heavily net bought, with values ranging from VND 3 billion to VND 9 billion. NCS, VVS, and HLB also saw net buying, though the values were only a few hundred million to VND 1 billion.

Conversely, MCH shares faced significant selling pressure, with a notable value of VND 127 billion. DDV and ACV also saw net selling of VND 3 billion each. QNS and QTP experienced net selling of around VND 500 million each.

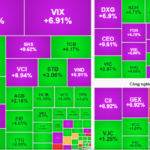

Real Estate Stocks Ride the Wave, Propelling VN-Index to Surge

The trading session on November 4th concluded on a positive note, marking a significant rebound after over two weeks of consecutive declines. The VN-Index surged by more than 34 points, representing a 2.12% increase, closing in on the 1,652-point mark. This impressive rally signals a much-needed recovery following a prolonged period of steep losses.

Unlocking October’s High-Yield Potential: Which Sectors Historically Outperform in This Profitable Month?

November historically marks a bullish trend for both the S&P 500 and VN-Index, as noted by Mr. Minh’s statistical analysis.