Largest in History

Vingroup (stock code: VIC) has just released a document seeking written opinions from shareholders. Notably, Vingroup’s document includes plans to issue bonus shares to increase capital.

Accordingly, Vingroup plans to present shareholders with a proposal to issue 3.85 billion shares, equivalent to a 1:1 ratio. This is the largest bonus share issuance in the history of Vietnam’s stock market. The implementation is expected in the fourth quarter of this year. If successful, Vingroup’s chartered capital will double, reaching over 77 trillion VND.

Currently, Vingroup is the largest enterprise on the stock market with a market capitalization of nearly 800 trillion VND. Since the beginning of the year, VIC shares have increased fivefold and are at an all-time high. On the trading session of November 6th, VIC shares were priced at 210,000 VND per share.

Vingroup plans to present shareholders with a proposal to issue 3.85 billion shares.

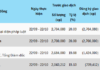

In the first nine months of this year, Vingroup achieved a consolidated net revenue of 169.611 trillion VND, a 34% increase compared to the same period last year. Consolidated after-tax profit reached 7.565 trillion VND, 1.9 times higher than the same period in 2024, completing 76% of this year’s profit plan.

As of September 30th, Vingroup’s total assets reached 1,087.870 trillion VND, a 30% increase compared to December 31, 2024.

Trillion-Dollar Deals

Recently, Becamex IDC (stock code: BCM) finalized the shareholder list for a written opinion on issuing additional shares to the public to increase its chartered capital.

According to the plan, Becamex IDC will issue 300 million shares through an auction on HoSE with a starting price of 69,600 VND per share. The auction is scheduled for the morning of April 28th at the Ho Chi Minh City Stock Exchange (HoSE). However, due to market impacts from U.S. countervailing duties, BCM postponed the auction as the stock hit the floor for four consecutive sessions.

If the auction succeeds, Becamex IDC could raise at least 20.880 trillion VND, surpassing Vietcombank’s 2007 auction, which raised over 10.500 trillion VND.

Hoang Huy Financial Services Investment Corporation (stock code: TCH) announced the issuance of over 200 million shares to existing shareholders at a ratio of 10:3, meaning shareholders owning 10 shares can purchase 3 new shares.

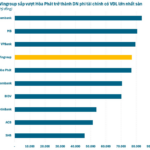

Numerous enterprises and banks have continuously issued shares to increase chartered capital recently.

DIC Corporation (stock code: DIG) relaunched its plan to issue 150 million shares to existing shareholders at a ratio of 1,000:232, priced at 12,000 VND per share, aiming to raise 1.800 trillion VND from Q3 2025 to Q1 2026.

Dat Xanh Group (stock code: DXG) plans to privately issue over 93 million shares at 18,600 VND per share, raising 1.739 trillion VND for the DatXanh Homes Parkview project in Ho Chi Minh City.

In the financial sector, Orient Commercial Bank (stock code: OCB) will issue over 197 million shares to increase equity capital by 8%. With a par value of 10,000 VND per share, the total issuance value is nearly 1.973 trillion VND. Upon completion, OCB’s chartered capital will increase by nearly 1.973 trillion VND, from 24.658 trillion VND to over 26.630 trillion VND.

Nam A Bank (stock code: NAB) will issue over 343 million shares to existing shareholders. Meanwhile, Vietbank (stock code: VBB) finalized the shareholder list to issue over 107 million shares from equity capital.

In the second phase, Vietbank will issue an additional 271 million shares to existing shareholders, equivalent to 33% of the increased chartered capital after the first phase. If both phases are completed, Vietbank’s chartered capital will rise from 7.139 trillion VND to nearly 10.920 trillion VND.

Stock Market Flash Briefing & Event Calendar: November 6, 2025

“Stay ahead of the curve with our comprehensive roundup of the most impactful, concise news highlights tailored for listed companies on the stock exchange.”

Vietnamese Billionaire Pham Nhat Vuong Ventures into Iron and Steel Production

Vingroup is expanding its business portfolio with the addition of several key industries, including: (1) Iron, Steel, and Cast Iron Production – specializing in the manufacturing of iron and steel; (2) Iron and Steel Casting; (3) Metal Forging, Stamping, Pressing, and Rolling – along with metal powder metallurgy; and (4) Mechanical Engineering – encompassing metal processing and coating services.