KIS Vietnam Securities Corporation (KIS Vietnam) has announced a written shareholder consultation from November 4, 2025, to 3 PM on November 14, 2025.

Shareholders are invited to provide feedback on adjustments to the offering plan of 78.9 million shares to existing shareholders.

Previously, the first Extraordinary General Meeting of Shareholders in 2025, held on October 15, 2025, approved the offering of 78.9 million shares to existing shareholders.

The ratio is set at 100:20.98, meaning shareholders holding 100 shares will receive 1 right to purchase an additional 20.98 shares. The offering price is 10,000 VND per share, with no transfer restrictions on the issued shares.

KIS Vietnam seeks shareholder input on the transfer of purchase rights. Specifically, shareholders may transfer their entire purchase rights once during the registration period, up to 5 days before the registration deadline. The recipient of the transferred rights cannot retransfer them. The company will manage the transfer process to ensure the number of shareholders post-issuance does not exceed 100.

Additionally, KIS Vietnam is adjusting the use of proceeds from the offering for shareholder approval. With an expected 789 billion VND in proceeds, the company plans to allocate 75.6% (596.4 billion VND) to margin lending and advance payments, and the remaining 24.4% (193 billion VND) to proprietary trading.

Upon completion of this offering, KIS Vietnam’s chartered capital will increase from 3,762 billion VND to over 4,551 billion VND.

In terms of business performance, KIS Vietnam recorded 1,927 billion VND in operating revenue for the first nine months of 2025, a 4.3% increase year-over-year. Proprietary trading contributed the most with over 303 billion VND, followed by lending revenue at 248 billion VND, and brokerage revenue at 209 billion VND.

Operating expenses rose by 5.6% to 1,273 billion VND. As a result, pre-tax profit reached 472 billion VND, a 4.6% increase compared to the same period last year.

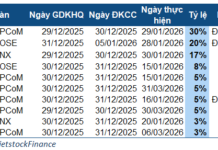

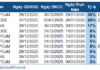

Noi Bai Cargo Services to Distribute 80% Cash Dividend

Noi Bai Cargo Services plans to allocate over VND 209.3 billion for dividend payments in 2024, representing an 80% payout ratio. The final registration date for shareholders to receive this dividend is November 18, 2025.

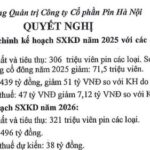

Rabbit Battery Brand Owner Adjusts 2025 Plan Downward

According to the newly announced Board Resolution, Hanoi Battery Joint Stock Company (HNX: PHN), the owner of the Con Thỏ battery brand, has adjusted downward its 2025 business plan targets. As a result, the production and consumption volume is now set at 306 million batteries of various types, which is 71.5 million units lower than the plan presented to the Annual General Meeting of Shareholders.

PC1 Announces Official Release Date for Over 53 Million Bonus Shares to Shareholders

PC1 is set to issue over 53.6 million bonus shares to its shareholders, with the aim of increasing its chartered capital to nearly VND 4,113 billion.