Dao Phuc Tuong, former Investment Director at APS Asset Management and Vietnam Holding Asset Management, participated as an independent expert at the Vietnam Investment Forum 2026.

Mr. Dao Phuc Tuong at the Vietnam Investment Forum 2026 – Photo: Organizer

|

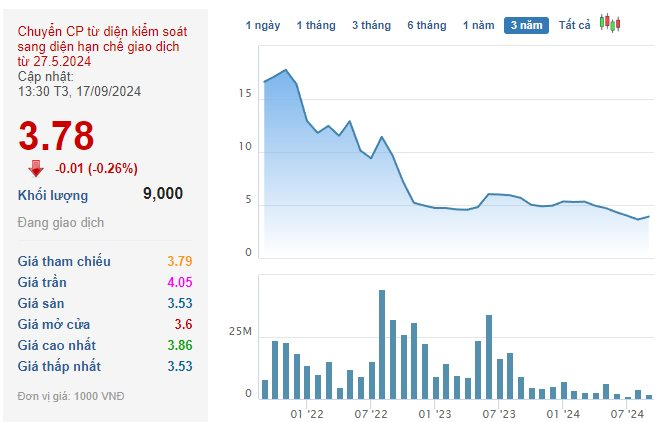

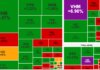

During the forum’s discussion session on the afternoon of November 4th, Mr. Tuong stated that the stock market has reached a challenging phase in terms of growth. This is evident in the recent correction after the VN-Index surged over 30% this year. He attributed this to the significant contribution of non-recurring income to corporate profit growth, cautioning against overly optimistic expectations for this trend to continue into 2026.

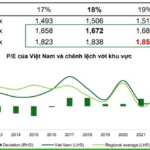

In Q4/2025, the expert noted that profit growth, particularly in the banking sector, faced challenges due to the high comparative base from the previous year. Additionally, the valuations of many stock sectors are at their 10-year average and even near their 3-year highs.

“Regarding growth drivers, I haven’t seen any breakthrough momentum for 2026, especially given the already high valuation levels, though not excessively so,” Mr. Tuong remarked.

Notably, the seasoned investor highlighted the risk of the market’s large margin debt. “Don’t be surprised if there are sharp declines on the buying side,” he warned.

However, such downturns could present buying opportunities, as Mr. Tuong believes the foundation for corporate profit growth remains, albeit with expected polarization. He identified sectors with promising profit growth prospects for the coming year, including construction materials, civil construction, oil and gas, and seafood.

In terms of market performance, even if these sectors rise, the VN-Index is unlikely to surge due to growth challenges faced by large-cap companies.

Regarding ongoing and upcoming IPOs, the expert with 20 years of experience advised caution, citing unattractive valuation levels. Nonetheless, he emphasized that the IPO wave is essential in the medium to long term to introduce new assets and attract capital to the market.

He advised investors considering IPO participation to evaluate three criteria: (1) the company’s ability to achieve its announced growth plans, (2) the valuation assigned to its growth prospects, and (3) the post-IPO free-float ratio.

– 16:36 05/11/2025

Vietnamese Stock Accounts Surpass 11 Million, Exceeding 2030 Target

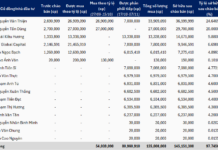

As of September 2025, Vietnam’s stock market has surpassed expectations, boasting over 11 million trading accounts—a milestone originally targeted for 2030 under the government-approved Securities Market Development Strategy unveiled in late 2023, according to data from the Vietnam Securities Depository and Clearing Corporation (VSDC).

VN-Index Projected to Surpass 1,800 Points: VCBS Highlights Sectors Poised for Year-End Momentum

With a focus on high economic growth, the investment strategy for the final months of 2025 will prioritize large-cap stocks, particularly those in sectors driven by Vietnam’s intrinsic strengths.