Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 614 million shares, equivalent to a value of more than 18.4 trillion VND; the HNX-Index reached over 84.3 million shares, equivalent to a value of more than 1.8 trillion VND.

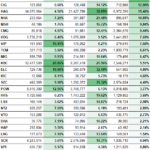

The VN-Index opened the afternoon session and continued its sideways movement with fairly balanced buying and selling pressure. Despite sellers briefly pushing the index below the reference point, buyers maintained a stronger position, helping the VN-Index close in positive territory. The most influential stocks were VIC, CTG, GAS, and VCB, contributing over 9.3 points to the index. Conversely, TCB, FPT, HPG, and VHM faced selling pressure, reducing the index by more than 3.6 points.

| Top 10 Stocks Impacting VN-Index on November 5, 2025 (Point-Based) |

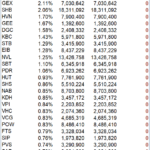

Similarly, the HNX-Index showed positive momentum, influenced by stocks such as KSF (+5.4%), PVS (+5.9%), PTI (+7.69%), and HUT (+1.67%).

| Top 10 Stocks Impacting HNX-Index on November 5, 2025 (Point-Based) |

At the close, the market saw a slight increase with green dominating most sectors. The energy sector led with a 3.44% gain, primarily driven by BSR (+3.07%), PLX (+2.92%), PVS (+5.9%), and PVD (+5.9%). The communication services and real estate sectors followed with gains of 2.29% and 1%, respectively. Conversely, the information technology sector declined by 2.26%, led by FPT (-2.32%), CMG (-0.76%), ELC (-2.75%), and VEC (-5.51%).

Foreign investors resumed net selling, totaling over 807 billion VND on the HOSE, concentrated in TCB (173.65 billion), VRE (126.89 billion), GEX (118.13 billion), and STB (102.03 billion). On the HNX, they net bought over 45 billion VND, focusing on PVS (125.4 billion) and IDC (3.78 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Fluctuations Around 1,655 Points

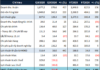

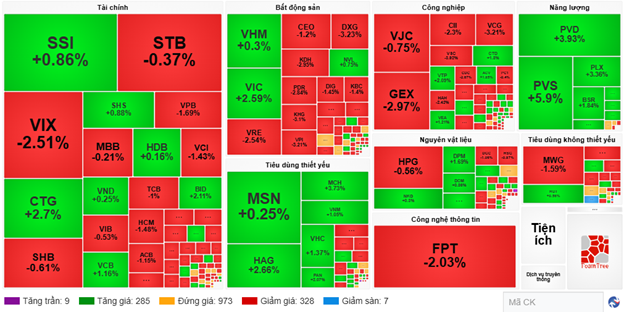

The VN-Index continued to fluctuate around the 1,655-point mark during the final morning session. At the midday break, the VN-Index rose by 3.74 points (+0.23%) to 1,655.72 points, while the HNX-Index remained at the reference level, reaching 266.31 points. Market breadth showed 294 gainers, 335 losers, and 973 unchanged stocks.

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing 4.67 points. CTG, VCB, and BID added a combined 4.3 points. Conversely, VPB and FPT had the most negative impact, reducing the index by 1.67 points.

| Top 10 Stocks Impacting VN-Index in the Morning Session of November 5, 2025 (Point-Based) |

Sectoral divergence continued, with all sectors moving within narrow ranges. The energy sector temporarily led the market with a 2.8% gain, driven by BSR (+1.84%), PLX (+3.36%), PVS (+5.9%), PVD (+3.93%), OIL (+3.81%), PVT (+2.02%), PVC (+3.74%), and PVB (+3.62%).

The essential consumer sector also traded actively, with highlights including HAG (+2.66%), MCH (+3.73%), VNM (+1.05%), VHC (+1.37%), and PAN (+2.07%). However, several stocks saw notable adjustments, such as DBC (-1.33%), ANV (-2.06%), KDC (-2.06%), and MPC (-3.98%).

Large-cap sectors like real estate, industrials, and financials faced negative adjustments from VRE (-2.54%), KDH (-2.95%), KBC (-1.4%), PDR (-2.84%), DXG (-3.23%), GEE (-2%), GEX (-2.97%), VCG (-3.21%), CII (-2.3%), TCB (-1%), VPB (-1.69%), ACB (-1.15%), and TCX (-2.29%). Nevertheless, buying interest persisted in stocks like VIC (+2.59%), KSF (+0.74%), CTD (+1.8%), VTP (+2.09%), ACV (+1.85%), HVN (+4.89%), CTG (+2.7%), BID (+2.11%), VCB (+1.16%), and BVH (+2.58%), helping these sectors retain their green status for the morning session.

Conversely, the information technology sector temporarily lagged with a 1.88% decline, influenced by FPT (-2.03%) and ELC (-2.52%).

Source: VietstockFinance

|

Foreign investors turned net sellers with a value of over 910.3 billion VND across all three exchanges, concentrated in SSI with a value of 102.49 billion VND. Meanwhile, PVS led the net buying list with a value of 49.22 billion VND.

| Top 10 Stocks in Foreign Net Buying and Selling in the Morning Session of November 5, 2025 |

10:30 AM: Tug-of-War Around the Reference Level

Buying and selling pressures were evenly matched, preventing major index movements. As of 10:30 AM, the VN-Index dipped slightly by 3.34 points, trading around 1,648 points, while the HNX-Index saw a minor increase, trading around 266 points.

Stocks in the VN30 basket showed a predominance of red, with only a few maintaining green. Specifically, FPT, MWG, VPB, and VRE collectively reduced the index by 5.29 points, 2.3 points, 1.55 points, and 1.27 points, respectively. Conversely, VIC, MSN, HDB, and SSI were bought strongly, contributing over 3.7 points to the VN30-Index.

The financial and non-essential consumer sectors faced strong selling pressure, with notable declines in VIX (-2.33%), STB (-1.11%), VPB (-1.86%), SHB (-0.92%), MWG (-1.71%), HAX (-1.38%), and PET (-0.83%).

Conversely, the energy sector showed strong momentum, supporting the overall market with contributions from the four major oil and gas stocks: BSR (+2.76%), PLX (+3.51%), PVS (+2.48%), and PVD (+2.84%).

The essential consumer sector also posted impressive gains, with MCH (+5.05%), MSN (+0.38%), VNM (+0.35%), HAG (+2.66%), and VHC (+1.89%) standing out.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks unchanged. Sellers gained the upper hand, with 395 decliners (7 hitting the lower limit) versus 262 advancers (9 hitting the upper limit).

Opening: Cautious Sentiment at the Start

The VN-Index and HNX-Index opened this morning fluctuating around the reference level, reflecting investor caution. However, positive contributions came from the essential consumer, industrial, and real estate sectors.

The essential consumer sector led the index with a 1.58% gain, despite some divergence. Green appeared in MCH (+5.87%), HAG (+3.25%), and QNS (+0.9%).

The industrial sector also showed divergence, but buyers dominated with green in ACV (+1.29%), MVN (+14.01%), and VEA (+1.21%).

Conversely, the VN30 basket opened less positively, with 20 decliners and only 10 advancers. FPT, MWG, HPG, and VPB all declined, while buying-side gains were insignificant.

– 15:25 05/11/2025

Which Stocks Typically Surge in November?

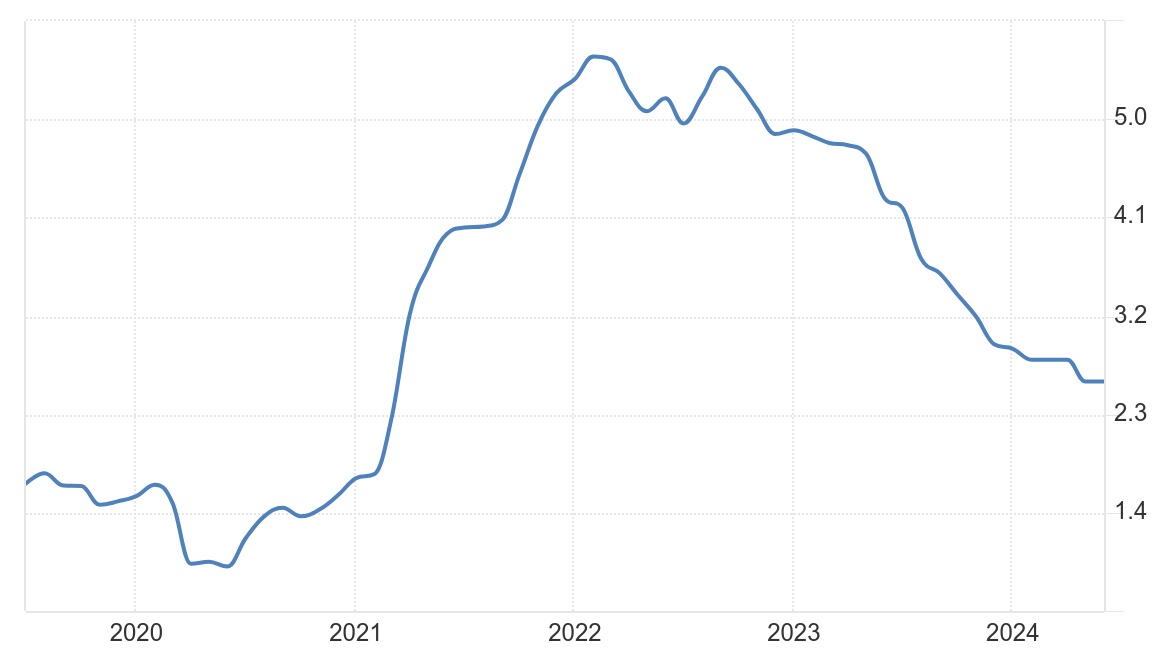

Following a dip in October, the VN-Index is poised to rally toward a critical threshold as stocks historically demonstrate robust performance in November.

Foreign Investors Surprise with Over VND 1.2 Trillion Net Buy on HoSE, Aggressively Accumulating a Securities Stock in November 4th Session

In a surprising turn of events, foreign investors led the sell-off in HDB, offloading a staggering VND 171 billion worth of shares.