| Market Continues to Reverse |

|

Source: VietstockFinance

|

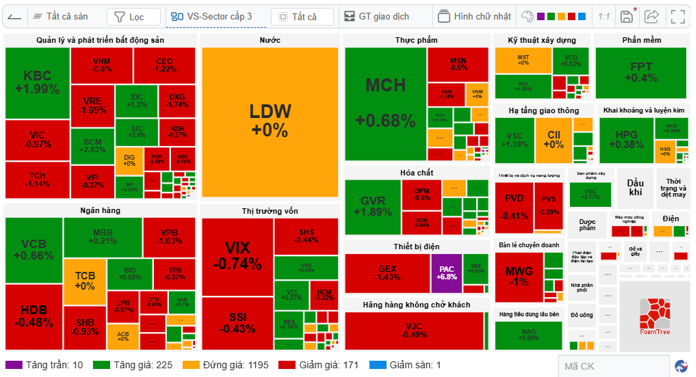

The afternoon session was a mix of emotions, with the market oscillating between recovery and decline. Volatility intensified, accompanied by liquidity more than double that of the morning session, reaching 17.9 trillion VND on the VN-Index. Overall market liquidity recorded nearly 20.3 trillion VND.

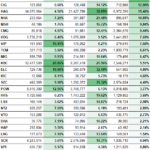

At the close, the market’s landscape remained largely unchanged from the morning, with red dominating key sectors like banking, securities, and real estate. Real estate showed some resilience, with stocks like VIC, KBC, DIG, and HDC attempting to rise.

Pressure also came from food groups such as MSN and MCH; steel with HPG, NKG, and HSG; chemicals with GVR, DPM, and DCM; and notable stocks like FPT, GEX, and VJC.

Conversely, some sectors ended in the green, including transportation infrastructure (CII, VSC, ACV, HHV), oil and gas (PVD, PVS), and maritime transport (HAH).

|

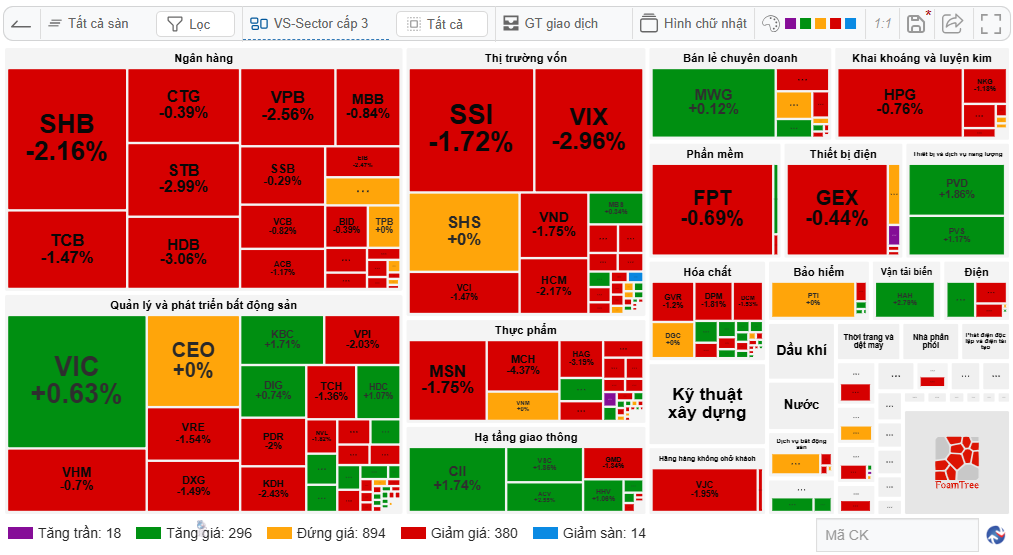

Red Dominates the Market

Source: VietstockFinance

|

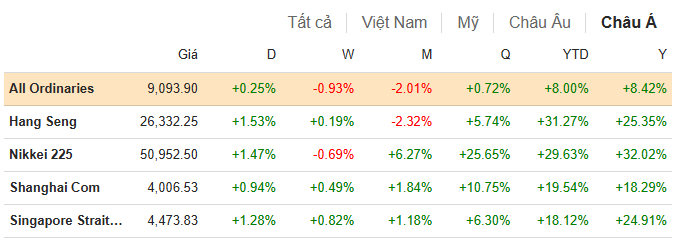

Despite efforts, the VN-Index closed in the red, diverging from global markets. Today, many Asian markets rose positively, with Hang Seng up 2.04%, Nikkei 225 up 1.19%, Singapore Straits Times up 1.31%, and Shanghai Composite up 0.97%. On Wall Street, Dow Jones, S&P 500, and Nasdaq rose 0.48%, 0.37%, and 0.65%, respectively.

However, Vietnam’s stock market challenges were somewhat anticipated. Short-term forecasts from most securities firms predict continued volatility. The immediate resistance zone of 1,660–1,670 points must be overcome before further targets can be considered.

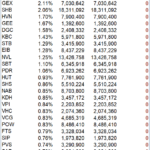

Foreign investors continued to sell off today, with a net outflow of nearly 1.2 trillion VND. STB led with 180 billion VND, followed by VPB at 102 billion VND and HPG at 89 billion VND. Conversely, MWG saw the strongest net buying, at over 182 billion VND.

| Foreign Investors Continue to Sell Off |

Morning Session: Gradual Decline, Contrasting Global Trends

Despite brief recoveries, Vietnam’s stock market closed the morning in the red, with VN-Index down 14.31 points to 1,640.58, HNX-Index down 2.31 points to 264.39, and UPCoM-Index down 1.29 points to 115.21.

|

Market Declines Gradually in the Morning

Source: VietstockFinance

|

Declining stocks outnumbered advancing ones nearly 2:1 (416 vs. 215). Red dominated across sectors, including banking (TCB, HDB, STB, VPB, CTG, SHB), securities (VIX, SSI, SHS, VCI, VND, HCM), real estate (VHM, CEO, VRE, DCG, KDH), food (MCH, MSN, VNM), electrical equipment (GEX, GEE), steel (HPG, NKG), and others like VJC, DGC, and MWG.

Bright spots included VIC (+0.58%), KBC (+1.14%), TPB (+0.03%), and transportation infrastructure stocks like CII, VSC, HHV, and ACV, though insufficient to shift the market.

Morning trading volume reached nearly 8.4 trillion VND, with VN-Index at 7.4 trillion VND. Low liquidity highlighted the market’s lack of support against pressures, resulting in a decline with no significant resistance.

Foreign investors continued to sell off, with a net outflow of 778 billion VND. Their trading activity also declined significantly compared to previous sessions.

Global markets contrasted sharply, with Hang Seng up 1.55%, Nikkei 225 up 1.49%, and Singapore Straits Times up 1.28%, adding to Vietnamese investors’ woes.

|

Asian Stocks Shine While Vietnam Burns

Source: VietstockFinance

|

10:30 AM: Pressure Mounts

By 10:30 AM, declining stocks rose to 333, outpacing 211 advancing ones. Pressure spread beyond banking and securities to large-cap stocks across sectors.

VN-Index fell 5.82 points to 1,649.07, HNX-Index dropped 2.15 points to 264.55, while UPCoM-Index rose slightly by 0.41 points to 116.91. Market liquidity remained low.

Securities stocks like VIX (-2.96%), SSI (-1.58%), SHS (-1.77%), VND (-1.25%), and HCM (-1.3%) declined. Banking stocks also fell, with TCB (-1.32%), HDB (-1.93%), VPB (-1.37%), and STB (-1.68%) leading.

Large-cap stocks like HPG, MWG, GEX, FPT, and MSN also contributed to market pressure.

Real estate remained mixed, with VRE (-1.38%), CEO (-2.45%), DXG (-2.24%), TCH (-2.27%), PDR (-2%), and KDH (-1.72%) declining. However, VIC (+1.74%) and VHM (+0.2%), alongside industrial stocks like KBC (+1.71%), BCM (+1.4%), and IDC (+0.5%), provided balance.

All market caps declined: Large Cap (-0.34%), Mid Cap (-0.37%), Small Cap (-0.08%), and Micro Cap (-0.68%).

Opening: Early Volatility

By 9:30 AM, VN-Index dipped 3.73 points to 1,651.16, while UPCoM-Index rose 0.38 points to 116.88. HNX-Index held steady. The market opened with early volatility.

235 stocks advanced, including 10 at their upper limit, slightly outpacing 172 decliners (1 at its lower limit). 1,195 stocks remained unchanged. Trading volume exceeded 1.2 trillion VND.

Green and red were evenly split across sectors, notably in real estate, banking, securities, food, and electrical equipment. Few sectors showed clear trends.

Notably, water utility stock LDW dominated trading volume with a 7.1 million share block trade at 21,000 VND per share, totaling 149 billion VND.

Securities firms predict continued short-term volatility for VN-Index. The 1,660–1,670 resistance zone must be tested before further targets are considered.

|

Market Map as of 9:30 AM

Source: VietstockFinance

|

On Wall Street, Dow Jones rose 225.76 points (0.48%) to 47,311, S&P 500 gained 0.37% to 6,796.29, and Nasdaq Composite advanced 0.65% to 23,499.8.

US markets rose as the Supreme Court’s scrutiny of Trump-era tariffs raised hopes of potential rollbacks. Shares of Advanced Micro Devices (AMD) and AI-related stocks rebounded after prior valuation concerns.

– 15:40 06/11/2025

Technical Analysis Afternoon Session 05/11: August 2025’s Previous Low Holds Strong

The VN-Index continues its upward trajectory, currently trading above its August 2025 low (equivalent to the 1,605-1,630 point range). Meanwhile, the HNX-Index exhibits positive momentum, forming a Long Lower Shadow pattern.

Vietstock Daily 06/11/2025: Cautious Sentiment Persists?

The VN-Index edged higher, though trading volume plummeted significantly below its 20-day average, underscoring the prevailing cautious sentiment in the market. Currently, the Stochastic Oscillator has dipped into oversold territory. Should a buy signal emerge within this region, the index’s short-term outlook could see a positive shift.

Market Pulse 05/11: Energy Sector Shines as Overall Market Liquidity Declines

At the close of trading, the VN-Index rose 2.91 points (+0.18%) to 1,654.89, while the HNX-Index gained 0.79 points (+0.3%) to 266.7. Market breadth tilted toward decliners, with 361 stocks falling and 323 advancing. Similarly, the VN30 basket saw red dominate, as 18 constituents declined and 12 advanced.

Which Stocks Typically Surge in November?

Following a dip in October, the VN-Index is poised to rally toward a critical threshold as stocks historically demonstrate robust performance in November.