On November 4th, continuing the 10th session agenda, Minister of Finance Nguyen Van Thang, authorized by the Prime Minister, presented the amended Personal Income Tax Law to the National Assembly.

Minister of Finance Nguyen Van Thang. Photo: Pham Thang

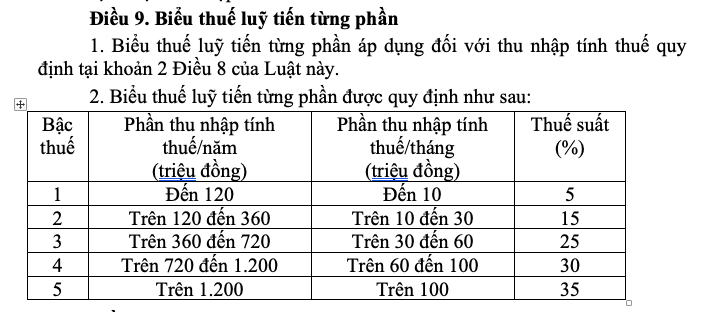

According to the Minister, the draft law adjusts the progressive tax brackets for resident individuals earning income from salaries and wages. The number of tax brackets is reduced from 7 to 5, with wider intervals between them.

During the drafting process, the legislative body proposed two tax bracket options in the documents submitted for feedback from ministries, localities, National Assembly delegations, and relevant organizations and individuals.

Option 1 revises the tax brackets to 5 levels, with intervals of 10, 20, 20, and 30 million VND. The corresponding tax rates are 5%, 15%, 25%, 30%, and 35%, with the highest bracket applying to taxable income over 80 million VND/month. This option, combined with the new family deduction, is estimated to reduce tax revenue by approximately 26.4 trillion VND/year.

Option 2 also revises the tax brackets to 5 levels but with progressively increasing intervals of 10, 20, 30, and 40 million VND. The tax rates remain the same as in Option 1: 5%, 15%, 25%, 30%, and 35%. The highest bracket applies to taxable income over 100 million VND/month. This option, with the new family deduction, is estimated to reduce tax revenue by approximately 27.4 trillion VND/year.

After consolidating feedback, most opinions favored Option 2, which the Government has submitted to the National Assembly. Under this option, most tax brackets will see reduced tax liabilities compared to the current law.

Progressive tax brackets as outlined in the draft law.

Presenting the review report on the progressive tax brackets, Chairman of the National Assembly’s Economic and Financial Committee Phan Van Mai noted concerns about the rationale behind adjusting income thresholds and corresponding tax rates. Some income intervals in the draft law impose a heavier tax burden on taxpayers, while most other intervals result in lower tax obligations compared to the current law. This raises fairness concerns among different income groups.

Regarding family deductions, Minister Nguyen Van Thang announced that on October 17, 2025, the Standing Committee of the National Assembly approved a resolution adjusting personal income tax deductions. The deduction for the taxpayer increases from 11 million VND/month to 15.5 million VND/month, and the deduction for each dependent rises from 4.4 million VND/month to 6.2 million VND/month, effective from the 2026 tax year.

To promote decentralization and flexibility in government administration, the draft law authorizes the Government to adjust these deductions based on price and income fluctuations.

The review committee emphasized that family deductions are a critical factor in determining tax liabilities and thus receive significant public attention. International experience and past implementation show that family deductions are not frequently adjusted and are not urgent matters requiring Government regulation for flexibility. Therefore, the committee recommends specifying family deductions in the draft law while allowing the Government to propose adjustments to the Standing Committee of the National Assembly when necessary, as per the current Personal Income Tax Law. This includes adding specific deduction amounts and removing the provision that authorizes the Government to set family deductions in Article 10, Clause 1 of the draft law.

Prime Minister Pham Minh Chinh Highlights Achievements in ‘Reorganizing the Nation’

Referring to the two-tier local government system operational since July 1, Prime Minister Pham Minh Chinh emphasized that this marks a significant achievement following the “reorganization of the nation.” We have swiftly transitioned, leveraging digital transformation, to shift from management to fostering development and serving the people.

Government Proposes 0.1% Personal Income Tax on Gold Bullion Transfers

The proposed amendment to the Personal Income Tax Law suggests a 0.1% tax on gold bar transactions, aiming to enhance market transparency and curb speculative activities.