Launched in November 2024, the Vietnam Securities Companies Retail Services Ranking project is organized by the Research and Ranking Division of VietnamBiz. The initiative receives technical support from two partners: Vietnam Investment Credit Rating Joint Stock Company (VIS Rating) and WiGroup Financial Economic Data Joint Stock Company.

Guided by the principles of Science – Neutrality – Non-commercial – Continuous Improvement, this year’s ranking surveyed over 70 securities companies and ranked the top 35 firms by scale, which collectively hold 96% of the brokerage market share.

After a year of evaluation, the judging panel selected the Top 10 securities companies with the best retail services in Vietnam: Pinetree, Mirae Asset (Vietnam), DNSE, SSI, TCBS, MBS, Rong Viet, VnDirect, VPBankS, and VPS.

At the awards ceremony, organizers emphasized that the project’s philosophy is to encourage securities companies to enhance innovation, responsiveness, and service quality to better meet investor needs. The ranking prioritizes features aligned with user demands, such as eKYC, e-contracts, conditional orders, statements, 24/7 deposit/withdrawal, platform integration, model portfolios, transaction fees, margin loan interest rates, effective technology application, market education, knowledge dissemination, and data provision for investors.

Top 10 leading firms among the 35 ranked organizations

Pinetree’s inclusion in the Top 10 securities companies with the best retail services in Vietnam for 2025 recognizes its relentless efforts to deliver sustainable prosperity to clients through superior digital financial platforms.

Founded in 2019 as a subsidiary of Hanwha Investment & Securities Co., Ltd. under South Korea’s Hanwha Group, Pinetree pioneered a unique strategy in Vietnam: a fully digital securities model with “no branches, no brokers, only digital platforms.” This business model was unprecedented in Vietnam at the time.

Additionally, Pinetree distinguished itself by introducing a lifetime free trading policy, a first in Vietnam as of 2019.

This innovative strategy not only optimized operational costs but also enhanced client experiences. Within two years of operation, Pinetree achieved profitability, validating its model’s effectiveness.

Inspired by Pinetree’s success, several securities firms began adopting similar strategies to compete in the market.

Beyond its pioneering business model, Pinetree prioritizes client-centricity and empowers investors with autonomy. Its in-house core system, built to South Korean standards, and comprehensive digital financial ecosystem integrate cutting-edge technology, diverse news feeds, and analytical reports, enabling clients to optimize investment strategies based on their preferences and market conditions.

Pinetree’s recognition as a Top 10 firm in Vietnam’s 2025 retail securities services ranking reaffirms its commitment to client-centricity, convenience, and value creation.

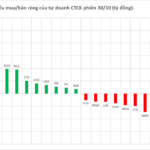

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th

Proprietary trading firms have resumed net buying on the Ho Chi Minh City Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.