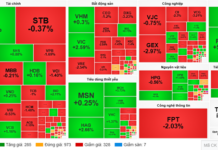

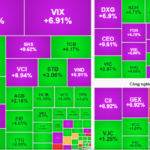

Today’s market spotlight shines on the real estate sector, as a wave of green and purple swept across the trading board. The entire sector recorded 46 gainers, 10 of which hit the ceiling, with only 17 decliners and no stocks hitting the floor. This group led the session with a robust 2.74% increase, significantly boosting the overall index.

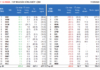

Following a lackluster morning session, real estate stocks surged in the afternoon. Numerous stocks soared to their ceiling prices, including DXG (+6.9%), CEO (+9.61%), PDR (+6.78%), VRE (+6.86%), TCH (+6.95%), DIG (+6.99%), and HDC (+6.87%). Other notable gainers within the 3-5% range were KDH (+4.71%), KHG (+4.69%), NVL (+3.88%), KBC (+4.24%), NLG (+3.24%), and IJC (+4.22%).

Multiple stocks rebounded strongly (Image: N.M).

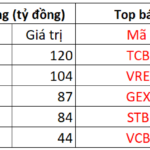

Notably, Vingroup’s VIC was the top contributor to the VN-Index today, adding 4.95 points. The stock rose 2.87% to VND 201,000 per share, reclaiming the VND 200,000 mark after an extended period. Its counterpart, VHM, also climbed 1.73% to VND 100,200 per share, contributing an additional 1.58 points to the index.

Beyond real estate, the securities and steel sectors also staged a strong recovery after a period of sell-offs. Several brokerage stocks, such as SSI, VND, HCM, and MBS, gained between 3-6%, while steel stocks like HPG, HSG, and NKG turned green across the board.

On the flip side, selling pressure was confined to a few industrial zone real estate stocks, including IDC (-0.26%), SZC (-0.16%), LDG (-1.45%), and SIP (-0.88%). However, the declines were minimal, indicating that supply was largely absorbed.

Today’s trading activity suggests that investor sentiment is stabilizing after a series of deep declines. Despite early-session pressure from adjustments in construction, retail, and technology sectors, bottom-fishing inflows returned strongly by the close, driving a remarkable market reversal.

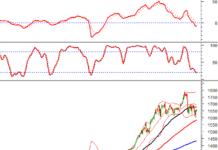

Analysts view today’s rally as a confirmation of the VN-Index’s short-term bottom. Improved liquidity and proactive buying signal a return of confidence, particularly in real estate and leading blue-chip stocks.

If the recovery momentum continues in the coming sessions, the market may enter a new accumulation and recovery phase, targeting the 1,670-1,680 resistance zone.

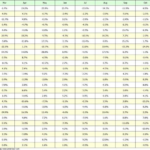

CEO’s Loan Accounts for 99% of VRC’s Outstanding Debt

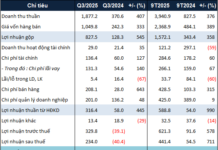

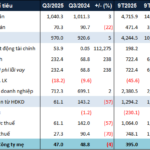

The consolidated net profit of VRC Real Estate and Investment Corporation (HOSE: VRC) dipped by 4% in Q3 and declined by 31% in the first nine months of the year.