Mobile World Investment Corporation (stock code: MWG) has announced a resolution to establish a subsidiary company.

Accordingly, MWG has founded Thien Tam Investment Limited Liability Company with a charter capital of VND 2,200 billion and An Nhi Investment Limited Liability Company with a charter capital of VND 500 billion.

This move is part of a restructuring strategy to specialize the operations of its subsidiaries. The pharmaceutical retail segment (An Khang) and the mother & baby product retail segment (AVAkids) will now be managed and operated by newly established, dedicated subsidiary companies. The restructuring aims to ensure that each business segment has an independent, in-depth, and flexible development strategy, aligning with the company’s long-term sustainable growth objectives.

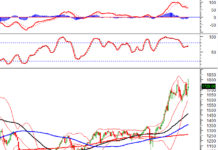

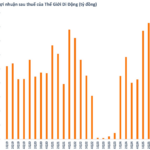

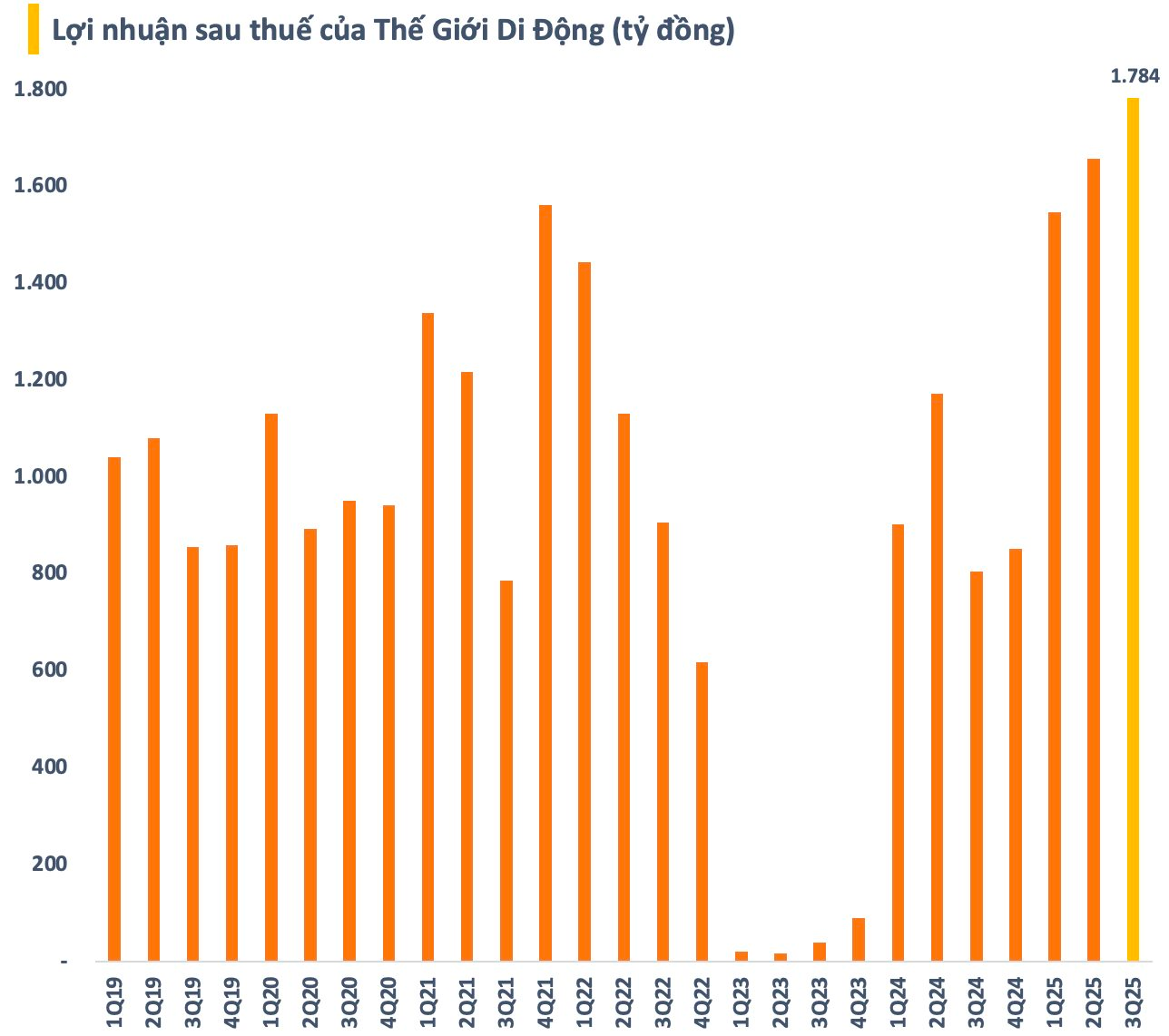

In terms of business performance, MWG recorded a record after-tax profit of VND 1,784 billion in Q3, a 121% increase compared to the same period last year and 8% higher than the previous quarter. This marks the third consecutive quarter of profit growth for the retail enterprise led by Nguyen Duc Tai.

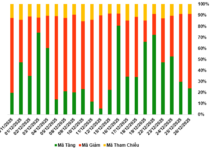

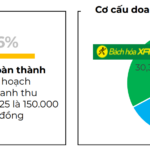

For the first nine months of the year, MWG reported net revenue of VND 113,607 billion and after-tax profit of VND 4,989 billion, up 14% and 73% respectively compared to the same period in 2024. With these results, the retail company has achieved 76% of its revenue target and exceeded its full-year profit goal by 3%.

For 2025, MWG has set a revenue target of VND 150,000 billion and an after-tax profit goal of VND 4,850 billion, representing increases of 12% and 30% respectively compared to 2024. From the beginning of the year, the company’s leadership has demonstrated a strong commitment to achieving these goals early, as evidenced by Doan Van Hieu Em’s statement, “2025 Target – October Finish Line – Year-End Excellence.” In terms of profit, MWG has already realized this ambition, even surpassing expectations.

In the first nine months, the An Khang pharmacy chain also showed positive developments, with an average monthly revenue per store of VND 540 million, maintaining three consecutive months of growth. Compared to the same period, the chain will continue to improve store-level operational efficiency, aiming to contribute profits to the group.

The AvaKids chain recorded double-digit revenue growth in the first nine months compared to the same period last year, with an average monthly revenue per store of VND 1.8 billion. Total revenue in Q3/2025 increased by 10% compared to the previous quarter and over 30% compared to the same period last year. The chain has achieved profitability at the company level and continues to improve its financial performance month by month.

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.

Record-Breaking Q3: The Gioi Di Dong Posts Nearly VND 1.8 Trillion in Profit

Mobile World Investment Corporation (HOSE: MWG) has announced its consolidated Q3/2025 financial report, revealing a remarkable performance. The company achieved a net revenue surpassing 40 trillion VND, marking a 17% year-on-year growth. Even more impressively, its net profit soared to 1.77 trillion VND, a staggering 121% increase compared to the same period last year. This outstanding result sets a new record for the retail giant’s profitability.