Comprehensive Coverage of VinaCapital’s 2025 Investor Conference Held on October 28th

|

Mr. Jens Lottner, CEO of Techcombank (HOSE: TCB), representing the banking sector, shared insights with nearly 150 global investors regarding the industry’s growth prospects. He emphasized the bank’s commitment to partnering with the government to drive innovation and contribute to Vietnam’s long-term economic development, thereby attracting high-quality international capital.

Techcombank is renowned for its comprehensive financial ecosystem. Currently, it leads in market capitalization among privately listed commercial banks, boasts the highest CASA ratio, operational efficiency, and asset quality in the industry, with a capital adequacy ratio (CAR) of 15.8% and one of the lowest non-performing loan ratios in the market.

During the panel discussion, Mr. Jens elaborated on Techcombank’s development strategy, the pillars of its sustainable competitive advantage, and growth prospects as Vietnam enters a transformative phase.

Mr. Jens Lottner, CEO of Techcombank, Sharing Insights at the Conference

|

Three Pillars: Digitalization, Data, and Talent

After over five years with the bank, what do you consider the key factor behind Techcombank’s success?

CEO Jens Lottner: The first core factor is people. Techcombank has built and maintained a high-quality workforce, blending domestic and international talent. Alongside local recruitment, we actively hire international professionals and attract Vietnamese talent from global hubs like Silicon Valley, Los Angeles, Singapore, Sydney, Paris, and London. Coupled with comprehensive training and development, Techcombank has become a magnet for top talent, offering an average income 50% higher than peer banks and attractive benefits. For Techcombank, talent is the foundation for leveraging the other two pillars: digitalization and data.

In terms of digitalization, Techcombank has heavily invested in technology, prioritizing a cloud-first strategy. Currently, 60% of the bank’s IT infrastructure operates on the cloud, significantly higher than the 20% industry average. This enables Techcombank to scale without increasing operational staff, resulting in a 2.5-fold customer growth over the past five years with optimized marginal costs.

Regarding data, with over 8 billion customer data points processed daily—thanks to being one of the banks with the highest transaction volumes—Techcombank builds detailed profiles for each customer, incorporating approximately 12,000 attributes. This data fuels CRM models and digital marketing, enhancing customer experience and optimizing business performance.

As the industry leader in efficiency, Techcombank’s cost-to-income ratio (CIR) is the lowest at around 30%. Is there room for further improvement?

CEO Jens Lottner: Currently, 40% of Techcombank’s revenue comes from digital channels, with operating costs 10-15 percentage points lower than the current CIR. Theoretically, we could reduce costs further, but Techcombank prioritizes investment. Over the next five years, the bank plans to invest over 1 billion USD in technology, marketing, and employee compensation. We are confident in maintaining a 30% CIR while ensuring sustainable growth, even amid margin pressures.

Sustainable Competitive Advantage

Techcombank is strong in both retail and corporate banking, a rarity among Vietnamese banks. What is the bank’s long-term vision for these segments?

CEO Jens Lottner: Techcombank aims to serve Vietnam’s rapidly growing middle class. Currently, the loan portfolio comprises 55-60% corporate and 40-45% retail, but over the next five years, this ratio will reverse, with retail taking the lead. As GDP per capita reaches 6,000-7,000 USD, individual asset accumulation and consumer lending demands will surge, driving retail growth.

There’s a perception that Techcombank heavily relies on real estate. Will this change in the future?

CEO Jens Lottner: Excluding mortgage loans, real estate currently accounts for about one-third of Techcombank’s loan portfolio. This will decrease to 20-25% as part of our credit portfolio diversification strategy. Historically, we’ve financed only premium projects in Hanoi and Ho Chi Minh City, but land in these areas is nearly depleted. Instead, Techcombank will shift to infrastructure financing and boost unsecured lending and retail products to maintain net interest margins (NIM).

How does Techcombank maintain its edge in a competitive market?

CEO Jens Lottner: Techcombank’s advantage rests on three key factors. First, our low-cost funding, with a leading CASA ratio, reduces capital costs. Second, we hold the highest market share in Napas transactions, solidifying our position as a top transaction bank. Third, stringent risk management keeps non-performing loans at minimal levels.

For instance, in real estate, our non-performing loan ratio over the past decade is 0%. This is because Techcombank finances projects, not developers, through an optimized risk control model. The only requirement is that projects are completed on schedule and meet customer expectations. Many aim to replicate this model but haven’t succeeded.

Additionally, our corporate culture and investment in strategic pillars are hard to replicate. While many banks grant branch managers full autonomy, Techcombank centralizes data and analysis at headquarters, ensuring consistency and efficiency, then provides recommendations to branches. Investing 500 million USD in technology is challenging, but fostering a culture of compliance is even harder. These are Techcombank’s significant advantages.

Sustainable Growth and Capital Market Opportunities

What is Techcombank’s credit growth plan for the next 2-3 years?

CEO Jens Lottner: Assuming 8% GDP growth and 3-4% inflation, nominal GDP growth is 12%. With a credit multiplier of 1.5, industry credit growth could reach 18%. Techcombank targets over 20% credit growth, exceeding the average, by focusing on retail and risk management.

Beyond credit growth, what drives net interest income (NII) and non-interest income (NFI) growth?

CEO Jens Lottner: With 20% credit growth, NII will grow accordingly. While NIM may face slight pressure, we can maintain a portfolio with NIM above 4% in this market.

Non-interest income (NFI) is also crucial, currently contributing 22% to total operating income, significantly higher than the industry average (below 10%).

This growth is driven by our early development of investment banking. We operate numerous fee-based products, offering ample NFI growth opportunities.

Moving forward, we’ll continue developing the “originate-to-distribute” model in the bond market, leveraging capital market growth while contributing to economic development.

What is the current unsecured lending ratio, and how will it evolve?

CEO Jens Lottner: Unsecured lending currently accounts for 3% of the portfolio but could rise to 11-12% soon. Our technological edge has enabled us to expand credit assessment using alternative data, reaching business households. With 6.5 million business households in Vietnam, Techcombank serves 2.5 million, 700,000 of which are eligible for loans based on transaction data. This is a strategic direction for portfolio diversification and sustainable growth.

Additionally, Vietnam’s financial investment products remain growth-rich, especially in product and service diversification. This is why Techcombank entered insurance and digital assets, aiming to create a comprehensive financial ecosystem that helps customers manage finances, grow assets sustainably, and accumulate wealth effectively.

– 13:30 05/11/2025

Techcombank’s CEO Jens Lottner Unveils Comprehensive Digital Transformation and Data Optimization Strategy at 2025 Investor Conference

The “2025 Investor Conference,” held on October 28, 2025, in Ho Chi Minh City, is themed “Vietnam 2.0,” marking a new era of development shaped by comprehensive reforms and the government’s long-term vision. This pivotal event aims to propel Vietnam toward its goal of becoming a developed nation by 2045.

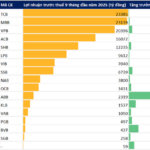

2025 Q3 Bank Performance Update: More Lenders Surpass VND 10 Trillion Pre-Tax Profit by October 29

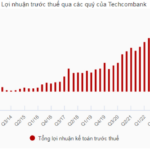

In Q3/2025, a bank reported a staggering pre-tax profit, soaring 12 times higher than the same period last year.