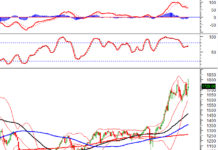

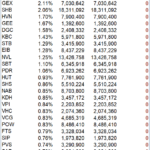

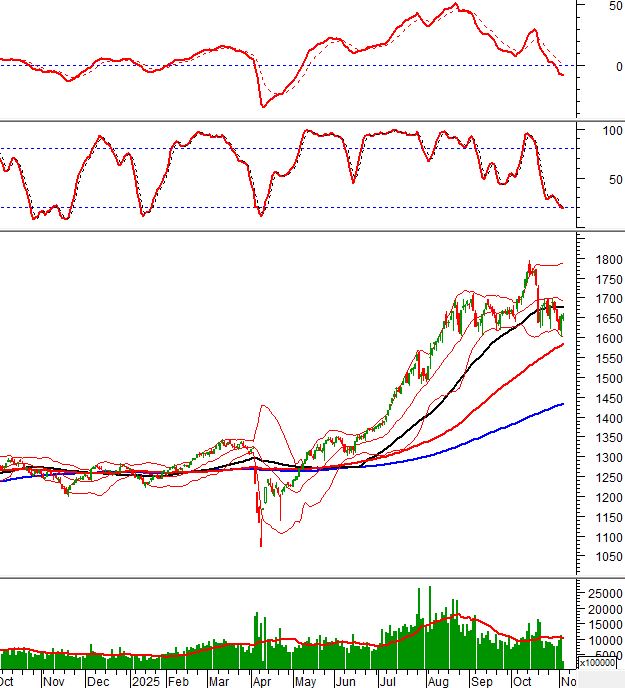

Technical Signals of VN-Index

In the morning trading session on November 5, 2025, the VN-Index continued its upward trend, surpassing the previous low from August 2025 (equivalent to the 1,605-1,630 point range).

The Stochastic Oscillator has dipped into the oversold territory. If a buy signal re-emerges within this range, the short-term outlook will become increasingly optimistic.

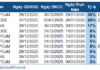

Technical Signals of HNX-Index

During the morning session on November 5, 2025, the HNX-Index exhibited positive fluctuations, forming a Long Lower Shadow pattern.

The Middle line of the Bollinger Bands will remain a strong resistance level for the index in the short term.

CTG – Vietnam Joint Stock Commercial Bank for Industry and Trade

In the morning session on November 5, 2025, CTG share prices continued to rise, testing the Middle line of the Bollinger Bands. Increased trading volume during the morning session indicates a less pessimistic investor sentiment.

Currently, the stock price is well-supported by the 100-day SMA, as the Stochastic Oscillator has risen above the oversold region after generating a buy signal.

However, recent trading volumes remain below the 20-session average. If this factor improves in the coming period, the recovery momentum will be more sustainable.

PAN – PAN Group JSC

During the morning session on November 5, 2025, PAN share prices rose for the second consecutive session, testing the 50-day SMA. Trading volume exceeded the 20-session average, indicating continued investor activity.

Additionally, the stock price successfully broke through the upper boundary of the Falling Wedge pattern, while the MACD indicator continued to rise, approaching the zero line after generating a buy signal.

If the technical signals persist and PAN prices continue to recover, the potential price target will be in the 36,000-37,300 range.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:06 November 5, 2025

Vietstock Daily 06/11/2025: Cautious Sentiment Persists?

The VN-Index edged higher, though trading volume plummeted significantly below its 20-day average, underscoring the prevailing cautious sentiment in the market. Currently, the Stochastic Oscillator has dipped into oversold territory. Should a buy signal emerge within this region, the index’s short-term outlook could see a positive shift.

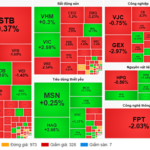

Market Pulse 05/11: Energy Sector Shines as Overall Market Liquidity Declines

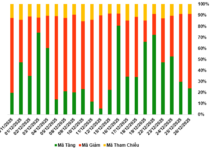

At the close of trading, the VN-Index rose 2.91 points (+0.18%) to 1,654.89, while the HNX-Index gained 0.79 points (+0.3%) to 266.7. Market breadth tilted toward decliners, with 361 stocks falling and 323 advancing. Similarly, the VN30 basket saw red dominate, as 18 constituents declined and 12 advanced.

Vietnam’s Stock Market Surges, Leading Asia’s Rally in a Triumphant Return

Vietnamese stocks surged to their highest level since early October, providing much-needed relief to investors following a prolonged and unsettling market correction.