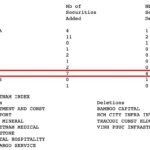

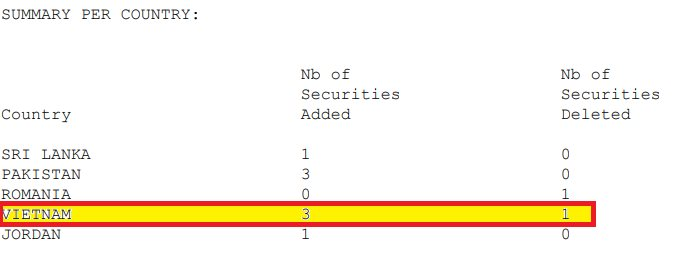

MSCI has released its November 2025 review for the MSCI Frontier Markets Index, a key benchmark for frontier markets. The index has added a total of 8 stocks and removed 2. Notably, three Vietnamese stocks have been included: Ho Chi Minh City Infrastructure Investment (CII), MB Securities (MBS), and Vietnam Airlines (HVN). Conversely, Viettel Construction (CTR) has been removed from the index.

Following this review, the MSCI Frontier Market Index now comprises 244 stocks, an increase of 6 from the previous period.

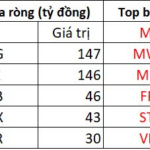

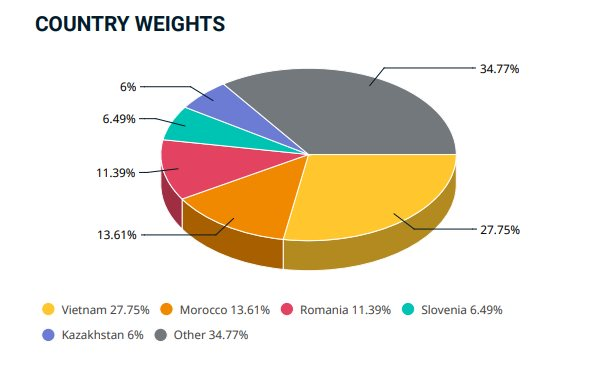

As of October 31, Vietnam maintains the highest weighting in the MSCI Frontier Market Index at 27.75%, followed by Morocco at 13.61%. Among the top 10 stocks by weighting, Vingroup (VIC) leads, with Vinhomes (VHM) and Hoa Phat (HPG) also featured, ranking 6th and 7th, respectively.

Meanwhile, the MSCI Frontier Markets Small Cap Index has added 29 new stocks and removed 9 in its November review. Vietnam contributed 7 new additions, including L40, CCL, HGM, JVC, NNC, OCH, and SCS, while 4 stocks were removed: BCG, TCD, IDV, and CII. CII’s removal is due to its transition to the MSCI Frontier Markets Index.

These changes will take effect after the market close on November 24. The next review is scheduled for February 10, 2025, CEST (UTC +1), or early February 11, 2025, Vietnam time.

7 Vietnamese Stocks Enter the MSCI Frontier Markets Small Cap Index

The MSCI Frontier Markets Small Cap Index has undergone significant changes in its latest quarterly review for Q4 2025, announced on November 6, 2025. The index added 29 new stocks while removing 9, with Vietnam seeing a notable shift: 7 Vietnamese companies were included, but 4 were dropped from the index.

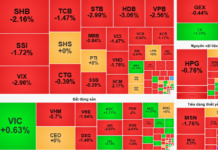

Mining Company Stocks Hit Upper Limit Amid VN-Index’s Sharp Decline

As a result, the stock price surged to its highest level in three months, with its market capitalization surpassing $1.3 billion.

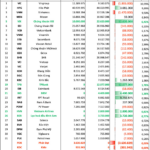

Surprise Stock Surges into $13 Trillion “Shark Portfolio”

Over 10 million new shares were purchased during the trading session on the weekend of September 19th.