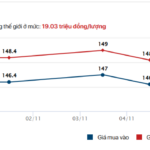

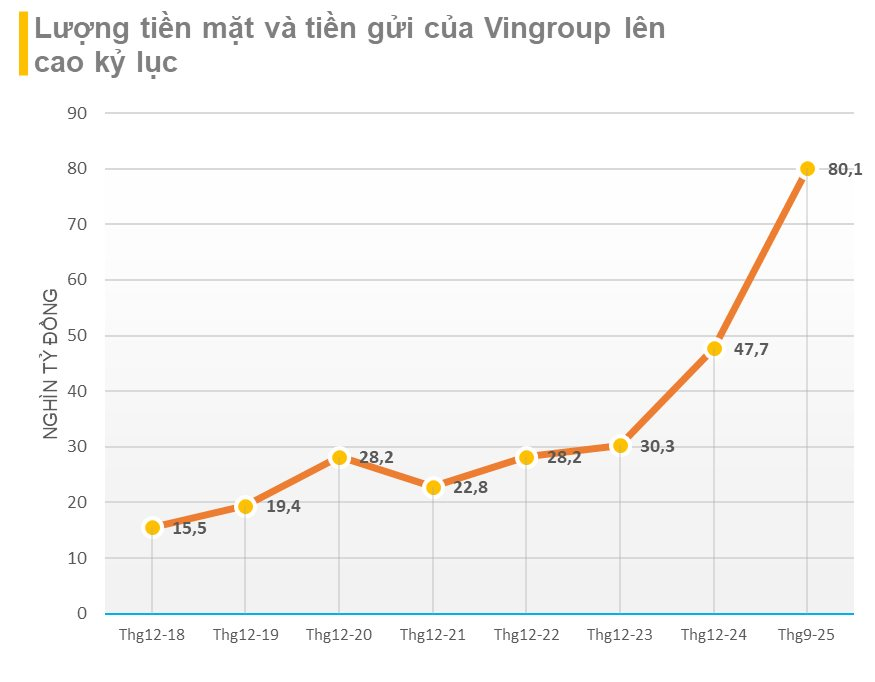

According to Vingroup’s (VIC) consolidated financial report for Q3/2025, as of September 30, 2025, the conglomerate’s total cash and bank deposits reached nearly VND 80.1 trillion, marking a 68% increase from the beginning of the year. This figure is VND 2 trillion lower than at the end of Q2/2025, yet it stands as the second-highest level in the group’s history.

Specifically, cash and cash equivalents (deposits under 3 months) amounted to VND 72.151 trillion, while deposits over 3 months (recorded under the Held-to-Maturity Investments category) totaled VND 7.918 trillion.

Vingroup’s cash and bank deposits account for approximately 7.4% of its total assets.

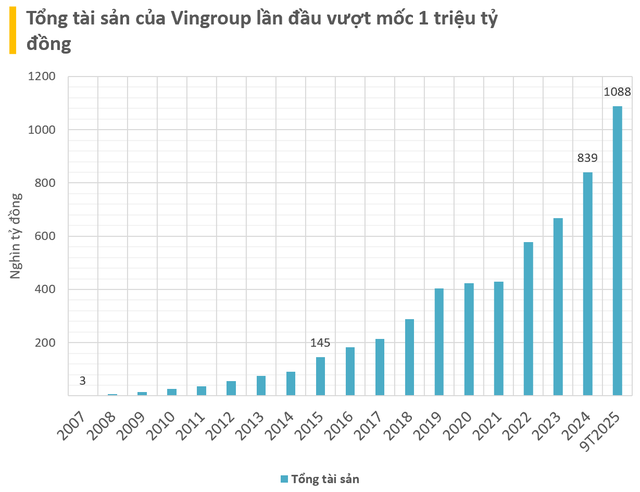

In addition to the substantial cash reserves, Vingroup’s total assets as of September 30, 2025, surpassed VND 1 million trillion (equivalent to over USD 41 billion), reflecting a 30% increase since the beginning of the year. This milestone positions Vingroup as the first private enterprise and the second non-banking corporation in Vietnam to achieve this asset threshold, following the National Energy Group PVN.

Vingroup’s cash and bank deposits represent approximately 7.4% of its total assets.

A company’s cash flow is influenced by various factors. For Vingroup, three key factors contributed to its robust cash flow during the first nine months of 2025.

First, the company’s long-term payables surged by VND 109.633 trillion, from VND 22.554 trillion to VND 1,032.188 trillion.

Second, Vingroup’s net borrowing amounted to nearly VND 94.4 trillion, with borrowings totaling nearly VND 220.5 trillion and debt repayments exceeding VND 126.1 trillion.

Third, Mr. Pham Nhat Vuong provided a VND 23 trillion funding injection to Vingroup’s subsidiary, VinFast, comprising VND 5 trillion in Q1/2025 and VND 18 trillion in Q2/2025.

How has Vingroup allocated its funds? The cash flow statement reveals a net cash outflow from investment activities of over VND 144.5 trillion. The largest allocation was for capital contributions to other entities (net of receipts), exceeding VND 104.4 trillion, followed by expenditures on fixed assets and long-term assets, totaling more than VND 68.8 trillion.

Among Vingroup’s significant investments are the VinFast group’s projects, with construction in progress at the end of the period valued at over VND 17.7 trillion. The urban development project in Ho Chi Minh City stands at more than VND 19.4 trillion, and the Vinhomes City Royal project at over VND 14.8 trillion.

Is the Largest Stock Offering in History on the Horizon?

Vingroup, one of Vietnam’s leading conglomerates, is seeking shareholder approval for a groundbreaking issuance of 3.85 billion shares—the largest in the country’s stock market history. If successful, this move will double the company’s chartered capital to over 77 trillion VND, marking a significant milestone in its growth trajectory.

Bảo Việt Group to Disburse Over VND 780 Billion in Dividends for 2024

On November 17, 2025, Bao Viet Group will finalize its shareholder list to distribute over VND 783.2 billion in dividends for 2024, at a rate of 10.551%.