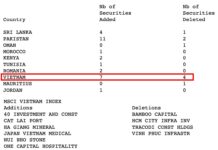

According to statistics from the General Department of Customs, Vietnam’s cement and clinker exports in the first nine months of 2025 reached over 26 million tons, equivalent to more than 984 million USD. This represents a 17% increase in volume and a 14% rise in value compared to the same period in 2024.

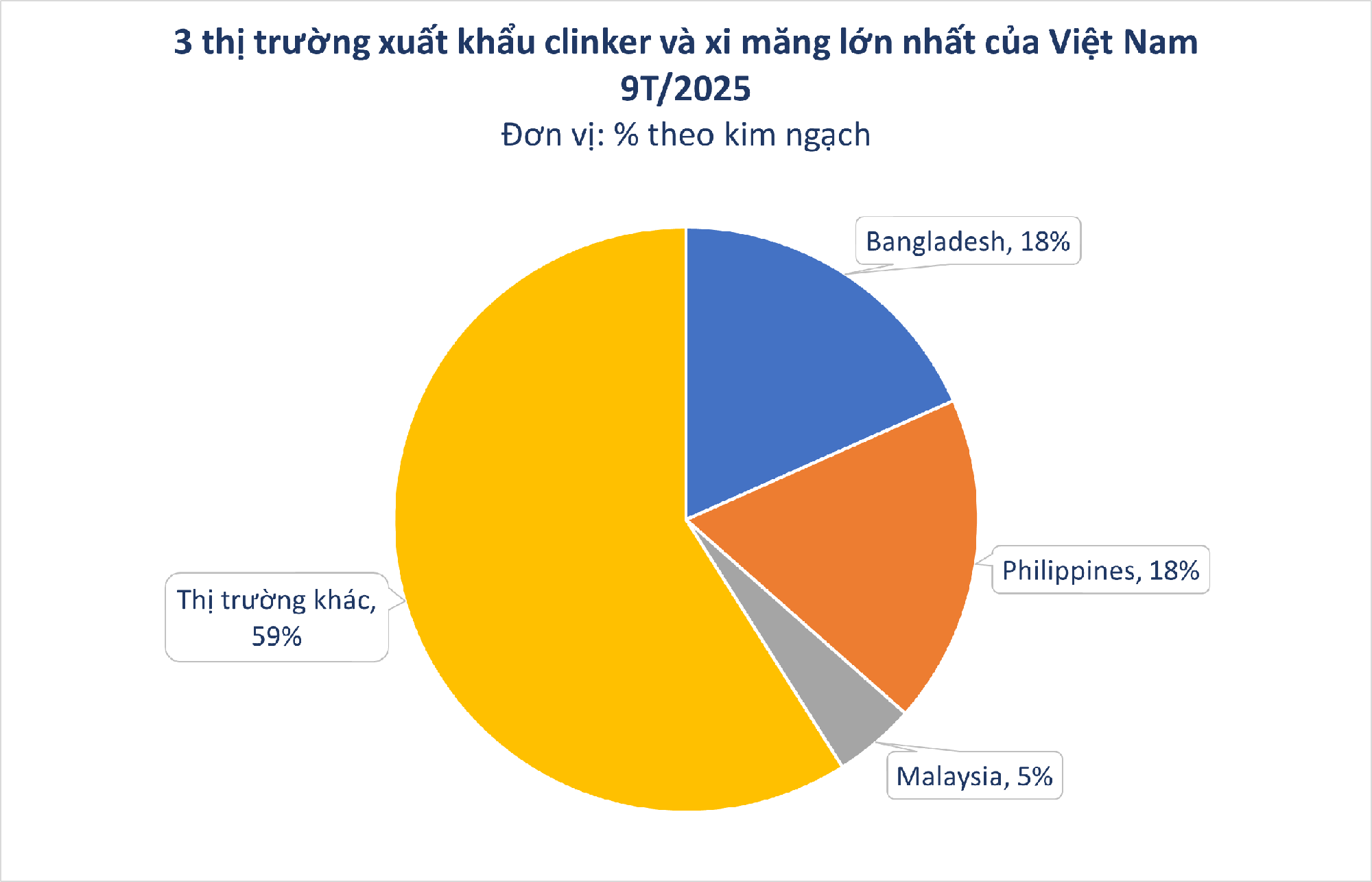

Bangladesh was the largest importer of Vietnamese cement and clinker, accounting for approximately 18% of the total exports, with 4.8 million tons valued at nearly 160 million USD, a slight increase from 2024.

The Philippines ranked second, importing 4.7 million tons worth 182 million USD, a significant decline in both volume and value compared to 2024. Malaysia surpassed Taiwan (China) to become the third-largest market, with over 1 million tons valued at nearly 42 million USD.

Notably, Laos has significantly increased its purchases of Vietnamese cement, reaching 120,000 tons worth over 9 million USD, a staggering 382% increase in volume and 380% in value. In September alone, exports to Laos surged by 700% in volume and 600% in value.

According to Statista, in 2024, China led global cement production with 1.9 billion tons (over half of the world’s total), followed by India with 450 million tons. Vietnam, with over 110 million tons, surpassed the US and Russia to claim the third position—a remarkable achievement given the domestic oversupply (designed capacity of 120 million tons/year, but demand is only around 65 million tons).

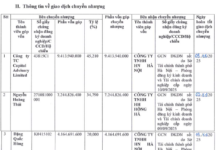

The government has issued Decree No. 108/2025/NĐ-CP, amending and supplementing Decree No. 26/2023/NĐ-CP on export tax rates, preferential import tax rates, lists of goods, and absolute tax rates, mixed taxes, and out-of-quota import taxes.

The most notable change in the Decree is the reduction of the export tax rate for clinker from 10% to 5%, aimed at supporting the domestic cement industry, which is facing numerous challenges.

This preferential tax rate will be applied until December 31, 2026. From January 1, 2027, the tax rate will revert to 10% as stipulated in the Export Tax Schedule issued with Decree No. 26/2023/NĐ-CP.

According to the Ministry of Construction, Vietnam currently has 92 cement production lines with a total designed capacity of 122.34 million tons/year. However, these lines are operating at an average capacity of only 77%. Thirty-four lines have had to halt production for 1 to 6 months, with some stopping for the entire year, leading to losses for many cement producers.

Reducing the export tax rate for clinker from 10% to 5% until the end of 2026 will provide clinker and cement producers with over a year to adjust their production plans and manage inventory.

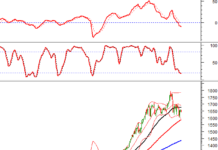

Towards the end of the year, domestic cement consumption is expected to rise as the government boosts public investment, particularly in transportation infrastructure and construction. The real estate supply is also anticipated to recover as legal unblocking measures begin to impact the market.

However, the early arrival of the rainy and stormy season in the North and Central regions is predicted to affect construction progress, reducing regional cement demand.