Vietnam Airports Corporation (stock code: ACV) has recently released its Q3 2025 consolidated financial report, revealing a net revenue of VND 6,476 billion, marking a 15% increase compared to the same period in 2024. Despite a significant rise in cost of goods sold, gross profit saw a modest 6% growth, reaching nearly VND 4,000 billion.

After deducting expenses, ACV reported a post-tax profit of VND 3,210 billion, a 37% surge year-over-year. This quarter’s profit ranks as the second-highest in the company’s history, just shy of the record VND 3,228 billion achieved in Q2 2024.

For the first nine months of the year, ACV’s cumulative net revenue reached VND 19,167 billion, with post-tax profit at VND 8,936 billion, reflecting a 14% and 5% increase, respectively, compared to the same period last year.

Within the revenue structure, aviation services contributed over VND 16,000 billion, while non-aviation services generated VND 2,429 billion, both growing by 15-17% year-over-year, driven by increased international passenger traffic. Conversely, sales revenue declined by 16% to VND 777 billion, as the company shifted from direct sales to leasing commercial space.

ACV’s revenue growth is expected to remain stable until mid-2026

In a recent update, Vietcombank Securities (VCBS) highlighted that infrastructure improvements will enable airlines to launch new routes and increase flight frequencies, ensuring sustained growth in passenger volumes across ACV’s airports in the medium to long term. This will support stable growth in both core revenue segments.

As of early 2025, major airports like Tan Son Nhat and Noi Bai are operating at full capacity, creating growth bottlenecks for ACV. However, VCBS notes that these constraints are gradually easing as new terminal projects come online from Q2 2025 onward.

Notable projects include Tan Son Nhat’s Terminal 3, operational since April 2025 with a capacity of 20 million passengers annually. Noi Bai’s Terminal 2 is set to complete its expansion by December 2025, increasing capacity from 10 million to 15 million passengers per year. Additionally, Long Thanh Airport Phase 1, expected to commence commercial operations by mid-2026, will add a capacity of 25 million passengers annually, significantly alleviating congestion in the southern region.

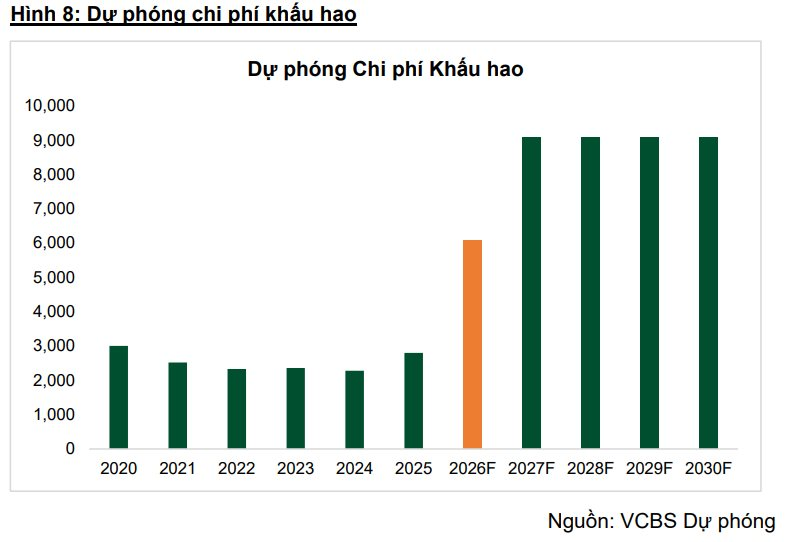

VCBS analysts predict that if Noi Bai’s Terminal 2 expansion is completed on schedule, ACV’s revenue growth could remain steady until mid-2026. Thereafter, the company may face pressure as Long Thanh Airport Phase 1 begins operations in June 2026, with initially low efficiency but substantial depreciation costs.

Assuming 65% of total investment is allocated to buildings and structures with a 25-year depreciation period, the remaining project value is primarily assigned to machinery and equipment, depreciated over 10 years.

Profit outlook boosted by FX loss reversal of over VND 600 billion

On a positive note, ACV stands to benefit from favorable exchange rate movements. The JPY/VND exchange rate is a critical financial variable impacting ACV’s business performance. The company holds significant long-term debt in Japanese Yen (JPY), primarily from ODA/JICA loans for airport infrastructure projects such as Noi Bai’s Terminal 2 and other upgrades. As of Q3, JPY-denominated loans totaled approximately VND 10,300 billion.

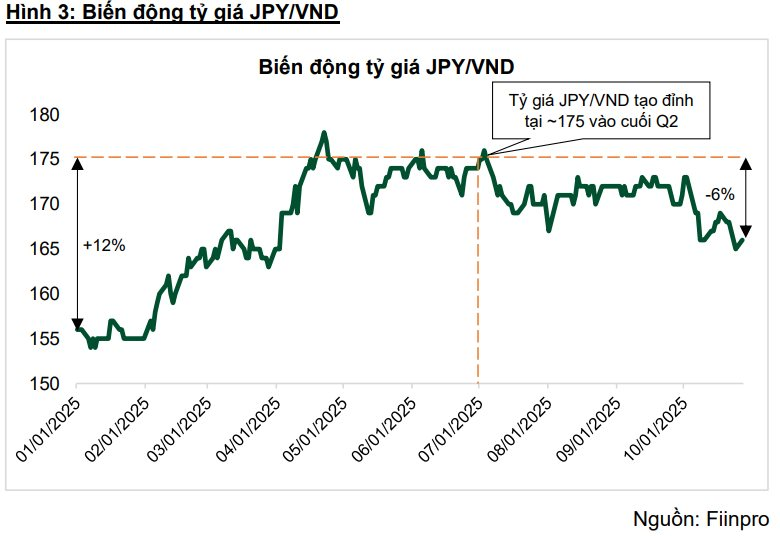

The sharp appreciation of JPY against VND in Q2 compelled ACV to recognize substantial unrealized foreign exchange losses, as the JPY-denominated debt increased in VND terms. However, JPY/VND peaked at the end of Q2 2025 and has since stabilized in Q3, with expectations of further moderation due to Japan’s accommodative monetary policy.

VCBS forecasts a partial reversal of Q2’s FX losses, amounting to ~VND 600 billion, ensuring that ACV’s net profit is no longer eroded by significant FX losses. This will allow the company’s core business profits to be fully reflected.

For the full year 2025, VCBS projects ACV’s revenue to reach VND 19,223 billion, with post-tax profit at VND 8,936 billion, representing a 14% and 5% increase, respectively, compared to the previous year.

Cash Kings of the Stock Market: Vingroup Reigns Supreme, MWG Quadruples Since Start of Year, 5 Companies Surpass 40 Trillion VND Mark

The Q3/2025 financial reports reveal a remarkable trend: 13 non-financial enterprises listed on the stock exchange hold a staggering cash reserve exceeding 20,000 billion VND, comprising cash, cash equivalents, and short-term deposits. Notably, several of these companies have experienced a significant surge in their cash holdings during this period.

Q3 2025 Revenue Skyrockets 155x as Company Sells Prime Hanoi Triple-Frontage Project to Sun Group for $2.4 Billion

Over the first nine months, the company recorded an after-tax profit of VND 216.6 billion, a significant increase from the mere VND 3.7 billion achieved in the same period last year.

Landmark Group Expands Workforce by 1,000 in 9 Months, Secures Over 2.9 Trillion VND in Personal Prepayments for Apartment Purchases

As of Q3/2025, Dat Xanh Group Corporation (HOSE: DXG) holds over VND 2.9 trillion in customer deposits for apartment pre-sales, nearly tripling the figure from the beginning of the year and marking a 70% increase from the previous quarter.