|

VNM ETF Treasury Stock Changes During the Week of October 24-31

|

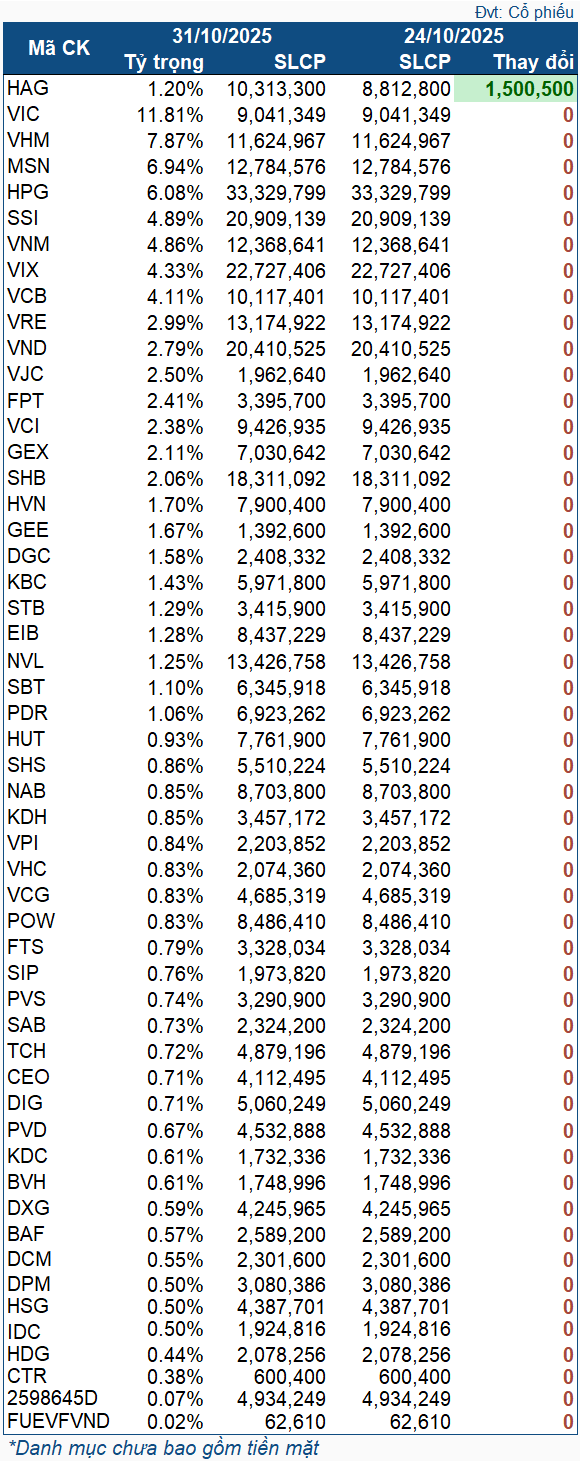

Specifically, during this period, the VNM ETF Fund only net purchased over 1.5 million shares of HAG. Other stocks in the portfolio remained unchanged. This was also a week when the VN-Index experienced significant declines, notably on October 27 (down 31 points, or 1.82%) and October 31 (down nearly 30 points, or 1.79%).

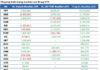

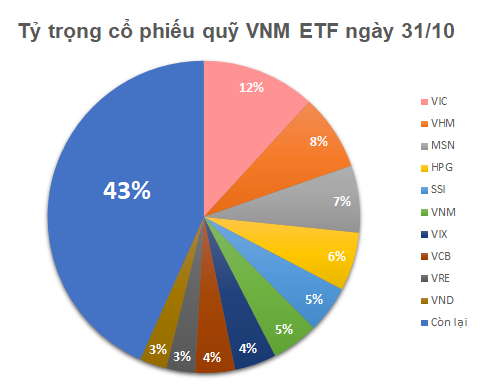

As of October 31, the total asset value of the VNM ETF Fund stood at 558 million USD, down from 580 million USD the previous week. Assets were allocated across 51 stocks, 1 fund certificate, and 1 stock warrant. The top holding was VIC, with a weight of over 11.8%. This was followed by VHM (7.87%), MSN (6.94%), HPG (6.08%), and SSI (4.89%).

– 12:00 05/11/2025

Real Estate Stocks Ride the Wave, Propelling VN-Index to Surge

The trading session on November 4th concluded on a positive note, marking a significant rebound after over two weeks of consecutive declines. The VN-Index surged by more than 34 points, representing a 2.12% increase, closing in on the 1,652-point mark. This impressive rally signals a much-needed recovery following a prolonged period of steep losses.