Market Drivers and Resistances

Following an initial surge fueled by upgrade news, the VN-Index briefly approached the 1,800-point mark, only to face a sharp reversal. Despite positive macroeconomic factors—such as Q3 GDP growth of 8.23%, Vietnam’s tax agreement with the U.S., easing U.S.-China trade tensions, and the Federal Reserve’s 0.25% rate cut—these signals proved insufficient to sustain market momentum. Selling pressure concentrated on blue-chip stocks, notably Vingroup, Gelex, and banking sector equities.

By the end of October, the VN-Index closed at 1,639.65 points, a 1.33% decline from September. Average daily trading volume in October fell to VND 37 trillion, nearly 30% below August’s peak.

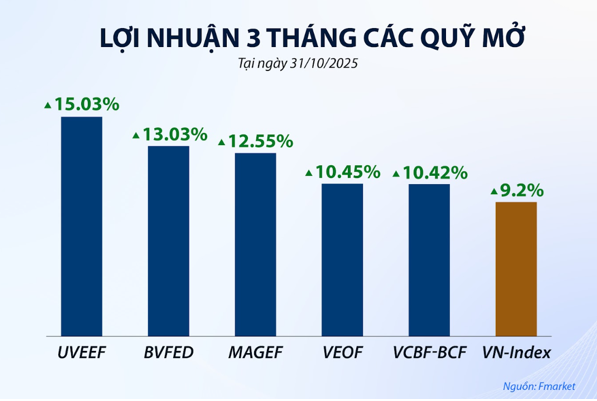

The market’s sharp correction weighed on October performance for equity mutual funds. However, over the past three months (as of October 31, 2025), several funds outperformed the VN-Index. According to Fmarket data, top-performing funds included: UVEEF (+15.03%), BVFED (+13.03%), MAGEF (+12.55%), VINACAPITAL-VEOF (+10.45%), and VCBF-BCF (+10.42%), compared to the VN-Index’s 9.2% gain. Year-to-date, numerous equity funds maintained over 20% growth.

According to Huỳnh Hoàng Phương, Financial Management Expert, while many mutual funds underperformed recently, individual investors also struggled to outperform during this volatile period.

“Few investors fully capitalized on speculative rallies, with many incurring losses due to mistimed purchases or lack of discipline. In contrast, funds maintained double-digit returns with significantly lower risk,” noted Mr. Phương.

The 2025 market is driven by highly speculative stocks, making defensive portfolio strategies among mutual funds a prudent approach for long-term investment preservation. September fund portfolios maintained substantial allocations in Banking, Construction Materials, and Retail—sectors with stable cash flows and attractive valuations.

Specifically, in Banking, 24 funds held MBB, 21 held CTG, and 19 held TCB. These stocks, known for stable cash flows, attractive valuations, and low profit volatility, served as portfolio anchors, helping funds manage risk amid market turbulence.

In Construction Materials, HPG featured in 24 fund portfolios, with the highest weightings in BVFED, MAGEF, and UVEEF. Retail sector leader MWG was held by 23 funds, prominently in DCDS, TBLF, and VLGF portfolios.

Expert Huỳnh Hoàng Phương attributed the surge in speculative capital to short-term performance distortions, emphasizing that corrections are essential to refresh the market and filter out speculative flows, paving the way for sustainable growth.

“Post-correction, funds that timely rebalance their portfolios typically achieve superior performance during subsequent recoveries,” he added.

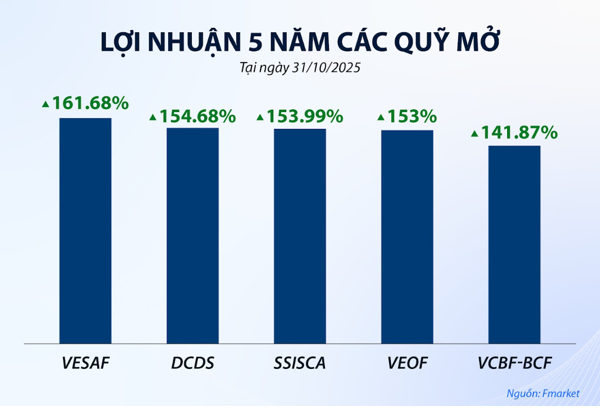

From 2020 to 2025, most Vietnamese equity funds outperformed the VN-Index over 50% of the time, highlighting the importance of consistency and clear strategies for sustainable results. Leading Fmarket funds delivered compound annual returns of approximately 20.4%.

Anticipated Year-End Revival

Vietnam’s stock market typically corrects in October. However, 2025 differs as improving economic fundamentals signal a more robust recovery and growth phase.

The State Bank of Vietnam reported credit growth of 13.4% as of September 29, 2025, compared to 2024 year-end—1.5 times higher than the same period in 2024 (9.11%) and the highest in five years. Notably, 78% of total outstanding loans targeted production and business activities, reflecting tangible economic support.

Low interest rates facilitated corporate investment expansion, bolstering economic recovery. The government targets 8%+ GDP growth in 2025 and over 10% in 2026, with projected credit growth of 19-20% during this period.

Over the next 12 months, macroeconomic policies are expected to remain supportive. The Fed’s rate cuts will ease domestic interest rate pressures, allowing for looser monetary policy. Concurrently, increased public investment is likely to drive growth, particularly in construction materials, infrastructure, and banking.

According to VinaCapital, listed companies’ average profits are projected to rise 23% in 2025, followed by 16% annual growth in 2026-2027.

“Excluding 13 overheated stocks, the forward P/E ratio drops to 10.5 times, while corporate profits grow 16%. Many undervalued stocks present 2026 investment opportunities,” stated Nguyễn Hoài Thu, Deputy CEO of VinaCapital Fund Management.

Foreign investors have net sold over VND 75 trillion since early 2025, reducing foreign ownership in the VN-Index to 15.5%, a multi-year low. However, analysts predict a foreign capital influx once the Fed cuts rates, exchange rates stabilize, and Vietnam achieves emerging market status, significantly boosting market momentum.

Ms. Nguyễn Hoài Thu cautioned about potential interest rate hikes due to exchange rate pressures but emphasized long-term strategies focused on fundamentally strong, reasonably priced stocks as optimal for current conditions.

– 14:15 06/11/2025

Maturing Investors: The Opportunity to Professionalize Vietnam’s Stock Market

Over the past 2–3 years, Vietnamese investors have shifted their approach to the stock market, moving beyond short-term speculation to embrace more structured and strategic participation. The market now exhibits clear signs of transitioning from a speculative mindset to one focused on value investing. This evolution presents an opportunity to foster a more professionalized market, encouraging investors to engage with investment organizations, thereby reducing risk and enhancing profitability.

Vietstock Daily 06/11/2025: Cautious Sentiment Persists?

The VN-Index edged higher, though trading volume plummeted significantly below its 20-day average, underscoring the prevailing cautious sentiment in the market. Currently, the Stochastic Oscillator has dipped into oversold territory. Should a buy signal emerge within this region, the index’s short-term outlook could see a positive shift.

Market Pulse 05/11: Energy Sector Shines as Overall Market Liquidity Declines

At the close of trading, the VN-Index rose 2.91 points (+0.18%) to 1,654.89, while the HNX-Index gained 0.79 points (+0.3%) to 266.7. Market breadth tilted toward decliners, with 361 stocks falling and 323 advancing. Similarly, the VN30 basket saw red dominate, as 18 constituents declined and 12 advanced.