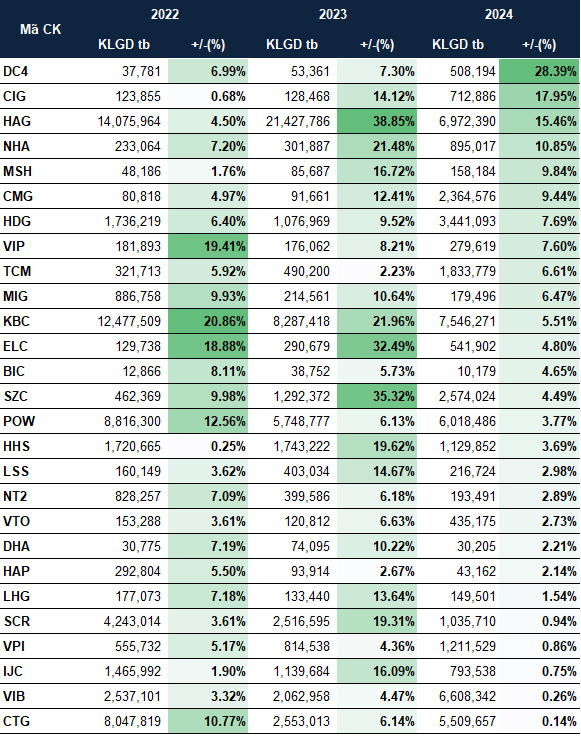

According to data from VietstockFinance, 27 stocks on the HOSE exchange consistently rose in November over the past three years (2022 – 2024). Notably, many of these stocks belong to the real estate sector, including DC4, HDG, KBC, SZC, HHS, LHG, SCE, VPI, and IJC.

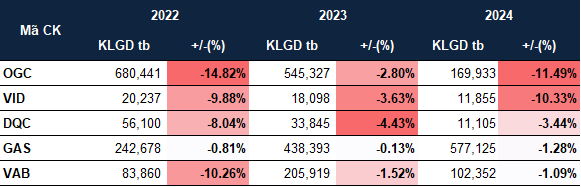

Conversely, only 5 stocks on the HOSE exchange consistently declined during this period: OGC, VID, DQC, GAS, and VAB.

|

Stocks on the HOSE exchange that increased in November from 2022 to 2024

Source: VietstockFinance

|

|

Stocks on the HOSE exchange that decreased in November from 2022 to 2024

Source: VietstockFinance

|

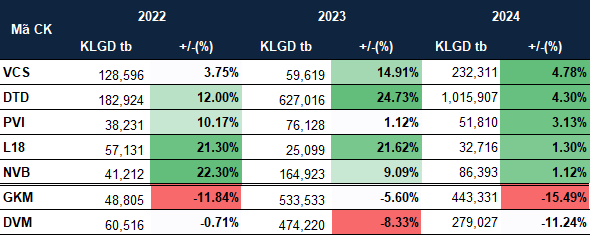

On the HNX exchange, a similar trend emerged, with more stocks consistently rising than falling. Specifically, the rising group includes 5 stocks: VCS, DTD, PVI, L18, and NVB. In contrast, only 2 stocks declined: GKM and DVM.

|

Stocks on the HNX exchange that increased/decreased in October from 2022 to 2024

Source: VietstockFinance

|

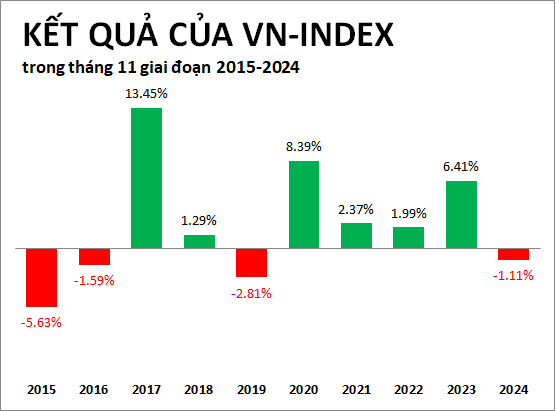

The performance of the VN-Index also indicates that November has been a positive period. Over the past decade, the index has risen in 6 years, including a consecutive 4-year streak from 2020 to 2023.

Source: VietstockFinance

|

Despite past optimism, the VN-Index has shown less favorable volatility in early November 2025. However, Yuanta Vietnam Securities (YSVN) believes short-term investor sentiment remains positive, as the index’s decline is largely driven by large-cap stocks.

Additionally, YSVN observes that many stocks have exited oversold territory and are in a technical recovery phase. New buying opportunities are gradually increasing, leading the firm to conclude that short-term risks are decreasing.

Regarding sectors, Asean Securities (Aseansc) notes that capital continues to rotate in search of opportunities. While Banking, Securities, and Real Estate sectors trade cautiously, others like Technology, Telecommunications, and Energy show more promising performance.

– 12:00 05/11/2025

Vietnam’s VN-Index Plunges, Half-Billion-Dollar ETF Buys Only One Stock

During the period of October 24–31, as the VN-Index experienced significant declines, the VanEck Vectors Vietnam ETF (VNM ETF) remained largely unchanged. The only stock purchased net was HAG.

Real Estate Stocks Ride the Wave, Propelling VN-Index to Surge

The trading session on November 4th concluded on a positive note, marking a significant rebound after over two weeks of consecutive declines. The VN-Index surged by more than 34 points, representing a 2.12% increase, closing in on the 1,652-point mark. This impressive rally signals a much-needed recovery following a prolonged period of steep losses.