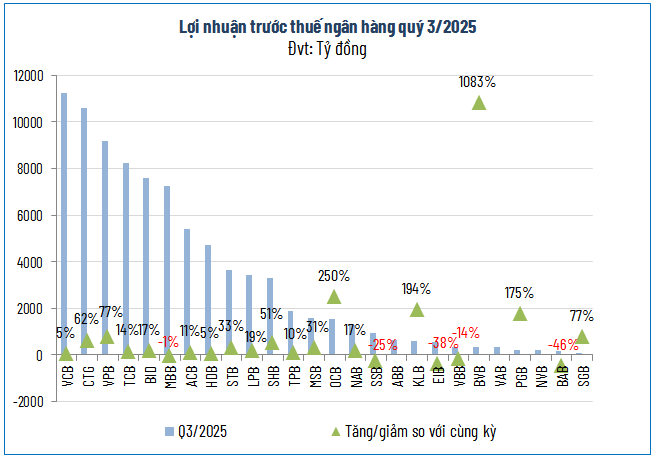

Bank Profits Surge Over 25% in Q3

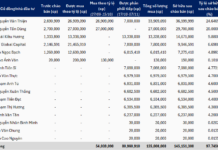

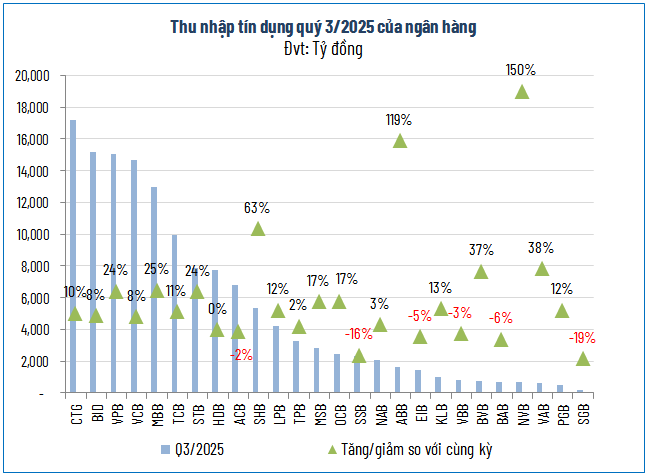

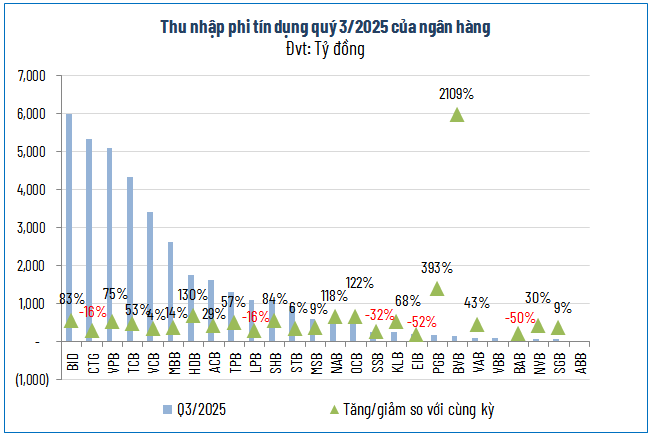

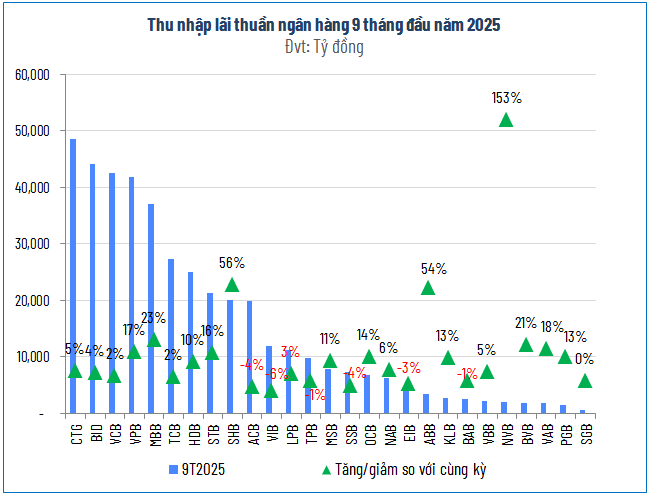

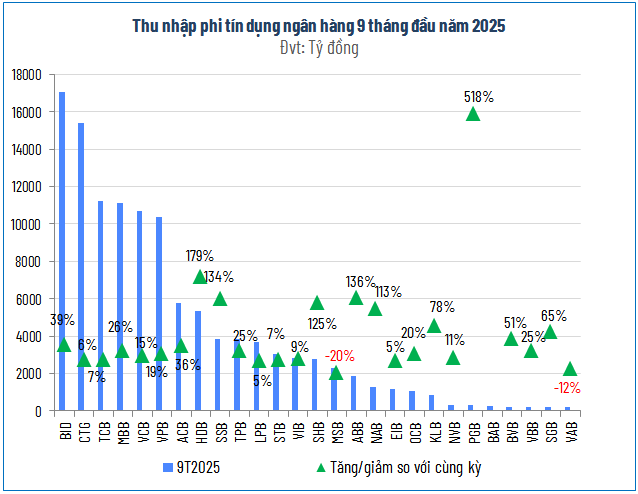

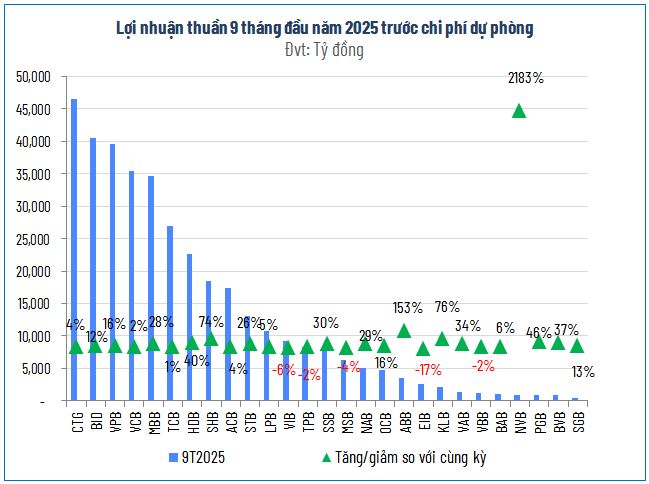

Q3/2025 financial results reveal a robust growth in bank profits. According to VietstockFinance data, 26 banks recorded net interest income exceeding VND 138 trillion, a 13% year-on-year increase. Non-interest income soared by 30%, reaching over VND 37 trillion.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

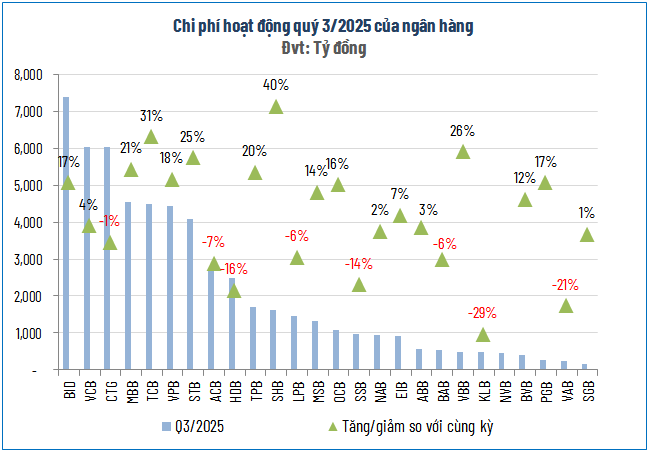

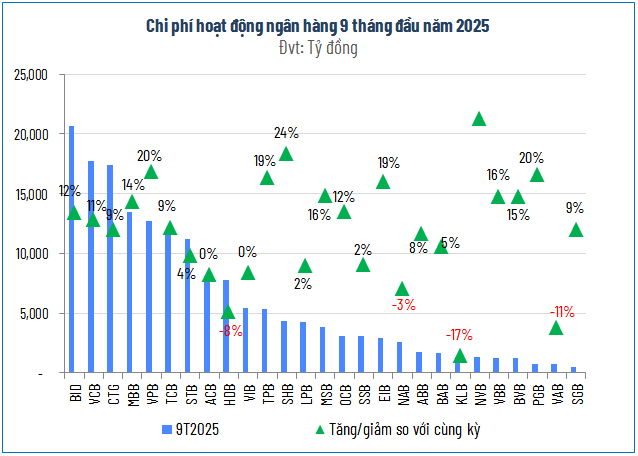

With operating expenses well-managed (up 9%), net operating profit reached nearly VND 120 trillion, a 20% year-on-year increase. After a 9% rise in credit risk provisions to over VND 34 trillion, pre-tax profit of the 26 banks hit over VND 85 trillion, up more than 25%.

Source: VietstockFinance

|

Source: VietstockFinance

|

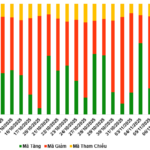

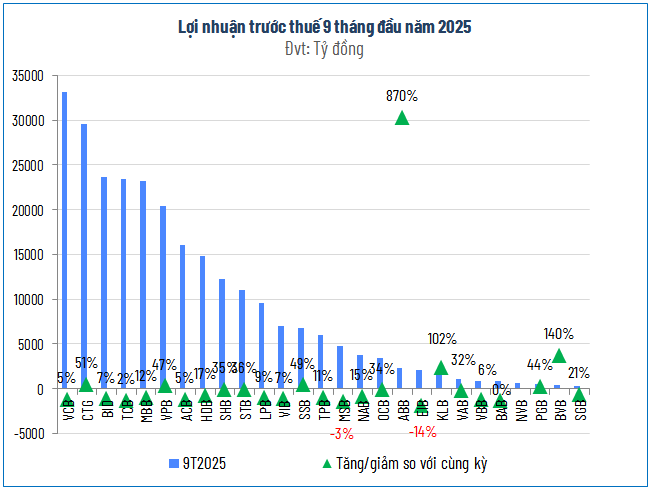

Several banks reported exceptional profit growth compared to the same period last year, including BVB (11.8 times), OCB (3.5 times), KLB (2.9 times), and PGB (2.8 times). Meanwhile, ABB and NVB turned around impressively, posting pre-tax profits of VND 646 billion and VND 191 billion, respectively, compared to losses in the same period last year.

Conversely, five banks saw declining profits, primarily due to reduced credit income. BAB experienced the sharpest decline, down 46%.

Industry-Wide 9-Month Profits Grow by Double Digits

For the first nine months, pre-tax profit of 27 banks reached over VND 259 trillion, a 19% year-on-year increase.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

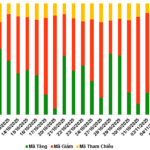

Net interest income remained the primary driver, totaling over VND 411 trillion, up 9% year-on-year. Non-interest income grew by 26%, contributing over VND 117 trillion. Both operating expenses and risk provisions increased reasonably, by 9% and 4%, respectively.

Source: VietstockFinance

|

Source: VietstockFinance

|

Among the top performers, ABB led with a 9.7-fold profit increase compared to the same period last year, followed by BVB (2.4 times) and KLB (over 2 times). NVB also turned a profit, recording over VND 650 billion.

Profit Race Among Top Banks Reaches Plateau

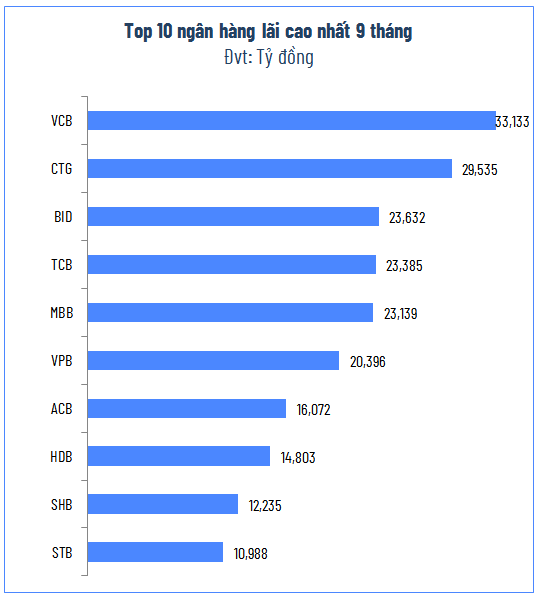

The profit race among leading banks is plateauing, with the top three state-owned banks maintaining their dominance. Vietcombank remains in the lead with profits exceeding VND 33 trillion, followed by VietinBank at VND 29.5 trillion, and BIDV in third place, nearly VND 6 trillion behind VietinBank.

Source: VietstockFinance

|

Notably, Techcombank, with a 14% Q3 increase, overtook MBB to secure the fourth position industry-wide.

The remaining spots in the top 10 highest-profit banks were claimed by ACB (+5%), HDB (+17%), SHB (+35%), and STB (+36%).

Early Profit Achievers Emerge Among Banks

Source: VietstockFinance

|

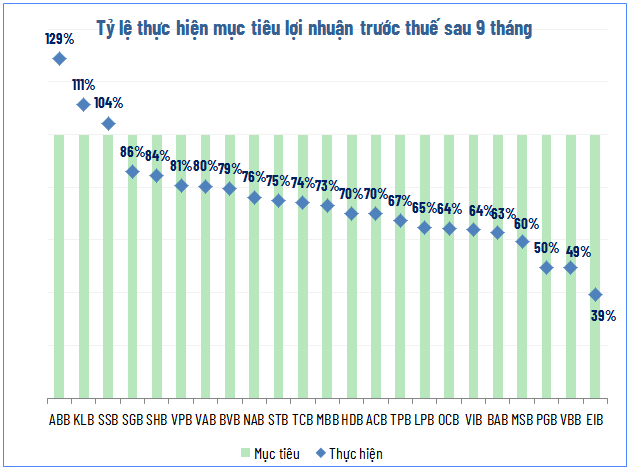

Alongside positive results, several banks have already surpassed their annual profit targets. ABB, the fastest-growing bank, has exceeded its yearly plan by 29% in just nine months. KLB and SSB have also surpassed their targets by 11% and 4%, respectively, while most other banks have achieved over 60% of their goals.

– 12:00 07/11/2025

November 7, 2025 Warrant Market Update: A Day of Mixed Market Movements

At the close of trading on November 6, 2025, the market saw 57 stocks rise, 200 fall, and 44 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of VND 877.65 million.

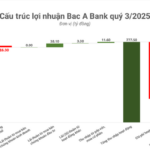

Bank Profits Plummet by Nearly Half in Q3

This bank’s financial performance has taken a significant hit, driven by a sharp rise in funding costs and risk provisioning expenses. Compounding the issue, non-credit segments such as services, foreign exchange, and securities have all posted underwhelming results.