After a prolonged period of low interest rates, the race to raise rates has suddenly heated up as multiple banks announce increases in deposit rates. VPBank is the latest entrant into this competition.

Specifically, in the new interest rate schedule effective from November 2025, Vietnam Prosperity Bank (VPBank) has raised its interest rates across various terms by 0.3 percentage points per year compared to the previous month.

In detail, the savings deposit rate for over-the-counter transactions with terms of 1-5 months stands at 4.2% per year for deposits under 10 billion VND, increasing to 4.3%-4.4% per year for deposits of 10 billion VND and above. For longer terms exceeding 12 months, rates range from 5.3%-5.6% per year, while online deposits enjoy an additional 0.1-0.2 percentage points, reaching a maximum of 5.8% per year.

Similarly, Vietnam International Bank (BVBank) has launched a “10 Golden Days of Interest Rates” program, offering a peak rate of 6.8% per year for 12-month online deposits. From November 3 to 13, customers can receive an additional 1.2 percentage points, with rates of 4.75% for 1-month terms, 6.5% for 6-month terms, and 6.8% for 12-month terms. BVBank also introduces online deposit certificates with flexible terms of 6-15 months, offering a maximum interest rate of 6.3% per year for 15-month terms.

According to reports from Nguoi Lao Dong Newspaper, several other commercial banks such as Bac A Bank, SHB, HDBank, NCB, MB, and VCBNeo have also collectively adjusted their interest rates upward in November.

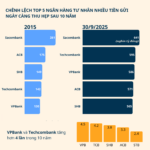

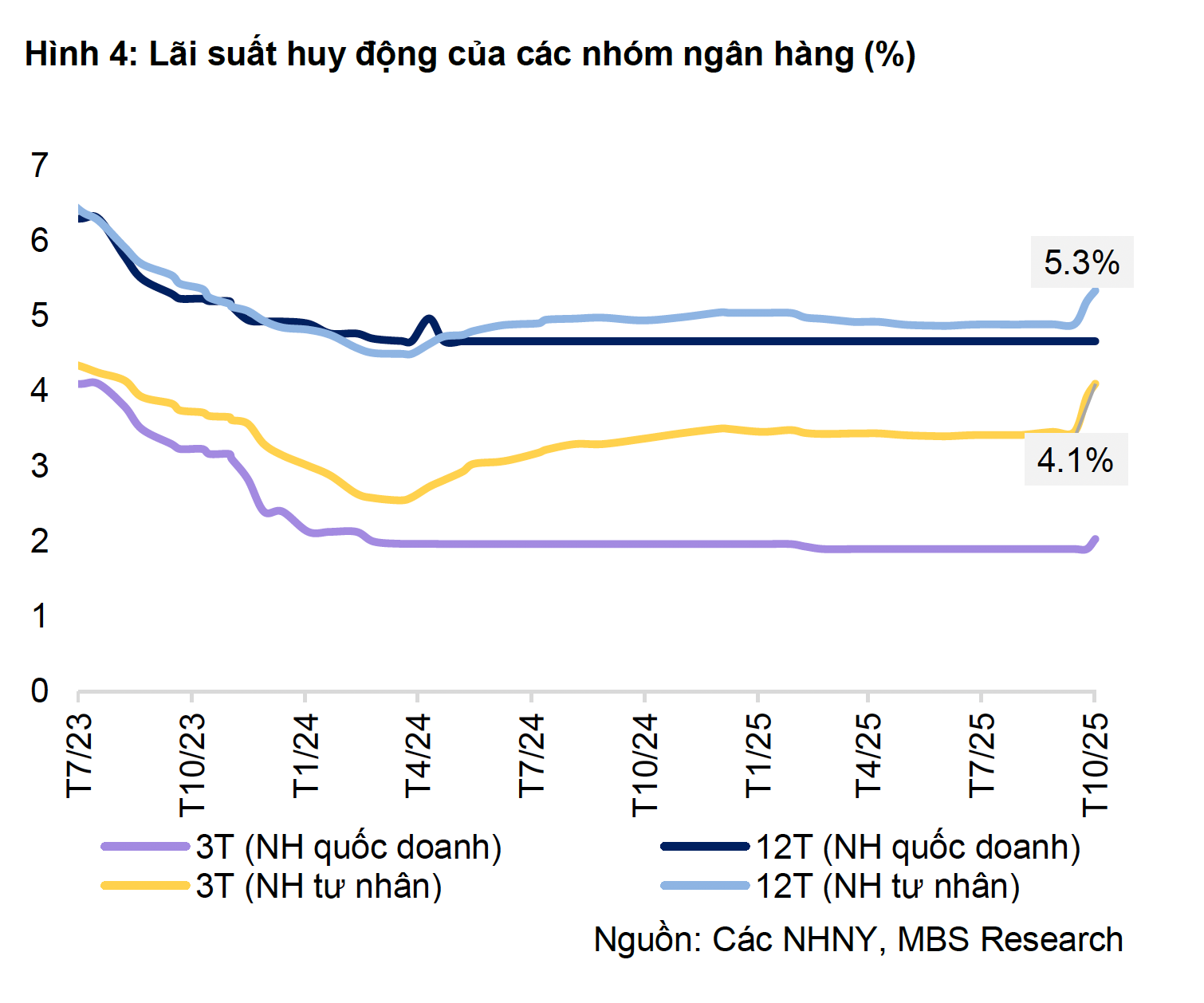

A report by MBS Securities Company reveals that in October alone, six banks raised their interest rates, with LPBank leading at 6.1% per year for 12-month terms. This trend reflects the growing demand for capital mobilization as banks prepare for year-end lending, a period typically marked by increased credit demand due to seasonal cycles.

Rising savings deposit rates across multiple banks

According to the State Bank of Vietnam, as of October 30, the credit balance of the entire system had increased by approximately 15% compared to the end of 2024, and is projected to reach 19%-20% by the end of 2025.

Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Vietnam Securities Company, stated that since late September, many small and medium-sized banks have increased their deposit rates by 0.1-0.5 percentage points, primarily for terms of 3-12 months. Additionally, various promotional programs offering interest bonuses, gifts, and incentives for new or long-term depositors have been launched to attract funds.

“The pressure to mobilize capital at year-end is becoming increasingly evident. Banks will intensify promotional efforts to attract deposits while striving to maintain interest rate increases at a reasonable level,” Mr. Minh commented.

Regarding monetary policy, Dr. Le Anh Tuan, CEO of Dragon Capital, assessed that inflation risks remain low while domestic consumption has yet to surge significantly. However, exchange rate fluctuations are a factor to monitor, as they could impact interest rate management.

“Despite declining global interest rates, domestic rates may still edge up slightly to stabilize the exchange rate and ensure capital flows. If the exchange rate remains stable, monetary policy in 2026 could continue its easing trend, supporting growth,” Mr. Tuan predicted.

Recent upward trend in deposit rates

Critical Alert from VARS to All Condominium Buyers

According to the Vietnam Association of Realtors (VARS), lending interest rates are trending upward, while promotional periods remain temporary. Once loans transition to floating rates, if the general interest rate rises, debt repayment pressures will intensify significantly. Many borrowers find themselves in a situation where “they haven’t paid any principal yet, but the interest has already doubled.”

Gold Prices for SJC and Ring Gold Remain Steady on November 1st

Domestic gold prices on November 1st remained unchanged compared to the previous session’s closing price.

What Makes Debt-Free Real Estate Businesses Stand Out?

Given the capital-intensive nature of real estate development, particularly in its early stages, companies in this sector often leverage financial strategies to secure funding. However, there are notable exceptions where businesses maintain zero debt.