Illustrative Image

Profits of state-run Indian oil refineries surged in Q3/2025, despite a significant reduction in reliance on discounted Russian crude oil. This trend highlights that the industry’s earnings are now primarily driven by global price fluctuations rather than cheap supplies from Moscow.

According to the Economic Times (ET), the combined profits of the three major players—Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL), and Hindustan Petroleum Corporation (HPCL)—in Q3/2025 reached 17,882 crore Rupees, a staggering 457% increase year-on-year. This surge is attributed to lower crude oil prices and higher refining-marketing margins.

Mangalore Refinery and Petrochemicals Limited (MRPL), another state-owned enterprise, also reported a return to profitability after posting losses in the same period last year.

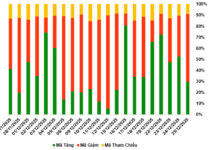

Data from analytics firm Kpler reveals that IOC, BPCL, HPCL, and MRPL imported 40% less Russian crude oil compared to the same quarter in 2024. In Q3, Russian oil accounted for only 24% of the total crude imports by Indian state-run refineries, down sharply from 40% in 2024.

IOC stated that Russian oil now constitutes just 19% of its crude input mix, while HPCL Chairman Vikas Kaushal noted that the figure stands at a mere 5% for HPCL, as it is economically unviable to process this type of oil in their refineries.

Executives emphasized that the positive financial results are largely due to favorable global market conditions. An oil refinery executive quoted by ET remarked, “Global factors such as benchmark oil prices and high fuel rates have a far greater impact than the discounts from the small portion of Russian oil we process.”

During Q3, Brent crude averaged $69 per barrel, 14% lower than the $80 per barrel recorded in the same period last year. Reduced input costs, coupled with higher output product prices, significantly boosted profit margins.

Diesel prices rose by 37% to $18.7 per barrel, gasoline prices increased by 24% to $8.4 per barrel, and jet fuel prices climbed by 22% to $8.4 per barrel. Consequently, IOC’s gross refining margin (GRM) reached $10.6 per barrel—over six times the $1.59 per barrel reported in Q3/2024—partially supported by inventory gains.

The sharp rise in diesel prices is attributed to low inventories in Asia and Europe, alongside reduced exports from Russia. Limited supply and recovering demand also contributed to improved margins for gasoline and jet fuel.

Additionally, new sanctions from the U.S. and European Union targeting major Russian energy firms like Rosneft and Lukoil have compelled Indian refineries to reduce imports from Moscow. Both state-owned and private sectors are now shifting to alternative sources in the Middle East, the U.S., and other markets.

This shift underscores India’s refining sector’s strategic move toward import diversification, leveraging global price volatility to enhance profitability.

Source: Reuters

A Trillion Dollar Product Helps Russia Make Unprecedented Cash Wealth

Russia is flush with unprecedented amounts of cash thanks to the sale of a billion-dollar commodity.