Understanding Tax Compliance in Vietnam: A Comprehensive Guide

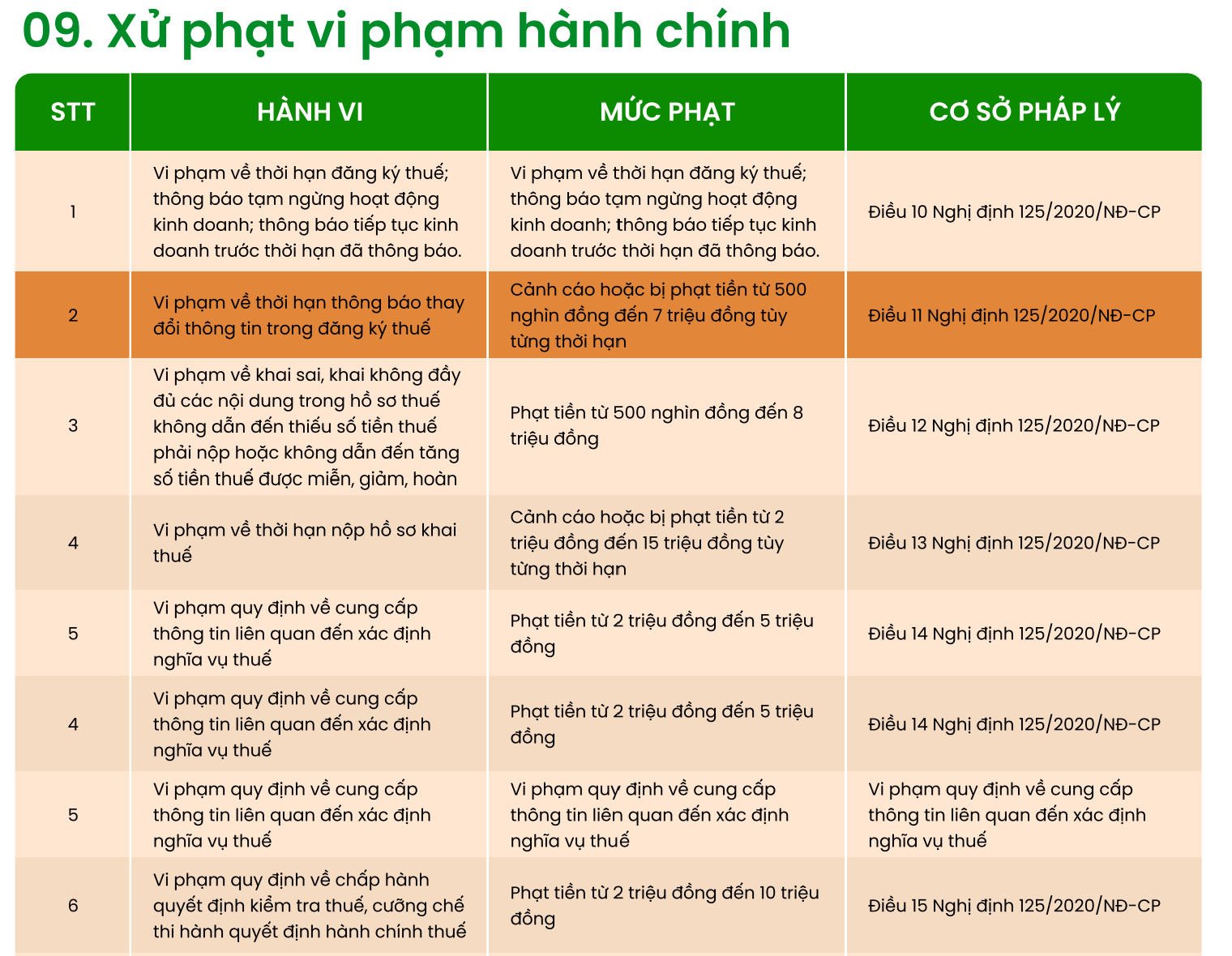

According to the Ministry of Finance, adhering to tax declaration and payment regulations is mandatory for all businesses and individuals in Vietnam. Government Decree 125/2020/NĐ-CP outlines stringent administrative penalties for non-compliance.

Violations related to tax registration deadlines fall under Article 10. Notably, Article 12 imposes fines ranging from VND 500,000 to VND 8,000,000 for inaccurate or incomplete tax declarations that result in underpaid taxes or inflated tax exemptions, reductions, or refunds.

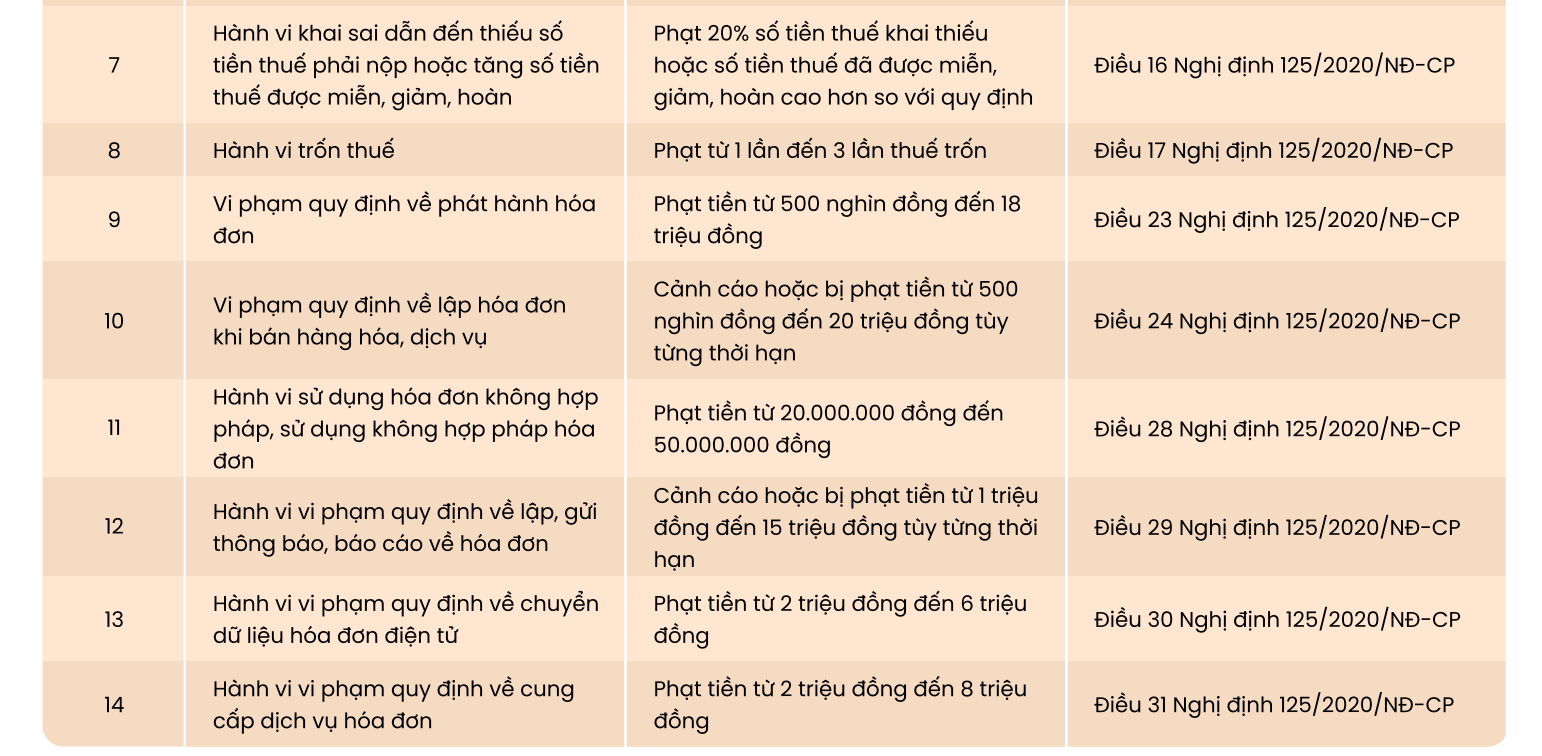

Penalties escalate significantly for more severe infractions. Under Article 16, offenders face a 20% fine on the underreported tax amount or the excess tax exemption, reduction, or refund claimed.

The most severe penalty is reserved for tax evasion (Article 17), which carries a fine of 1 to 3 times the evaded tax amount.

In addition to declaration violations, invoice-related offenses also incur heavy penalties:

- Violations of invoice notification and reporting requirements (Article 29): Warning or fines from VND 1,000,000 to VND 15,000,000.

- Use of illegal invoices (Article 28): Fines ranging from VND 20,000,000 to VND 50,000,000.

Detailed penalty breakdowns are illustrated below:

Penalty Structure for Tax Violations (Part 1)

Penalty Structure for Tax Violations (Part 2)