The Ministry of Finance has issued a directive to local leaders regarding the coordination of tax management for households and individual businesses following the abolition of lump-sum tax from January 1, 2026.

The directive emphasizes the need to strengthen data connectivity and sharing, aiming to establish an integrated database for managing business households.

The State Bank’s regional branches are instructed to guide commercial banks and credit institutions in sharing transaction data with tax authorities, facilitating money flow verification, revenue confirmation, and compulsory measures through bank accounts as per regulations. Additionally, they are to develop payment systems and integrated digital payment utilities for widespread use across local business models.

Provincial and city police departments will continue to share resident data, including permanent and temporary residence registrations, transportation monitoring, accommodation activities, and rental information. They will collaborate with tax authorities to integrate electronic identification into the tax management database for households and individual businesses. Local police units will also exchange information on crime reports, denunciations, and prosecution recommendations, handling cases of tax violations referred by tax authorities.

The Departments of Finance, Agriculture and Environment, and local authorities at the commune and ward levels will work with tax and statistical agencies to standardize and exchange business registration data, land information, business premises details, statistical survey results, and actual operational status of households and individual businesses. This ensures timely updates aligned with the tax authority’s database.

The Ministry of Finance further mandates intensified tax management for business households to prevent revenue losses during the transition period. This includes scrutinizing household business information, focusing on revenue and cash flow control, and building an integrated database to promptly identify high-risk households in tax compliance, invoice usage, and efforts to underreport revenue or evade taxes.

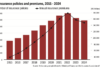

According to the Ministry of Finance, state budget revenue from households and individual businesses in the first nine months of this year increased by 30% year-on-year, reaching an estimated 25,089 billion VND. During this period, 18,348 lump-sum tax households switched to declaration-based tax payment, and nearly 2,530 business households transitioned to enterprise status.

ACB Partners with Ho Chi Minh City Tax Department to Lead Support for Business Households Transitioning Under Decision 3389/QĐ-BTC

ACB (Asia Commercial Bank) has officially partnered with the Ho Chi Minh City Tax Department to launch a comprehensive solution tailored for business households during the transition phase under Decision 3389/QD-BTC. This pioneering initiative by ACB aims to empower business households, alleviating the pressures of change, optimizing operations, and fostering business expansion.

From 2026, Lump-Sum Tax Abolition: 7 Essential Tips for Businesses to Avoid Tax Declaration Errors

Revised Introduction:

The Tax Department of Dak Lak Province has recently issued detailed guidelines for local businesses, outlining the steps to fulfill their tax obligations through the declaration method.

(Note: The revision maintains the core information while enhancing clarity, conciseness, and natural English phrasing.)

Automated Late Tax Payment Reminders and Penalty Review Needed

At the seminar “Promoting Voluntary Compliance, Full Tax Contribution – Building a Prosperous Era” organized by Lao Dong Newspaper on October 23, experts emphasized that tax authorities should shift from a “management and imposition” mindset to one of “accompaniment and support” to enhance taxpayers’ voluntary compliance.

Former Deputy Director of the General Department of Taxation: It’s Highly Unreasonable for Someone to Face an 8 Million VND Fine for a Mere 300,000 VND Delay in Personal Income Tax Declaration

At the seminar titled “Promoting Voluntary Compliance, Full Tax Contribution – Building a Prosperous Era,” organized by Lao Dong Newspaper on October 23, experts emphasized that tax authorities should shift from a mindset of “management and imposition” to one of “partnership and support” to enhance taxpayers’ voluntary compliance.

Business Tax Management from 2026: Ending Presumptive Tax, Fully Transitioning to Declaration Method

As of January 1, 2026, the lump-sum tax method will be discontinued, and the Ministry of Finance will introduce a new management model. Under this model, businesses will be categorized into three groups based on their revenue scale, with corresponding tax regulations and declaration requirements applied accordingly.