TPBank’s Tech-Driven Emotional Connection with Gen Z

For years, TPBank has been a pioneer in digital transformation, offering standout products like the TPBank App, LiveBank 24/7, and TPBank Biz.

However, in 2025, the iconic purple brand took a bold leap beyond technology. With the tagline “TPBank App – Peak Utility, Peak Living,” the bank redefined its app as more than a financial tool—it’s a personalized space where users express their peak lifestyle. Features like ChatPay, online card issuance, dual-yield accounts, and customizable interfaces are meticulously designed for seamless, intuitive, and relatable experiences. While not the first bank to integrate music into its messaging, TPBank stands out for its subtle yet culturally resonant approach tailored to Gen Z.

In “Em Xinh Say Hi,” TPBank seamlessly integrates into the narratives of young artists like Orange, Phương Ly, LyHan, and 52Hz.

In the reality show “Em Xinh Say Hi,” TPBank transcended traditional sponsorship. Instead of mere logo placement, the bank wove its app into the stories of artists such as Orange, Phương Ly, LyHan, and 52Hz. Each artist was paired with a key app feature—ChatPay with Orange, online credit cards with 52Hz, Flash2in1 cards with LyHan, and dual-yield accounts with Phương Ly. This strategy embedded the app into the musical journey, sparking curiosity among fans eager to “Live Peak” like their idols.

The TPBank App delivers experiences that captivate the youth.

During the show’s airing, TPBank App downloads surged by over 200%, peaking at 120,000 daily downloads, while online credit card applications tripled.

“Em Xinh Say App Đỉnh”: Gen Z Amplifies TPBank’s Story

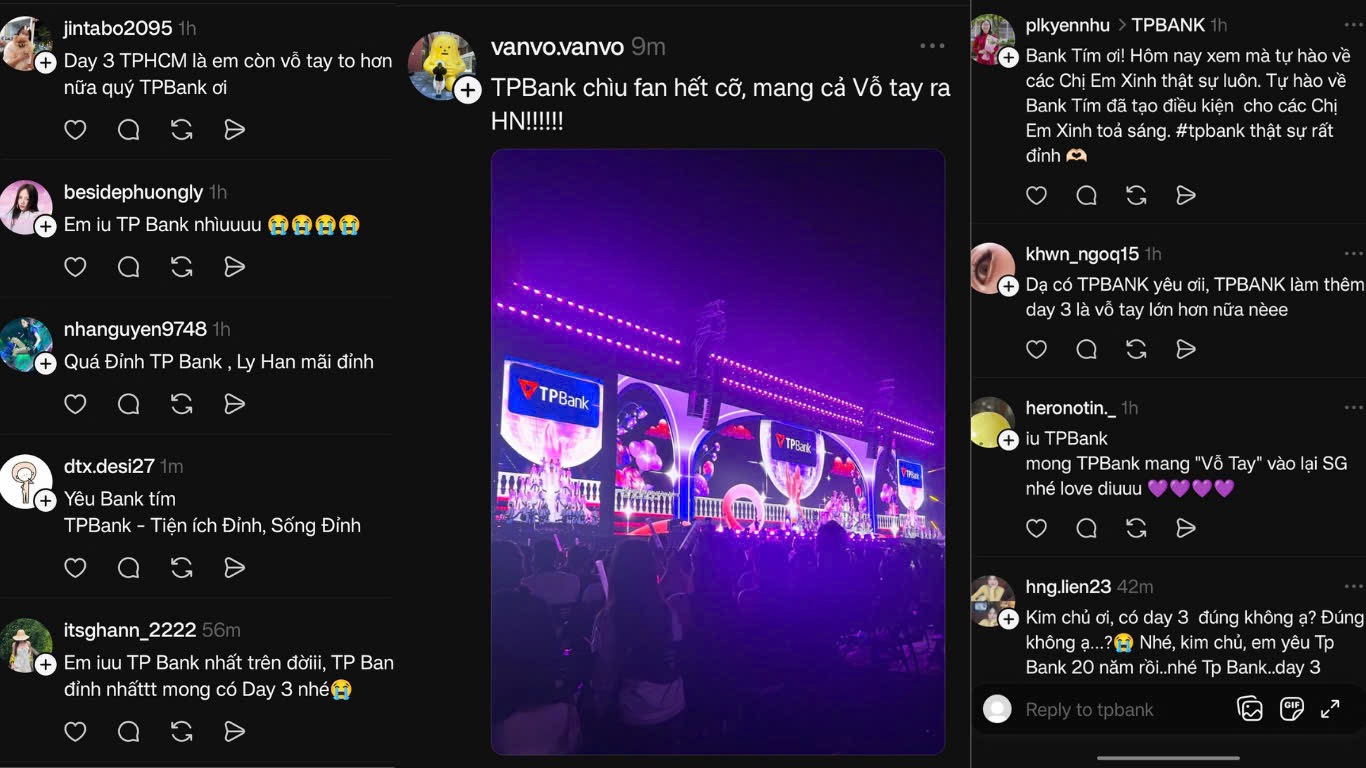

Following TV success, TPBank launched “Em Xinh Say App Đỉnh” on social media, particularly Threads, Gen Z’s digital playground. The campaign’s name cleverly merges “Say” (passion in Vietnamese) with its English meaning (to share), encouraging users to authentically share their experiences.

“Em Xinh Say App Đỉnh” inspires users to share genuine experiences and emotions.

Fans organically posted clips, memes, and behind-the-scenes moments of their idols using the TPBank App, creating unprecedented viral engagement. Within two weeks, the campaign drove tens of thousands of artist-themed app interface uses, ranking TPBank #1 in positive sentiment and #3 in banking discussions on social media (July–August 2025).

Emotional Connections Drive Sustainable Growth

The campaign’s impact extended beyond buzz, boosting service revenue by 19% (21% of total operating income) and sustaining an 11% profit growth year-over-year, reaching ₫6.05 trillion in Q3 2025. Total assets surpassed ₫450 trillion.

TPBank proves that in a tech-saturated era, emotional connection is the ultimate competitive edge.

“Peak isn’t just about technology—it’s about helping customers live peak every day,” shared a TPBank representative. By blending innovation with emotion, TPBank transformed digital banking into a cultural touchstone for youth, fostering joy, pride, and authenticity.

In a crowded market, TPBank speaks through music, emotion, and the heartbeat of Gen Z—a distinctive strategy proving that in an era of ubiquitous tech, emotional resonance is the true differentiator. That’s TPBank’s “Peak App.”

Optimize Year-End Financial Operations with NCB iziMobiz Digital Banking

Unlock sustainable growth with NCB iziMobiz, the digital banking platform by National Citizen Bank (NCB). Designed for businesses, it streamlines operations, optimizes operational costs, and enhances financial efficiency, empowering your enterprise to thrive in today’s competitive landscape.

Over 132.4 Million Individual Accounts Biometrically Verified

As of October 10, 2025, over 132.4 million individual customer profiles (CIFs) and more than 1.4 million organizational customer profiles have been biometrically verified through chip-embedded national ID cards or the VNeID application.