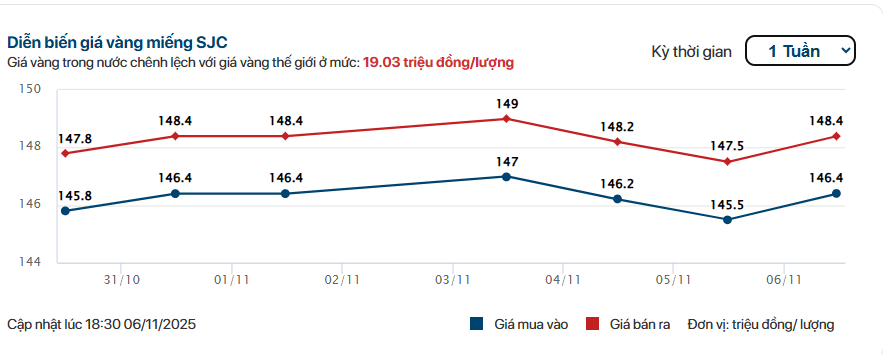

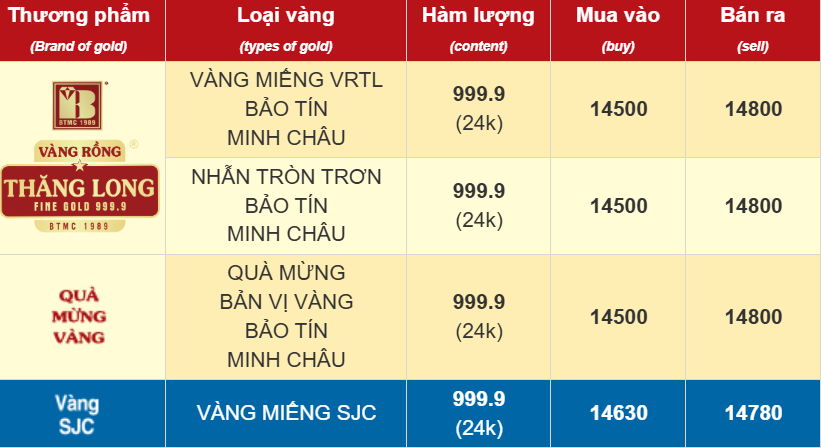

Specifically, the SJC gold price in the market is at 146.4-148.4 million VND per tael, marking an increase of 900 thousand VND per tael today.

Ring gold prices also rose uniformly by 0.7 – 1 million VND per tael. Accordingly:

At Bao Tin Minh Chau, the gold price for rings increased by 1 million VND per tael, currently listed at 145.8-148.8 million VND per tael.

At SJC Company, the price of plain gold rings rose by 500 thousand VND per tael to 143.3-145.8 million VND per tael.

At DOJI, the price of plain gold rings increased by 700 thousand VND per tael to 144.5-147.5 million VND per tael.

———————————–

Updated at 11:00, the SJC gold price increased by 300 thousand VND per tael to 145.8 – 147.8 million VND per tael.

Ring gold prices from major brands tended to move sideways or slightly increased by 200 thousand VND per tael. Among them, SJC Company is currently applying 142.7-145.3 million VND per tael. DOJI lists 143.8-146.8 million VND per tael. Bao Tin Minh Chau increased by 200 thousand VND per tael to 145.0-148.0 million VND per tael.

——————

Early in the morning of November 6th, some gold shops adjusted their gold prices upward compared to the previous day, with an increase of about 200-300 thousand VND per tael.

The SJC gold bar price in the market is commonly at 145.5-147.5 million VND per tael.

For plain gold rings, at DOJI and PNJ, this type of gold is at 143.8-146.8 million VND per tael. Bao Tin Minh Chau applies a price of 144.8-147.8 million VND per tael.

At SJC Company, the gold ring price is lower than major brands like DOJI, Bao Tin Minh Chau, and is currently listed at 142.7-145.3 million VND per tael.

Previously, on November 5th, domestic gold prices had a sharp decline of about 1.2 million VND per tael in the morning session, then rebounded by about 500 thousand VND per tael in the afternoon session.

In the international market, the world gold price is currently at $3,970 per ounce, recovering about $40 per ounce after falling sharply to $3,930 per ounce in yesterday’s session.

According to Kitco News, Russ Mould, Investment Director at AJ Bell, stated that gold is currently in the midst of its third major bull cycle since 1971, and like previous cycles, sharp corrections are inevitable. However, factors such as public debt, geopolitics, the strength of the USD, and inflation are likely to continue driving gold prices higher in this cycle.

“Over the past 12 months, gold has risen by 45% in USD terms – an increase that makes indices like the Nikkei 225, NASDAQ Composite, or Hang Seng look comparatively ‘sluggish,’ and raises the question: how high can gold go before it becomes a ‘bubble’?,” he wrote in a recent analysis.

Mould believes that skeptics who view gold as a useless metal, yielding no returns and even incurring a holding cost equivalent to 4% due to lost deposit interest, might be nodding in agreement as gold prices correct after last month’s new peak. However, he asserts: “This decline does not mean the bull cycle has ended. Both previous bull cycles – 1971–1980 and 2001–2010 – experienced multiple corrections but ultimately achieved significant gains.”

Meanwhile, according to Ole Hansen, Head of Commodity Strategy at Saxo Bank, market sentiment for gold has shifted from “excitement to caution” after the hot rally from August to early October. Investors are now reassessing how much of the “2025 narrative,” including rate cuts, fiscal tensions, geopolitical risks, and central bank demand, has been priced in. Hansen views this correction as “a healthy pressure release rather than a trend reversal.” However, he warns: A deeper decline cannot be ruled out if risk appetite in the stock market remains high and the USD continues to strengthen.

Gold Ring and SJC Gold Prices Plummet by Over 10 Million VND per Tael as of October 28th Close

Gold prices closed the day on October 28th with a significant decline, continuing their downward trend.

Gold Price Predicted to Drop After Hitting $5,000/oz, Experts Forecast

Our analysis team suggests that many investors will remain in the gold market even after the rally subsides, not solely due to price appreciation expectations, but because of gold’s diversification value and its role as a ‘safe haven’. This marks a distinct difference from other historical price surges.

Gold Ring and SJC Gold Prices Continue to Decline on the Afternoon of October 2nd

The current market price for SJC gold is set at 138 million VND per tael, while gold rings are trading at 135 million VND per tael.

Gold’s Non-Stop Rally Has Investors on Edge: “I Need to Sell 22 SJC Gold Bars at VND 155 Million per Tael”

“The gold market is buzzing with excitement as the SJC gold bar prices surge! This is your chance to shine and make some lucrative investments. Stay ahead of the game and be a part of this exciting opportunity. Will the prices continue to soar? Stay tuned and keep an eye on the latest updates to make informed decisions.”