Greening Becomes a Mandatory Trend

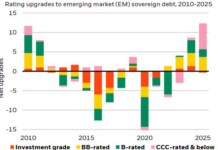

The “greening” trend has rapidly shifted from voluntary to mandatory in major markets, particularly the EU and the US. It is no longer a competitive advantage but a prerequisite for market entry. This is evident in recent policies such as the Carbon Border Adjustment Mechanism (CBAM), essentially a carbon tax on imports based on greenhouse gas emissions from production. Initially applied to steel, aluminum, cement, fertilizers, electricity, and hydrogen, the reporting phase began in October 2023, with full taxation starting in 2026. The EU Deforestation Regulation (EUDR) prohibits importing products like coffee, cocoa, rubber, wood, soybeans, and palm oil linked to deforestation after December 31, 2020. The US SEC’s Climate Disclosure Rule mandates detailed climate risk and greenhouse gas emissions reporting, including supply chain emissions, for listed companies.

In the textile industry, greening is most aggressively implemented and tightly regulated, forcing a complete overhaul of processes from design to disposal. The goal is to end “fast fashion” and hold the industry accountable for product lifecycles. Key tools include the Sustainable Textile Strategy, requiring EU exporters to meet eco-design standards, use recycled materials, avoid harmful chemicals, and reduce microplastics. Extended Producer Responsibility (EPR) mandates waste collection and recycling. Digital Product Passports (DPP) combat greenwashing by providing QR codes or digital tags detailing product origins, recycled content, chemicals used, and repair/recycling instructions.

The US emphasizes transparency, demanding supply chain disclosure, emissions reporting, and impact assessments, including energy and chemical use.

The textile industry faces the most aggressive and tightly regulated greening efforts. Photo: Nam Khánh |

Greening is now mandatory at macro and micro levels, driven by state interventions in the EU and US, along with supply chain, investor, and consumer demands. It aims to minimize environmental impacts across material extraction, production, distribution, consumption, and recycling, closing the material lifecycle loop. However, this “green barrier” poses significant trade challenges, despite its environmental benefits.

Key Challenges in the Textile Industry’s Green Transition

The shift from voluntary to mandatory greening presents challenges from supply chains and regulators. Non-compliance results in higher taxes or import bans. Key issues include:

– Energy Transition: Textile production, especially weaving, dyeing, and finishing, is energy-intensive. Switching to renewable energy (e.g., solar) to reduce carbon footprints is costly and slow, dependent on government policies and infrastructure.

– Water and Chemical Use: Dyeing processes require expensive wastewater treatment systems, water-saving technologies, and the elimination of banned chemicals.

– Circular Economy: Resource circularity depends on state policies for waste collection and recycling. Most post-consumer textiles and fabric scraps are landfilled or incinerated. New regulations mandate recycling these scraps into new fibers, requiring technology shifts.

Wastewater Treatment Solutions

Vietnam’s abundant water resources have led to underinvestment in wastewater treatment, causing pollution hotspots like the Bac Hung Hai Textile Industrial Zone. Immediate solutions include upgrading treatment systems in industrial zones (IZs) and relocating non-IZ factories to IZs with adequate treatment capacity.

Long-term solutions involve natural and alternative materials, water-saving technologies, and chemical reduction. Banning harmful chemicals from the start, as per Nike, Adidas, and Uniqlo standards, is essential. Companies should adopt Bluesign or OEKO-TEX certified dyes and chemicals.

New factories must invest in modern technologies like waterless dyeing and circular systems. Treated wastewater should be reused in production, with advanced treatments like MBR and RO to remove residual salts and colors.

Feasible Greening Models in Vietnam

Vietnam must escape the global textile industry’s processing trap. Photo: Nam Khánh |

Vietnam must move beyond processing by developing natural materials, modern fabrics, and eco-friendly dyeing. Key models include:

– Industrial Symbiosis: In eco-industrial parks like DEEP C (Hai Phong) and Aurora IP (Nam Dinh), factories share resources. Waste from one becomes input for another. These parks feature centralized high-tech wastewater treatment and shared solar energy systems.

– Fiber Recycling Centers: These centers recycle pre- and post-consumer fabric waste into high-quality fibers. Examples include Re:newcell (Sweden) and Worn Again (UK). In Vietnam, companies like Soi The Ky produce recycled fibers under the REPREVE brand.

– Repair and Refurbishment: Brands like Patagonia and The North Face extend product lifespans through repair services and resale programs, countering fast fashion.

– Extended Producer Responsibility (EPR): EPR is now an EU import requirement. Vietnam’s 2020 EPR policy mandates financial contributions for textile waste but lacks recycling requirements. Revising EPR to include collection and recycling, with a 5-10% annual target, could create a circular economy, generate profits, and jobs.

With 500,000 tons of textile waste annually and 150,000 tons of domestic consumption, a 5-10% recycling rate (7,500-15,000 tons) is feasible.

Government and Business Roles

The government must support businesses through green financing, early warnings on market requirements, and research collaborations. It must also enforce environmental regulations to standardize the industry and help it escape the processing trap.

Businesses must view environmental investments as essential for survival, not burdens. They should adopt new technologies, ensure supply chain transparency, and train workers for green operations.

In summary, the government must create a fair, disciplined, and supportive environment, while businesses must proactively embrace their responsibilities.

Nguyễn Thi (University of Natural Resources and Environment, Hanoi)

– 17:49 06/11/2025

30 Years of Defining Identity: Viettel Construction Steadfastly Rising in the New Era

Over the past three decades, Viettel Construction Corporation (Viettel Construction) has not only embarked on a journey of building with sweat, intellect, and a spirit of service but has also become a clear testament to why it is hailed as the “symbol of sustainability” in Vietnam’s construction, infrastructure, and technical services sector.