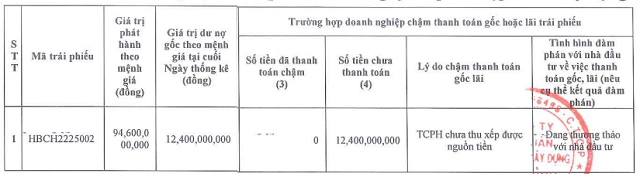

This is the remaining portion of the bond issuance from late October 2022, with an initial total value of 94.6 billion VND and an interest rate of 11% per annum, which matured at the end of October. The collateral includes equipment and materials from HBC valued at 177 billion VND and over 5.35 million HBC shares owned by Mr. Lê Viết Hải, equivalent to approximately 34 billion VND at current market prices. The bondholder is Vietnam Industrial and Commercial Bank Securities (VBSE).

Chairman Lê Viết Hải stated that the company is continuing negotiations with the bondholder. Previously, HBC repurchased a significant portion of this bond in the first half of the year, totaling over 35 billion VND, thereby reducing the principal debt to its current level. During the same period, the company also paid approximately 1.2 billion VND in interest for this bond.

HBC has yet to settle the remaining principal of the bond HBCH2225002. Source: HBC

|

HBC is also negotiating with investors to pay over 10 billion VND in interest for the bond HBCH2126001, initially valued at 500 billion VND, issued in late 2021 and maturing in late 2026. This bond currently has an outstanding debt of 376 billion VND, secured by over 48 million HBC shares owned by Mr. Lê Viết Hải, Ms. Bùi Ngọc Mai, Mr. Lê Viết Hiếu, and Ms. Phạm Thị Quốc Hương. The bondholder is the Ho Chi Minh City branch of the Maritime Bank of Vietnam (MSB).

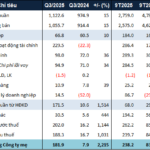

Although the bond scale is small, HBC still carries significant loan debt. As of the end of Q3, total borrowings were nearly 4 trillion VND, primarily short-term. Interest expenses since the beginning of the year amounted to 284 billion VND, while gross profit from core operations reached only 184 billion VND. In Q3 alone, HBC spent nearly 95 billion VND on interest payments, a 33% increase year-over-year.

The construction company’s debt has decreased from its peak of over 6 trillion VND at the end of 2022, when HBC recorded a record loss of over 2.5 trillion VND and interest expenses exceeded 520 billion VND. However, short-term debt remains high, at over 12.7 trillion VND at the end of Q3.

Meanwhile, HBC reported its highest quarterly profit since Q2 2024, with a net profit of 182 billion VND. Most of this profit came from 232 billion VND in late payment interest awarded by the court in favor of the company, rather than from core construction activities. Despite reporting significant profits and holding over 300 billion VND in bank deposits, HBC has delayed payment of the aforementioned bond principal.

Previously, HBC won several construction contract disputes. In late September, the People’s Court of Gia Lai Province ordered the TMS Group to pay nearly 154 billion VND, including 45 billion VND in late payment interest, related to the TMS Luxury Hotel Quy Nhơn Beach project.

| A surge in financial income in Q3 helped HBC achieve significant profits |

Hoà Bình Construction wins lawsuits, recovers hundreds of billions

Q3 profits surge due to financial income, but Hòa Bình lags after 9 months

– 13:58 06/11/2025

TCBS to Launch Public Offering of VND 5 Trillion in Bonds

TCBS is set to launch a public bond issuance of up to 5,000 billion VND, divided into four tranches, commencing in Q4 2025.

Nearly 3 Trillion VND from Bond Issuance Poured into Hue’s Luxury Resort Project

Newly established TN Development JSC has successfully raised VND 2.950 trillion through a 5-year bond issuance, fully guaranteed for payment. The proceeds are earmarked for the development of a resort project in Thua Thien Hue province.