At the Vietnam Investment Forum 2026, organized by VietnamBiz on November 4th, Dr. Nguyen Tu Anh, Director of Policy Research at VinUni University, emphasized that capital remains a critical factor for economic growth, alongside labor, technology, institutions, and the environment.

He hypothesized that if Vietnam aims for a 10% annual GDP growth rate from now until 2030, this would be real growth. Adding approximately 3% inflation, the nominal growth rate would reach around 13%.

“To achieve this, credit growth typically needs to exceed nominal GDP growth by about 3 percentage points. For safety, I’ll adjust this to 2 percentage points, meaning credit growth should be around 15% annually from now until 2030. Consequently, the credit scale of the economy will need to double over the next five years,” Dr. Tu Anh estimated.

“As a result, the assets of the banking system, equity capital, and related factors will also increase proportionally. Clearly, the role of the banking system in the economy is immensely important,” the expert noted.

Dr. Nguyen Tu Anh, Director of Policy Research at VinUni University

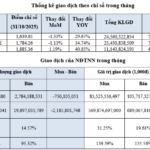

According to the State Bank of Vietnam, the total outstanding credit in the economy reached 15.6 million billion VND by the end of 2024. By September 29, 2025, the total outstanding credit was approximately 17.71 million billion VND, a 13.37% increase compared to the end of 2024. The State Bank projects credit growth for 2025 to be around 19-20%.

Dr. Tu Anh believes that while the capital market can develop and complement the economy, banks still hold a significant advantage in providing capital, as seen in East Asian economies and even the U.S.

The essence of the financial market is risk management, with banks specializing in information gathering, processing, and risk management. With advancements in digital technology, these tasks can be performed on a larger scale, at lower costs, and with greater accessibility to individuals. Consequently, banks’ capital and risk management costs are becoming increasingly efficient.

In contrast, the capital market inherently requires individuals to manage their own risks, which is a significant challenge, especially in a developing market like Vietnam. The country’s governance and legal systems are not yet robust enough to mitigate these risks effectively.

“Therefore, while we aim for capital market development to share the burden with the banking system, I believe banks will remain crucial in the medium term,” he concluded.

Mr. Quan Trong Thanh, Director of Research at Maybank Securities Vietnam

Mr. Quan Trong Thanh, Director of Research at Maybank Securities Vietnam, also emphasized that banks remain the most vital capital channel for the economy.

Analyzing Vietnam’s credit-to-GDP ratio of approximately 134%, Mr. Thanh noted that from 2013 to 2022, credit growth was primarily driven by retail lending, with corporate lending contributing a smaller share. Compared to other markets, this ratio remains safe and has room for further growth.

“The potential for corporate lending is still vast, with corporate loans to GDP below 80%, indicating a healthy level,” Mr. Thanh stated.

According to the expert, the banking sector’s next focus should be on expanding production lending. As Vietnam enters a phase of robust growth, targeting over 10% GDP with private enterprises as the main drivers, production lending will be key. However, this is a long-term strategy, requiring 5 to 10 years for gradual implementation.

In the short term, lending momentum will come from infrastructure and energy sectors. While investment in these areas has been modest in recent years, over the next five years, Vietnam’s GDP growth plan of 10% and the Ministry of Finance’s calculations indicate a total investment need of approximately $1.4 trillion, averaging $280 billion annually. Of this, FDI will account for only $24–30 billion, leaving over $250 billion to be sourced domestically, including from the government and private enterprises.

The government is actively encouraging private sector participation in infrastructure and energy investments. This “pie” is expanding, and private enterprise involvement is growing.

“Over the past two years, many private enterprises have engaged in road construction and infrastructure projects, and recently, they’ve begun expanding into energy. As private enterprises participate, banks are ready to finance. Even the most cautious banks, like Vietcombank, are willing to lend for infrastructure. The key is selecting capable private enterprises to execute these projects,” said the Director of Research at Maybank Securities Vietnam.

International Financial Center: Fueling Vietnam’s New Growth Cycle

Vietnam boasts a robust fiscal buffer and a public debt level well within safe limits, enabling the government to ramp up strategic public investment. This investment is directed toward bolstering digital economic infrastructure and modernizing financial institutions, fostering a more resilient and dynamic economy.

Market Enters Challenging Territory: High Margin Debt Poses Risk of Sharp Declines

With over 20 years of experience in finance and investment, Mr. Dao Phuc Tuong assesses that the market has now entered a challenging phase after surging more than 30% this year. The potential for corporate profit growth faces obstacles, as the recent high increase remains anomalous. Additionally, current valuations are no longer cheap, while margins are at record highs.

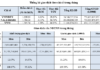

Bank Stocks: Profit Quality and Inherent Risks Insufficient for Valuation Expansion

The Q3/2025 financial results of numerous banks reveal a promising outlook, driven by credit expansion and improved non-interest income, signaling that the toughest phase of the profit cycle may be behind us. However, the stock market has responded with caution, scrutinizing profit quality, net interest margin positioning, potential delays in bad debt formation, and lingering legal risks. As risk premiums rise amid macroeconomic uncertainties and capital flows, valuation multiples are compressing, tempering the short-term positive impact of profit growth.