In late October and early November, banks began slightly increasing deposit interest rates to mobilize additional capital for year-end financial needs.

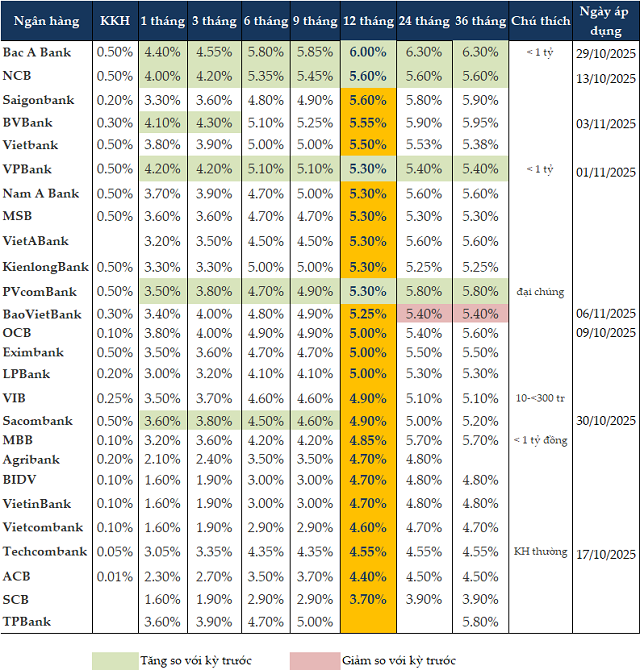

Starting October 29, 2025, Bac A Bank raised interest rates by 0.4–0.5 percentage points across all terms. For deposits under 1 billion VND, the bank offers 4.4%/year for 1-month deposits, 4.55%/year for 3-month deposits, 5.8%/year for 6-month deposits, 6%/year for 12-month deposits, and 6.3%/year for deposits over 12 months.

BVBank also increased deposit rates by 0.3 percentage points for 1–3 month terms starting November 1, 2025, raising 1-month rates to 4.1%/year and 3-month rates to 4.3%/year.

Additionally, BVBank launched a “10 Golden Days of Interest Rates” promotion with a top rate of 6.8%/year for 12-month online deposits. From November 3–13, 2025, the “10 Golden Days of Savings” campaign offers an extra +1.2%/year, with rates of 4.75%/year for 1 month, 6.5%/year for 6 months, and 6.8%/year for 12 months.

On November 1, 2025, VPBank uniformly raised rates by 0.3 percentage points across all terms. Specifically, 1–3 month savings rates increased to 4.2%/year, 6–9 month rates to 5.1%/year, 12-month rates to 5.3%/year, and over 12-month rates to 5.4%/year.

Other banks, including NCB, Sacombank, and PVcomBank, also raised deposit rates by 0.2–0.5 percentage points compared to previous updates.

As of November 6, 2025, 1–3 month deposit rates range from 1.6–4.55%/year, 6–9 month rates from 2.9–5.85%/year, and 12-month rates from 3.7–6.0%/year.

For 12-month terms, Bac A Bank offers the highest rate at 6%/year, followed by NCB and Saigonbank at 5.6%/year, and BVBank at 5.5%/year.

For 6-month terms, Bac A Bank leads with 5.8%/year, followed by NCB at 5.35%/year, and BVBank and VPBank at 5.1%/year.

For 3-month terms, Bac A Bank offers the highest rate at 4.55%/year, followed by BVBank at 4.3%/year, and NCB and VPBank at 4.2%/year.

|

Personal deposit interest rates at banks as of November 6, 2025

|

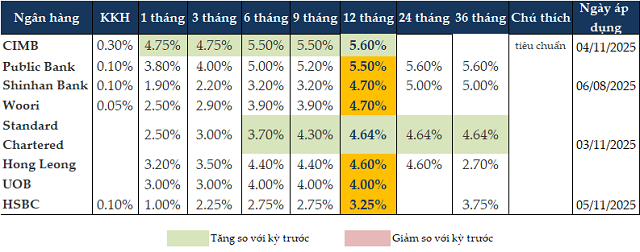

Foreign banks have also joined the race to attract deposits. CIMB and Standard Chartered Vietnam raised personal savings rates in early November. For 12-month terms, CIMB offers the highest rate at 5.6%/year; for 6-month terms, CIMB offers 5.5%/year; and for 3-month terms, 4.75%/year.

|

Personal deposit interest rates at foreign banks as of November 6, 2025

|

Deposit interest rates expected to rise slightly in the last two months of the year

Assoc. Prof. Dr. Nguyễn Hữu Huân – Senior Lecturer, University of Economics Ho Chi Minh City predicts that deposit interest rates will continue to rise slightly in the last two months of the year. Two key factors are putting simultaneous pressure on the system.

First, year-end capital demand is cyclical. The end of the year is always a peak season, with significant capital needs from both businesses and individuals for production, business, and holiday consumption. Second, exchange rate pressure remains high and is a priority concern.

These factors place the State Bank of Vietnam (SBV) in a challenging position. If the SBV aims to support ample liquidity for banks to meet rising capital demand and keep interest rates low, it must inject more VND into the market. However, this would immediately increase exchange rate pressure.

Therefore, the SBV is likely to adopt a more balanced approach, prioritizing exchange rate stability by injecting less liquidity than the actual increasing demand. With limited supply and rising demand, deposit interest rates (at least in the interbank market) may rise slightly.

However, Mr. Huân emphasizes that the rate increase will not be significant. If rates show signs of a sharp rise, the SBV will intervene immediately by injecting liquidity, accepting some exchange rate pressure. The government’s top priority is supporting interest rates to achieve economic growth targets, rather than maintaining exchange rates at all costs. Thus, deposit rates may rise slightly, but lending rates will remain low to support businesses.

Mr. Nguyễn Quang Huy – CEO of Finance and Banking Department, Nguyen Trai University believes the slight increase in deposit rates at many commercial banks since late September is a normal, cyclical, and anticipated development.

The primary cause is seasonal demand. Year-end is a peak credit demand period. Businesses need capital to boost production and stockpile goods, while individuals increase consumer loans for holiday shopping. To meet this rising demand, banks must increase deposits, making reasonable rate hikes necessary to attract savings.

Beyond seasonality, rising rates reflect positive economic signals. This indicates recovering credit demand and more effective absorption of bank capital into production and business activities compared to previous quarters.

Importantly, this is not a trend or policy shift. Macroeconomic foundations remain stable: inflation is controlled around 3.5–4%, system liquidity is ample, and the SBV flexibly manages interbank rates via open market operations. The monetary policy focus remains on supporting growth and exchange rate stability, not tightening.

Thus, deposit rates may fluctuate slightly in the next two months, but lending rates will stay low to support business recovery.

– 11:08 06/11/2025

Black Market USD Exchange Rate Surges Over 8% Since Start of the Year, with October Alone Seeing a 4.7% Spike

According to MBS, the surge is attributed to the widening price gap between domestic and international gold, fueling increased demand for USD in the unofficial market.

November 2025 Savings Interest Rates: Slight Uptick, Yet Remain at Low Levels

Interest rates for regular VND savings deposits at bank counters as of early November 2025 remain relatively stable, with slight increases observed in some short-term tenures. Analysts predict a modest upward trend in deposit rates for the final months of the year, though overall rates are expected to stay at a low level.