LNG carriers require exceptional insulation to maintain the super-chilled temperature of liquefied natural gas.

This surge in prices has intensified competition for available LNG vessels, reversing the prolonged slump in freight rates observed for most of the year.

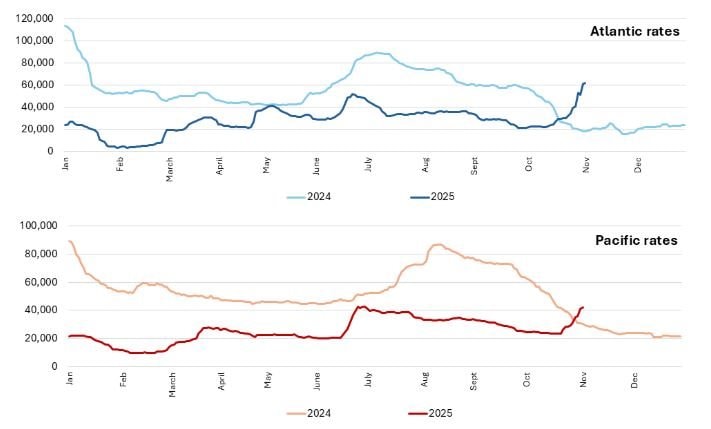

Rates plummeted to a five-year low in February as new vessel deliveries outpaced demand. However, they rebounded to a peak in June due to limited vessel availability and the Israel-Iran conflict, which led many shipowners to delay charters.

According to Spark Commodities, Atlantic freight rates for tri-fuel diesel electric (TFDE) vessels—the most common type, capable of carrying 174,000 m³ of LNG—reached $61,500 per day on Tuesday, slightly down from $61,750 on Monday. This marks the highest level since late August 2024, representing a 50% increase from $39,750 the previous week.

In the Pacific, rates for the same vessel type hit $42,250 per day on Tuesday, up sharply from $31,250 a week earlier—the highest since late June.

LNG freight rates in the Atlantic and Pacific surged in early November 2025.

Stephen Gordon, Managing Director of Clarksons Research, noted, “Recent delays in LNG discharge at Egyptian ports have been a contributing factor, creating a ripple effect on vessel schedules.”

An anonymous shipbroker disclosed that Egypt’s LNG delivery postponements disrupted shipping schedules, prompting charterers to swiftly secure vessels for future cargoes, thereby boosting demand.

Seasonal demand has further supported freight rates as countries in the Northern Hemisphere, including Europe and Japan, ramp up gas storage ahead of winter.

“Many utilities and traders are accelerating stockpiling efforts in preparation for the colder months,” another broker commented.

Additionally, the widening arbitrage window for U.S. LNG shipments to Asia has reduced vessel availability, as increased eastbound flows and longer transit times tie up more ships, Gordon added.

The expansion of U.S. LNG export projects, such as Plaquemines LNG and Corpus Christi Phase 3, is providing additional fundamental support to the market.

“Vessel supply is temporarily constrained, with few ships available to meet laycan deadlines in the Atlantic during November. This could continue to support rates in the short term,” he stated.

Qasim Afghan, an analyst at Spark Commodities, noted that the U.S.-Northeast Asia arbitrage window has closed but remains narrow: “If the JKM-TTF spread continues to widen as it did last month, arbitrage signals may soon return to Asia, placing upward pressure on LNG freight rates.”

The JKM-TTF spread refers to the price difference between the Asian benchmark (Japan-Korea Marker) and Europe’s gas trading hub (Title Transfer Facility).

Arbitrage signals indicate opportunities to profit from price disparities between markets. For LNG, this means Asian prices (JKM) are high enough compared to European prices (TTF) to justify shipping LNG from the U.S. or Europe to Asia, even after accounting for transportation costs.

When arbitrage signals emerge, traders and energy companies rush to charter LNG vessels to move cargoes from low-priced to high-priced markets, increasing vessel demand and freight rates. This, in turn, narrows the price gap between regions as supply shifts to higher-priced areas.

Conversely, when arbitrage signals disappear, the price differential is insufficient to cover shipping and logistics costs, reducing demand for long-haul voyages from the U.S. to Asia.

Samsung’s Shipbuilding Giant Set to Secure $237 Million Order for Three Oil Tankers at ‘Secret’ Vietnamese Shipyard

These three vessels are slated for delivery in March 2029, forming a key component of the company’s strategy to diversify its manufacturing base.